Whether to increase tolls amid the pandemic was one of the most critical decisions for Transurban

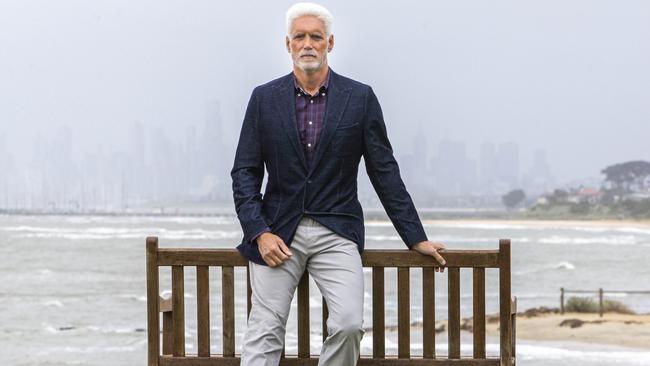

For the first time, Transurban’s Lindsay Maxsted and Scott Charlton speak about the March 2020 meeting that could have blown up the company’s business model.

It was the board meeting that could have blown up the business model of one of the nation’s biggest listed companies.

When the directors of toll road giant Transurban convened for their regularly scheduled gathering in early March 2020, the Covid-19 pandemic was rapidly taking hold.

Lockdowns were imminent across the nation’s biggest cities and businesses were being forced to close their doors. Jobs would soon be lost.

Yet on March 31, Transurban was scheduled to increase tolls across its network of toll roads in Sydney, Melbourne and Brisbane.

The Transurban board, then boasting names such as BHP directors Terry Bowen and Christine O’Reilly, Aristocrat chair Neil Chatfield, former Perpetual chair Peter Scott, Mirvac director Sam Mostyn and Future Fund guardian Jane Wilson, was having none of it.

“We had a serious dilemma,” reveals Transurban chairman Lindsay Maxsted.

The company’s management, led by long-serving chief executive Scott Charlton, had come to the meeting resolved that toll increases were a fundamental part of the group’s business model for investors.

They firmly believed that to tinker with the model, even in the middle of a pandemic when traffic volumes were collapsing, would prove to be a disastrous turning point in the company’s history.

The critical meeting, conducted remotely, went for three days before there was a resolution.

It ended with a proposal that Tolls would go up as scheduled, but customers directly impacted by the pandemic would be offered a 3-month toll credit, more time to pay, there would be fee waivers and payment plans.

When the plan was announced on March 19, the public and the sharemarket knew nothing of the behind-the-scenes boardroom machinations. Until now.

“That started with the board saying ‘We can’t have any price increases’ to where we finished, which is the wonderful spot where we were really clear to say ‘We will be here to help our customers, they’re in trouble here’. So there would be free tolls for the frontline workers or people who had to get to the hospitals, the aged care places, and to look after those that were most vulnerable,” Maxsted says.

“For the logistics companies, they were going to be using the roads even more so they could afford to pay the toll increases. It was just a wonderful resolution of a dilemma that didn’t seem to have a solution at the start. That’s not a disagreement with the CEO, but it’s where we came from totally different angles and were able to come up with the right answer.”

To the Transurban directors and those inside and outside the company that have watched it operate for the past decade under Maxsted and Charlton, the episode also highlighted the strength of their partnership, a unique one in corporate Australia.

Maxsted says a key lesson from the experience for other boards was having high quality people in the executive group and around the board table that were “actually prepared to listen.”

“So people came to that table from really different starting points, but sat down and listened,” he says, noting that Charlton and his executive team presented hard traffic data to the meeting that the board could work with and assuaged concerns.

“The data point is really fundamental. So rather than just saying, ‘I think this is going to happen, therefore, you’d better do this’, we could see what was underneath. Then some of the contribution in terms of how we would be very focused on helping certain groups, that came from one particular board members’ contribution, not mine. She probably started from the most furtherest away point in saying ‘We can’t do this toll increase’.”

Road to success

Charlton was a controversial appointment by Maxsted and the board in July 2012, when it preferred the former Deutsche Bank project finance banker-turned Leighton Holdings executive over then Transurban chief finance officer Tom Honan, who was the anointed internal candidate of retiring CEO Chris Lynch.

Since then Charlton has overseen more equity raisings than any chief executive in Australian history – $15bn worth – including two of the biggest ever shareholder-friendly rights issues for toll road acquisitions.

He’s also brought big heavyweight local and international institutional investors to the Transurban share register, including AustralianSuper, UniSuper and the secretive Abu Dhabi Investment Authority, that have all been keen on the company’s high yield assets and stable distributions.

Transurban has paid $11bn in gross distributions to security holders since 2010 and over those 12 years the firm’s security price has increased more than 250 per cent versus just over 50 per cent for the ASX 200.

The firm has grown from being a single toll road entity to the largest pure play toll road company in the world, all the while maintaining a balance between chasing growth and providing stable distributions to security holders. Although some worry about the monopoly it now holds.

As Maxsted prepares to step down after 12 years as chair and as Charlton enters the twilight of his reign, the former believes the secret sauce in their relationship has been their mutual respect for each other and their unwavering focus on what is best for the company.

“It is far more difficult now to work through what is best because of this whole issue between investors on the one hand and other stakeholders on the other,” the former says.

“Scott and I come from very different backgrounds, we don’t share any major external interests, but we are absolutely one in terms of everything we do here must be what is good for the company. And ipso facto, it would be good for the investors in the company. The stakeholders fit around that in terms of it won’t be good for the company unless you have happy and satisfied customers, happy employees and communities.”

Those who know both say Maxsted has been a hardworking and active chairman who has sometimes helped moderate the more deal-driven part of Charlton’s personality, especially early in the CEO’s reign.

But Charlton stresses he has never gone “chasing something to chase something or doing something to do something”.

“One of the things that’s great in not being in investment banking and being on the other side is the consequences you have to live with. You’ll see in Transurban that any executive that’s led a major transaction has had to run that transaction. So they know, whatever they pay for it, whatever the business plan is, they have to deliver on that,” he says.

“We have raised more equity than any other company in Australia over the last decade. That faith in the board and the executive team to execute is carried heavily and that drives us to make sure we don’t mess up that decision. So I don’t want to do anything wrong to tarnish that capability.”

Maxsted acknowledges he has been at odds with Charlton at times on “people issues” where “I might have had a different view” on executive appointments.

But their biggest test in the public eye was 13 months of gruelling negotiations with the Victorian government and builders John Holland and CPB Contractors on the delayed $10bn West Gate Tunnel project.

Following mediation proceedings, Transurban late last year agreed to pay an extra $2.2bn to ensure the project would be completed by late 2025, two years later than planned.

Maxsted acknowledges it was the “biggest downside” of his time working with Charlton, but says it never put any stress on their relationship.

“Yes, we all would have liked it to have been resolved more quickly. But there was a process we went through and it finished,” he says.

Charlton reveals his chairman became an important confidante during a tense period.

“I leaned on Lindsay quite a bit during that time because there were times where I just would say to him, ‘I don’t know if I can, I don’t know if we can get through this’ because we’d be in line with in one party and the other party would be moving away, and you’d be in line with that other party and then the other party would be moving away,” he says.

“It was a very difficult, protracted negotiation. I had to lean on Lindsay because a CEO doesn’t get to vent or express their frustration to a lot of people.”

He also claims the way Transurban can be portrayed in the media is “completely wrong”.

“What frustrates me and what I guess really hurts me is – and I don’t really take it personally – my team kill themselves to create a good outcome for the customer and for a project. To do all that and then to see what’s said about it, it’s very disappointing sometimes,” he says.

“So being able to vent frustration to Lindsay has been important. But I think things like Westgate actually brought us closer together.”

Transurban is now entering a period of deep community concern about tolling, highlighted by a recent NSW parliamentary inquiry scrutinising the stark discrepancies in tolling across Sydney’s motorways and the justification for toll increases on parts of the network.

The rise of the work from home phenomenon post Covid-19 and increased cost of living pressures has also put added scrutiny on toll charges at the same time as Transurban is enjoying the benefits of inflation-linked toll price increases.

The company has previously noted that a 1 per cent increase in CPI is likely to increase revenue more than the impact of a 1 per cent increase in interest rates in the near term.

Charlton has previously acknowledged the nation’s tolling regimes could be more transparent and equitable and believes the key for Transurban going forward will be delivering customers value for money, especially by using technology to offer more personalised services.

Looking ahead both Maxsted and Charlton hope that unlike a decade ago, it will be an internal candidate that takes the reins at the company when the CEO decides the time is right to move on.

Loosening up

Asked what he has taught Maxsted over the past 10 years, Charlton smiles before musing that his chairman now knows “how to have fun.”

“The first couple of years around the board, it was ‘Mr. Chairman’ and it could be a lot more formal. Now Lindsay has a dig at me and makes fun of me at board meetings. There’s a ton of mutual respect around the board and an understanding that it is important, but there is also a lot of informality and sharing. We’ve loosened him up a little bit, I think,” he says.

Maxsted doesn’t disagree with the proposition but believes he has also taught his CEO the importance and value of good governance.

The chairman’s departure from Transurban will bring an end to his public company life, after stints also on the boards of BHP and Westpac.

Maxsted served as Westpac’s chairman for eight years before bringing forward his departure at the end of 2019 when the bank was sensationally accused of breaching anti-money laundering laws by allowing payments linked to child abuse in Asia.

Asked if the affair has made him more resilient, he replies: “Maybe, but for these jobs you’ve got to have a serious amount of resilience. I think I had that before the events of November 2019. Maybe a tad more after that. You’ve got to understand certain things can go wrong within organisations and then you’ve got to know how to deal with that in terms of getting it fixed and moving on,” he says.

Now working with a restructuring fund run owned by investment banker John Wylie’s Tanarra Capital Group, taking the former KPMG CEO back to his roots in the advisory world, Maxsted will not miss certain aspects of public company life one bit.

“I think it is ever so much more difficult to be a director in listed company land today than it was when I started in 2008,” he says bluntly.

“I think the pressures on directors, for often the wrong reasons, are so much greater. The risk-reward equation just doesn’t work in many of the listed company spaces, particularly for anyone who’s been a really successful CEO to then take on the burden.

“Which is a real shame, because clearly this country needs really good people to be chairs and directors of boards. I’m not saying that won’t happen. I’m sure that will still happen. But it is more difficult now.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout