CBA CEO Matt Comyn warns economy at risk of ‘wage-price spiral’ after bank books $9.6bn annual profit

Commonwealth Bank CEO Matt Comyn says a potential ‘wage-price spiral’ poses real risks to the economy, as he also cautioned on the delayed transmission of rapid rate hikes.

Commonwealth Bank chief Matt Comyn says a potential “wage-price spiral” poses real risks to the economy this year, as he also cautioned on the delayed transmission of four rapid rate hikes to borrowers.

Speaking after CBA reported a higher dividend and annual profit rise to $9.6bn, Mr Comyn said while he expected Australia would avoid a recession, if businesses were pegging wage rises to elevated levels of inflation that could spur even more aggressive rate rises.

“We expect another 75 basis points of increases that will move the cash rate to 2.6 per cent … higher wage growth, which could lead to a wage-price spiral, is clearly a bigger concern and would cause the cash rate to go (up) even further. There’s risks to that,” Mr Comyn said in an interview.

“A real risk is businesses across the board indexing wage growth towards inflation, that’s going to cause economic problems over the course of the next couple of years because clearly that’s going to stimulate inflation.”

Mr Comyn’s comments come as he received a bumper 35 per cent increase in annual pay to just shy of $7m, and as CBA navigates its own wage negotiations after a pay deal in its enterprise agreement ended on June 30. The bank employs about 40,000 staff in Australia.

Mr Comyn said Reserve Bank rates hikes to date were still filtering through the economy, given the timing of mortgage repayment cycles and that some 40 per cent of borrowers had fixed-rate home loans.

“There’s a cumulative and delayed effect which we won’t even see the full affects of that until late this calendar year and even over the course of 2023,” he added. “Our interactions with customers would indicate that people are increasingly concerned about the outlook for interest rates.”

CBA is the nation’s largest home lender giving the bank detailed insights into the housing market.

Mr Comyn said the already announced rate hikes would trigger a quadrupling on monthly mortgage repayment outlays over the course of the calendar year. So far, though, CBA had seen only a “slight uptick” in requests for financial assistance.

He also noted consumer confidence and spending had been dented by concerns around rate hikes and broader cost of living pressures.

CBA expects a 15 per cent annual fall across national house prices, which he said would see a “variety of outcomes” across different postcodes and also weigh on confidence and spending.

While Mr Comyn pointed to anticipated recessions across the US, UK and Europe, he added: “We believe that sort of scenario in Australia can be avoided.”

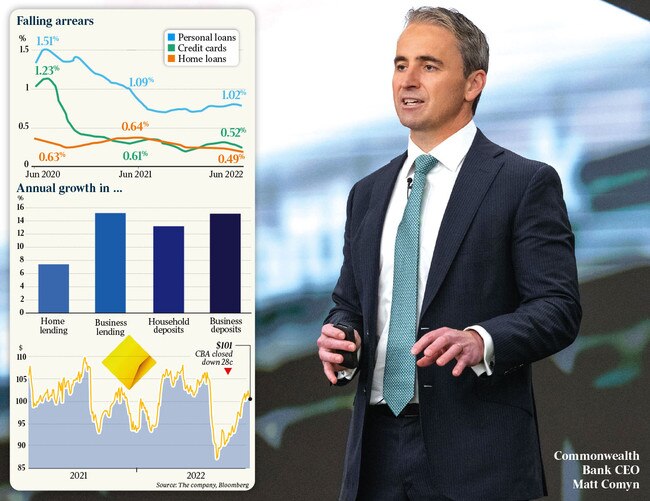

CBA on Wednesday said cash profit climbed 11 per cent to $9.6bn in the 12 months ended June 30, from the prior year, as business lending volumes jumped and loan losses remained subdued. That exceeded analyst estimates for an annual cash profit of about $9.4bn.

But competition for customers remained fierce with the bank’s net interest margin – what it earns on loans less funding and other costs – sliding 18 basis points through the year to 1.9 per cent. But the bulk of the decline occurred in the first half with a 5 basis point drop recorded in the latter six month period, as official rate hikes began in May.

CBA flagged it expected margins to rise this fiscal year as RBA rate hikes worked to temper rampant inflation, with higher rates helping to boost the bank’s profitability.

The bank’s shares dipped 0.3 per cent to $101 in Wednesday’s trading, as investors focused on bank’s prospects. The S&P/ASX200 declined 0.5 per cent.

“The credit environment remains very benign, but at some point there has to be a reversal of that. That‘s going to be a headwind for the whole sector,” Regal Funds Management’s Mark Nathan said.

“It is taking a bit longer for the margin benefit on deposits to come through. That is partly linked to competition in the deposit market firing up a bit.”

Barrenjoey analyst Jon Mott noted investors would focus on CBA’s uncertain outlook.

“The market was hoping for outlook comments on margins, which weren’t provided. With uncertainty rising and a reasonably full multiple, we expect trading to be soft,” he said.

But Macquarie Capital’s analysts said the decline in margins was “arguably the key area of disappointment” in the annual results.

Mr Comyn said while consumer demand would moderate as rate rises filtered through the economy, he remained positive on the medium-term health of consumers and businesses

“It is a challenging time, but we remain optimistic that a path can be found to navigate through these economic conditions,” he added.

Net interest income rose 1 per cent in 2021-22 as CBA’s residential mortgage and business lending grew, although home lending expanded at a rate that didn’t keep pace with its peer group.

Excluding lumpy one-off items, other operating income – which largely reflects fee income – increased 1 per cent.

CBA’s board declared a final dividend of $2.10 per share fully franked, which will be paid on or around September 29, taking the full-year payment to $3.85. That is up 10 per cent from $3.50 in the prior financial year.

The bank’s common equity tier one ratio was at 11.5 per cent at June 30, and it said it would meet new regulatory capital requirements beginning in January.

“CBA is well placed to accommodate these changes, and expects to operate with a post-dividend CET1 ratio of greater than 11 per cent, except in circumstances of unexpected capital volatility,” the bank said.

CBA has completed a $6bn off-market share buyback and started a further $2bn on-market buyback, as it returns proceeds from a divestment program that sought to shed non-core businesses.

The bank’s loan impairment expense fell by $911m, which led to a CBA to book a benefit of $357m in the year ended June 30, as it unwound some of its pandemic settings but also accounted for risks such as inflationary pressures and rising interest rates.

Annual operating expenses – excluding lumpy one-off items – fell 1.5 per cent as the bank paid out lower remediation costs and booked productivity benefits. That was offset somewhat by higher staff costs as CBA added full-time employees.

National Australia Bank’s June-quarter earnings update on Tuesday left investors jittery about revenue growth in the final months of its financial year ended September 30.