The message behind Penn’s parting Telstra profit

Unusually for the telco, this is shaping up as another smooth CEO transition.

A small but highly symbolic gesture by Telstra’s board – hiking the second-half dividend by half a cent – sent a clear message that the telco has made it through to the other side of a painful but much-needed makeover.

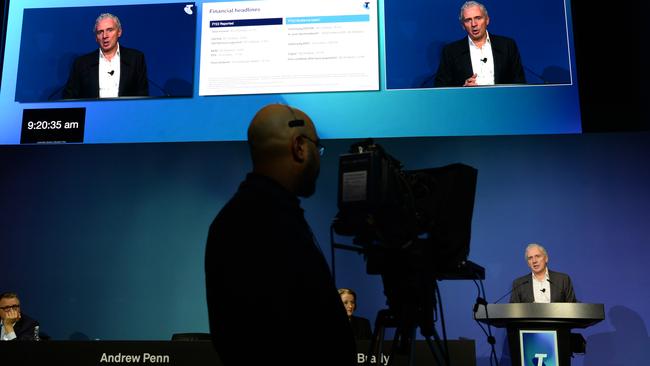

Chief executive Andy Penn steps down at the end of the month after more than seven years and has largely delivered on his ambitious T22 program that slashed billions in costs, including pulling 8000 staff from the organisation, slicing management layers and selling off heavy assets such as towers.

It’s unusual for the dividend to be increased at a company where top-line growth numbers are still going backwards, particularly in an uncertain economic environment, but it is a vindication for Penn’s four-year restructure, which has now come to an end.

“There’s no doubt we are in a very different place today as a consequence of the changes that we made over the last four years,” Penn says.

Unusually, Telstra’s board is already banking the financial benefits of the extension to the T22 program and upgraded earnings guidance for next year, which are yet to come. It is also an expression of confidence about the delivery of further restructuring measures under new chief executive Vicky Brady.

The T22 program sought to rip out costs and dramatically simplify Telstra’s product offering, boiling down a sprawling 1800 business plans to just 20. The telco had become lazy on NBN payments and was trading on its incumbency. NBN payments – compensation for migrating Telstra copper wire customers to the high-speed network – are now drying up and profit margins remain under pressure, with data a commodity.

In delivering his own assessment, Penn says the T22 program has been a success, delivering a better outcome for customers and employees. And this means the financial benefits of a leaner, more efficient Telstra are set to come through for shareholders.

Telstra remains among the most widely held of Australia’s big companies, with retail shareholders making up more than 40 per cent of the registry. But it’s been a hungry time for much of Penn’s tenure. A painful call was made early: to reset the dividend from the David Thodey era, when Telstra’s rivers of cash were flowing fast and NBN compensation payments were ramping up. Those payments are coming to an end, with more than $8bn so far sent to Telstra since 2013.

Penn is a second-time CEO. His first tenure at wealth manager AXA Asia Pacific was cut short by the $13.1bn carve-up of the wealth manager between AMP and France’s AXA SA. Few second-time-round chief executives see the distance and Penn has survived in the role for more than seven years, to leave on his own terms. Come September 1 he plans to head to Europe with wife Kallie for a holiday and catch up with family. He expects to be active over time with board roles and focusing on the digital economy and the arts.

One of his last jobs as Telstra boss is to deliver a speech at the National Press Club later this month on the increasing economic threats around cyber attacks.

Seamless transition

As far as investors are concerned, the handover to Telstra’s new chief executive Vicki Brady on September 1 will be seamless.

Unusually for the telco, it is the second smooth CEO transition in a row, following the management trauma of the Sol Trujillo years, which shows that the settings in the John Mullen-led boardroom are right.

Brady, the current chief financial officer, has committed to the extension of outgoing chief Andy Penn’s cost-cutting program which internally is called T25. And despite the headwinds, she has guided the market to underlying earnings growth of between $500m and $700m next financial year.

That means while more costs are set to be taken out, Brady won’t be pushing through a hard restructure for a company that until recent years has had more strategy resets than iPhone releases.

Brady’s immediate challenge when she takes charge is to steer Telstra with its $14bn cost base through the inflation storm. The company has in-built buffers, including price rises in mobile, and customers are facing inflation-linked contracts which go live in September this year.

There is still another $1bn in recurring NBN payments that are indexed to inflation. On the costs side, Telstra has actually found it has locked in savings on energy. But one project to watch is the ambitious $1.6bn intercity fibre project. Already costs estimates are threatening to blow out from when the project was announced in February, with inflation particularly around construction and fibre supply. For now Telstra is committed to its capex budget.

Elsewhere Brady is working on the T25 program, which is already under way, and has the ambition of turning Telstra’s long stuck revenue line around to secure mid-single-digit annualised growth through to financial 2025. It is also targeting another $500m in annualised cost savings.

Brady believes the foundations for Telstra are in place, with momentum in the business even after Thursday’s 4.6 per cent drop in annual net profit to $1.8bn.

But this is Telstra – a company with an extensive history of negative surprises.

Brady, who grew up in the NSW Riverina town of Holbrook, will also steer through the network-sharing agreement with smaller rival TPG Telecom. This deal, which will essentially see TPG link to Telstra’s infrastructure in regional Australia, is facing intense opposition from rivals, including Optus. The competition regulator is set to make a ruling on the deal in October.

Brady is taking charge as Telstra is positioning itself to control all of the platforms that we use in the shift to digital. All telcos are facing another step-change demand for data as new tech such as AI, Edge Cloud and 6G is being refined.

AMP’s rebuild

For AMP shareholders it’s been a long time coming, but the string of painful asset sales is starting to yield some return, with $1.1bn planned to be sent back to shareholders. AMP’s interim earnings took a modest step in this direction with an early $350m share buyback, while newish chief executive Alexis George dangled the prospect of another $750m in the form of more buybacks or a special dividend in the coming financial year.

The last special dividend was in early 2020, and before that the last regular dividend stream was in 2018. Through this period AMP has been in and out of the operating theatre.

Following an aggressive asset sale program and the sideshow of recent years of AMP facing a private equity buyout, George is now talking about operational issues and strategy rather than survival, with the bank – once earmarked for sale – now very much front and centre of the new AMP. It needs to be, with AMP’s once flagship wealth business still operationally weak with fund outflows, albeit slowing, and rising costs.

After sales of real estate, life insurance, and the infrastructure management arm, AMP these days is a vastly slimmed down wealth manager, a platform provider and a smaller bank. Its advice business remains under pressure and needs to be trimmed, with the unit not expected to return to profit until fiscal 2024.

George, a former top ANZ executive, is looking to deliver AMP’s banking customers the option of an unconditional 10 minute mortgage through digital channels in the September quarter. If this can be delivered it would put AMP ahead of at least three of the big four banks, which are still in the trial and testing stage.

johnstone@theaustralian.com.au

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout