Banking and finance royal commission interim report

Banks and industry bodies rush to welcome Kenneth Hayne’s scathing report as more tales of woe emerge.

- More work to do, says Westpac’s Hartzer

- Investors shrug off report

- ‘Deplorable outcomes for many consumers’: FSC

- ‘Rightly critical’, says CBA’s Comyn

- No comment’: APRA

- ANZ response

- Nats respond

- Better the devil you know

- Serious and important,’ says ASIC

- COMMENT: an industry rotten to the core

- Market reaction

- NAB chief’s weekend’s work

- CBA financial planning

- ‘Day of shame’

- ‘Bad apples’ at NAB and CBA?

- Labor’s response

- ‘Regulator working too closely with the sector’

- AMP’s ‘deliberate attempt to mislead’

- Frydenberg flags new laws

- Banks decided when and how laws would be obeyed

- New rules for advisers

- Planners flee finance majors

The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry released its interim report on Friday afternoon.

Commissioner Kenneth Hayne delivered it by hand to the Governor General and it was made public on the commission’s website.

The commissioner’s report delivered a scathing assesment of the practices of Australia’s financial sector and the overseers that regulate it.

But his work is not yet finished, with another round of hearings in November to be held in both Sydney and Melbourne, and a final report and recommendations due on 1 February next year.

Thanks for following developments with us this afternoon. Read more on The Australian this evening and over the weekend for more news and analysis on the royal commission.

Elizabeth Redman 6.29pm Bonuses fuelled scandal

Bonuses for NAB bankers were a “significant cause” of a scandal involving alleged bribery in a program where third parties received a commission for referring home loan applications to NAB, Commissioner Hayne said.

The commission heard tales of white envelopes full of cash passed across counters and loans approved on the basis of potentially fraudulent documentation such as forged pay slips.

NAB accepted there had been misconduct by employees and third party “introducers” and that it had breached its obligations under the National Consumer Credit Protection Act.

Mr Hayne said bankers received bonuses for meeting home loan sales targets while introducers received commissions tied to their volume of loans, which created a “further incentive for collusion”.

He also blamed inadequate training processes for bank staff and inadequate policies for detecting fraud.

NAB fell short of community standards by not responding fast enough and it had not been effective enough at remediating customers, he said.

6.20pm: Submission dates

The commission’s website has posted a notice saying public submissions in response to the interim report are open and must submitted by 5pm on Friday, 26 October.

The Commission is also accepting written submissions on policy related issues on round 6, the “insurance” round. Submissions can be made from the public submissions page and must be submitted by noon on Thursday, 25 October 2018, the website says.

Elizabeth Redman 5.59pm CBA’s problem gambler

Commonwealth Bank was right to admit it fell short of community standards when it gave a problem gambler a bigger credit card limit, Commissioner Kenneth Hayne concluded.

CBA admitted it should have used the information David Harris provided about his gambling problems before offering him further credit.

The bank admitted breaching its obligation under the National Consumer Credit Protection Act, not complying with an ASIC regulatory guide – which constitutes misconduct – and failing to comply with the Code of Banking Practice.

The bank accepted its internal systems were deficient but gave no indication it planned to work on this, Mr Hayne said.

Elizabeth Redman 5.53pm Anti-hawking laws breached

Select AFSL might have breached the Corporations Act when its representative gave personal advice to a customer about funeral insurance without being authorised to do so, Commissioner Kenneth Hayne found.

Kathy Marika said she did not want a second funeral insurance policy but Let’s Insure rang her again and sold her Select funeral insurance, which might have breached anti-hawking laws, Mr Hayne said.

The sales representative induced Ms Marika to provide contact details of family and friends, which Mr Hayne said fell below community standards.

And it was inappropriate for a Select representative to dissuade Ms Marika from cancelling her policies a week after she took them out, Mr Hayne said, adding the customer was concerned about whether she could afford the policies and had a statutory right to cancel.

Rosie Lewis 5.42pm: Capitalism on trial, say Greens

The Greens called for “serious reform” to clean up the “endless greed” in the financial services sector.

“Scott Morrison famously said when announcing this royal commission that it would not be ‘capitalism on trial’, but it’s now clear that’s exactly what it is, certainly it’s the worst excesses of capitalism on trial,” Greens treasury spokesman Peter Whish-Wilson said.

“Commissioner Hayne has not minced his words, and at the end of the day has kept his message pretty simple: banks can’t go on putting profits before people. Business as usual is not an option.”

Greens leader Richard Di Natale added: “This interim report shows that problems in the banking sector aren’t limited to a few bad apples. There is serious rot through the industry, and its culture and structures must change.”

Elizabeth Redman 5.37pm Neither tailored nor beneficial

A funeral insurer that said it tailors its product to indigenous people offers products that are neither tailored to indigenous people nor beneficial for them, commissioner Kenneth Hayne said.

If a customer of the Aboriginal Community Benefit Fund has a medical condition that is more common among indigenous people, he or she is likely to pay higher premiums.

Until recently ACBF policies did not pay out for suicide.

Customers may pay more in premiums than they will be entitled to receive.

And the insurer has significant numbers of customers under 30, which Mr Hayne said showed it relies on the cultural significance of funerals to indigenous people to actively sell its policies to indigenous children and young people.

ACBF’s ads may lead consumers to think it is an Aboriginal-owned company when it has no Aboriginal community affiliations, so it may have breached its legal obligations not to engage in misleading or deceptive conduct, Mr Hayne wrote.

The group’s bonuses incentivised staff to sign up whole families including infant children.

And the group corresponded with customer Tracey Walsh in an “aggressive and hostile manner over a significant period of time” before finally offering to settle her dispute – even though she had already paid “substantially” more than she would ever be entitled to receive under her policy.

5.35pm: More work to do, says Westpac’s Hartzer

Westpac has issued a short media release noting the publication of the report.

“This report marks a significant step in the Royal Commission process. We’re reviewing it carefully and are focused on learning from the mistakes of the past and preventing them from happening again,” Westpac CEO Brian Hartzer said in the statement.

“The royal commission has identified many examples of misconduct across the industry. I apologise to any customers who have been impacted by mistakes that we have made.

“While we’ve introduced a number of reforms, including to our remuneration structures, our approaches to dealing with customer issues and removing grandfathered commissions attributable to BT products, we know we still have more work to do.”

Elizabeth Redman 5.14pm: FOS at fault

Commissioner Kenneth Hayne has blamed the Financial Ombudsman Service for making a dispute between a grieving widow and Suncorp worse.

Rien Low told the hearing of the toll the dispute took on his mother, after the family discovered a string of loans when his father died.

The family went to the Financial Ombudsman Service who found one loan had not been made responsibly, the lender should not charge interest, and if the parties could not agree about repayment the lender could start recovery action.

“The chief difficulties that emerged between the parties stemmed from the inconclusive nature of the FOS determination: requiring the parties to decide between themselves how the loan was to be repaid,” Mr Hayne wrote.

Parts of Suncorp’s communications with the Lows could have been handled better, he said.

But he could not say Suncorp might have engaged in misconduct, without more precise guidance from FOS about how its determination should be given effect.

Samantha Bailey 4.58pm: Market close

Investors in the big four banks have shrugged off the publication of Commissioner Hayne’s report, with all the majors posting gains for Friday.

Commonwealth Bank took the biggest gains, putting on 1.9 per cent to $71.41, while ANZ grew 1.4 per cent to $21.18. Westpac added 1.16 per cent to $27.93 while NAB made 1.76 per cent to $27.81.

AMP lifted 1.59 per cent to $3.19 while insurer IOOF dropped 1.37 per cent to $8.14.

Macquarie fell 1.34 per cent to $126.04

Elizabeth Redman 4.46pm: Westpac’s pre-filled form

Commissioner Hayne’s report lashed Westpac for pre-filling in a form for a blind disability pensioner who was going guarantor on her daughter’s small business loan.

Carolyn Flanagan had to fill in a form to say she had already received legal advice about the loan, but the banker pre-filled it for her before she got advice.

“Doing so compromised the process for the provision of independent advice,” Mr Hayne wrote.

“The banker had Ms Flanagan adopt answers that were not then true.”

Mr Hayne could not say if Westpac acted unconscionably in taking her guarantee, recalling her plaintive statement: “If you can’t help your children, who can you help?”

But enforcing the guarantee was a different question. “The community would not think it right for Westpac to deprive Ms Flanagan of the use of her home during her life,” he wrote.

Ben Butler 4.54pm: Aussie welcomes Hayne report

The boss of CBA-owned mortgage broker Aussie Home Loans says he welcomes the royal commission’s interim report, which slams the company for putting its flow of commission revenue before the interests of consumers.

James Symond, the nephew of founder John Symond, said the company was “in the process of reviewing the report in detail”.

“We will provide a formal response to the royal commission, which will continue to advocate for our industry, our brokers, and the important service they provide for Australian home buyers, owners and investors,” he said.

He flagged concerns that the changes to the way brokers are compensated “could harm competition in home lending and impact the positive customer outcomes we know our industry delivers”.

In his interim report, commissioner Kenneth Hayne dealt with four former brokers who falsified documents to get home loans approved - and reap lucrative commissions for themselves and Aussie.

“The steps that Aussie took, and did not take, show it did not see itself as owing any obligation to protect the interests of borrowers,” Mr Hayne said.

“Its concern was to protect its income streams.”

He found Aussie’s conduct fell below community expectations.

Michael Roddan 4.48pm: ‘Deplorable outcomes for many consumers’: FSC

The Financial Services Council, which represents the for-profit superannuation, wealth management and life insurance sectors, said the royal commission showed the culture of the financial services industry must be urgently transformed to ensure organisations put the best interests of consumers at the heart of what they do.

FSC chief executive Sally Loane said the conduct of financial services providers over many years has been unacceptable.

The FSC had been one of the fiercest opponents of the Future of Financial Advice reforms ushered in under Labor.

“For consumers, interacting with banking and financial services is not voluntary,” Ms Loane said.

“In a compulsory system everyone has a right to be treated with fairness, honesty and utmost professionalism. The industry takes responsibility for the culture that led to some deplorable outcomes for many consumers and a transformation is long overdue.”

The FSC said it backed Treasurer Josh Frydenberg’s comments that consumers must be put “first, second and third.”

The FSC also said it supported policy debate over “whether our complex regulatory framework could be simplified” and whether the existing rules and regulations must be better implemented and enforced.

“I thank Commissioner Hayne for a robust and thorough report which deserves time to be properly considered and absorbed,” Ms Loane said.

Michael Roddan 4.43pm: ‘Rightly critical’, says CBA’s Comyn

Commonwealth Bank chief executive Matt Comyn said the royal commission was “rightly critical of our industry and our bank”.

“We have seen too many examples of unacceptable behaviour and unacceptable customer outcomes,” Mr Comyn said.

“The commission has highlighted the need for significant changes, particularly to systems, processes and culture. I am committed to making sure that we learn from the failures detailed in this report to fix what went wrong and put things right for our customers,” he said.

Mr Comyn, who came to the top job earlier this year after former boss Ian Narev was forced to bring forward his resignation following a series of high-profile scandals, said CBA was already making a number of changes to its business and “will make more to meet the community’s expectations and earn trust”.

The publicity of CBA’s failings, such as its financial planning scandal, its mishandling of life insurance customers and its more than 50,000 breaches of anti-money laundering legislation contributed significantly to the momentum for a royal commission.

“The vast majority of our people do the right thing by their customers every day,” Mr Comyn said. “They have also been let down,” he said.

4.41pm: Westpac customer Jacqueline McDowall

If you’re wondering why the ABA might have described Commissioner Hayne’s report as a “day of shame” for the industry, here’s a reminder.

Michael Roddan 4.37pm ‘No comment’: APRA

The Australian Prudential Regulation Authority is refusing to comment on the release of the royal commission interim report, preferring to wait to make a formal submission to the inquiry.

“We will make a submission in response to the interim report by the due date by 26th of October,” an APRA spokeswoman said.

APRA was castigated by Commissioner Kenneth Hayne for failing to ever take court action against one its regulated companies.

Stuart Parker 4.30pm AICD: ‘Conduct fell well short of the expectations’

The Australian Institute of Company Directors says the interim Hayne report raises important questions about governance, regulation and enforcement which go to the failings in the sector.

“It is clear that some conduct fell well short of the expectations of stakeholders and the community, and that governance and risk-management frameworks of these financial institutions did not prevent or remedy wrong-doing,” said AICD chief Angus Armour.

“Furthermore, the administration and enforcement of existing laws has been called into question.”

He said the AICD will make a submission before the final report and believes the inquiry’s work “presents an important opportunity to improve the governance and practices of this vital sector”.

Michael Roddan 4.27pm: ANZ response

ANZ boss Shayne Elliott said the release of the interim report was a “critical moment” for his industry and his bank to tackle the “urgent work required to fix the significant failures highlighted by the Commission”.

“While this work is well underway, there is more to do and today’s report clearly sets out the damage we can do when we fail our customers,” he said.

“We accept responsibility and we are determined to improve,” Mr Elliott said.

“ANZ is taking action to fast-track changes – leadership, strategic, systems, people and cultural. We will make the investments required to build a bank worthy of the trust and respect of our customers and the community.

“We will analyse the report in detail and respond directly to the Commissioner. We will also continue to engage constructively through the remainder of the process.”

Elizabeth Redman 4.26pm: Dover’s ‘client protection policy’

Financial advice shop Dover may have engaged in misconduct as it may have been misleading to call its “client protection policy” by that name, commissioner Kenneth Hayne wrote.

The wider the exemptions in the policy, the easier it may be to argue that the description was misleading, he said.

In three cases heard by the commission, Dover took no steps to find out if someone it hired could do their job professionally and ethically.

But since Dover said it would stop providing financial advice in June, it is up to the corporate regulator to decide whether it’s worth taking any more steps, he said.

Rosie Lewis 4.23pm: Nats respond

NSW Nationals senator John “Wacka” Williams, an early champion of the banking royal commission, pushed for a mandatory minimum sentence of 12 months jail for financial advisers who gave wrong advice and put themselves before their clients.

“We should simplify the laws so they’re not complicated and the wrong doers can’t weasel out of the courtroom through solicitor’s jargon,” Senator Williams told The Australian.

“We’ve seen these financial planners charging the dead, charging premium life insurance fees after they’re dead, giving advice after their dead, and charging for financial advice when there was no advice – that is blatant theft and proper punishment should be issued to deter it from happening in the future.”

His Nationals colleague George Christensen said the interim report had “vindicated” his fight for the royal commission “against the wishes of former prime minister Malcolm Turnbull”.

“In his interim report released today, Commissioner Kenneth Hayne has said that financial services entities ‘think that they, not ASIC, not the parliament, not the courts, will decide when and how the law will be obeyed or the consequence of the breach remedied’,” Mr Christensen said.

“In other words, banks are a law unto themselves. Just as they were under the previous Rudd and Gillard Labor governments. When the royal commission releases its recommendations in a few months, I will pushing for the Liberal National government to adopt them lock, stock and barrel.

“We need to fix the poor culture and criminal behaviour we have seen from banks, insurers, superannuation funds and other players in the financial sector.”

Samantha Bailey 4.20pm: Better the devil you know

Despite being described as a “day of shame” for the banks, shares in the big four have risen, and this might be why:

“I guess it’s better the devil you know. We’ve now got a better understanding of where the findings are going to land,” Morgans private client adviser Christopher Macdonald says.

“Clearly and unsurprisingly, there has been greed that’s really taken over at the expense of honesty. [It’s been a case of] profits over customers and there will be obviously a big rebound in terms of regulation to help the balance between customers and shareholders.

“The fact that it’s now out there and can be digested is a good thing. Markets always hate uncertainty so we’ve seen a little bit of a rally on the banks that may continue into next week, given that they are quite oversold.”

Andrew White 4.15pm ‘Serious and important,’ says ASIC

Australian Securities and Investments Commission chairman James Shipton said the interim report of the Hayne Royal Commission has made “serious and important” observations about the ASIC’s role as a regulator.

In a statement on the ASIC website the regulator said it would consider these observations and the broader findings of the inquiry and would respond by October 26.

“ASIC will continue to assist the Royal Commission and to work with the Government, the Parliament and other regulators to build a stronger legislative, enforcement and regulatory framework with tougher penalties.”

ASIC has provided much of the ammunition for the Royal Commission to air poor conduct by banks and financial services companies. But it was heavily criticised in the report and by the Treasurer Josh Frydenberg for not taking legal action to enforce the law and focusing instead on negotiated settlements.

“When misconduct was revealed, it either went unpunished or the consequences did not meet the seriousness of what had been done,” Mr Hayne said.

“The conduct regulator, ASIC, rarely went to court to seek public denunciation of and punishment for misconduct. The prudential regulator, APRA, never went to court.

“Much more often than not, when misconduct was revealed, little happened beyond apology from the entity, a drawn out remediation program and protracted negotiation with ASIC of a media release, an infringement notice, or an enforceable undertaking that acknowledged no more than that ASIC had reasonable ‘concerns’ about the entity’s conduct.

“Infringement notices imposed penalties that were immaterial for the large banks. Enforceable undertakings might require a ‘community benefit payment’, but the amount was far less than the penalty that ASIC could properly have asked a court to impose.

Ben Butler 4.11pm: COMMENT: an industry rotten to the core

Kenneth Hayne’s interim report depicts a finance industry that is rotten at its very core, patrolled by regulators too pathetic to take action.

The royal commissioner paints a portrait of a culture of rampant greed, unchecked by any fear that the finance cops will ever catch on.

Although just an interim report that asks far more questions than it answers, the thousand-page tome is also a hammer that drives the final nail into the coffin of the Australian model of light-touch regulation that has existed since the Wallis inquiry in 1997.

The share prices of the Big Four banks enjoyed a rally this afternoon as dumb money reacted with relief to findings that are light on any suggestion of criminal sanctions.

But the idea the banks are off the hook is unrealistic. This interim report deals only with behaviour uncovered in the first four hearing rounds of the commission, and much of the rampant criminality was unearthed later on.

Those rounds, and Mr Hayne’s final recommendations about what to do about this troublesome industry and its ineffective watchdogs, have been left for the final report in February.

In the meantime, the finance sector is already in convulsions, with banks busy shedding their scandal-ridden financial advice and insurance arms and turning back to their core business of borrowing and lending money.

Mr Hayne’s disgust for an industry that has been incapable of coming to terms with its own moral turpitude is palpable.

“From the executive suite to the front line, staff were measured and rewarded by reference to profit and sales,” he writes.

One of his most telling observations about the poor culture of the industry relates to a case study in which NAB bankers falsely witnessed documents.

“A culture of noncompliance can develop even though what is required is obvious,” he says.

Melissa Yeo 4.05pm: Market reaction

Banking stocks have fallen back from their biggest gains in a month, but the sector is still largely seeing red.

Commweatlh Bank rose as much as 3 per cent on the release of the report, but settled back to 2.20pc as investors digested the 1000 pages of findings.

NAB was trading up 2.27pc, ANZ by 2.02pc and Westpac by 1.68pc after touching a 7-day high of $28.34.

AMP is up 1.75pc while Macquarie was the only back bucking the positive moves, down 1.05pc.

Elizabeth Redman 4.03pm: CBA’s conduct “contrary to basic standards of honesty”?

Senior management of CBA and its financial advice businesses knew clients were either being charged or likely to be charged fees for no service for at least 18 months before telling the corporate regulator, commissioner Kenneth Hayne said.

The amount of money paid in compensation as a result shows these breaches were “significant by any measure”, he wrote.

But CBA’s penalty was an enforceable undertaking from corporate regulator ASIC that saw it make a $3 million “community benefit payment”.

This invites attention as to whether the consequences are adequate and whether the companies had sufficiently acknowledged what they had done was contrary to law and contrary to basic standards of honesty, Mr Hayne said.

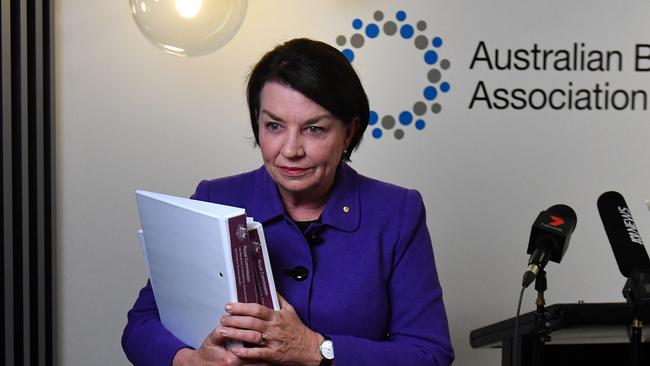

Stuart Parker 3.59pm: ‘No excuses’: Bligh

The Australian Banking Association concedes the release of the royal commission report marks a day of shame for the industry.

“There are no excuses for the behaviour that has been exposed by the royal commission,” said ABA chief executive Anna Bligh.

“Banks accept responsibility for their failures and right now they are working day and night to make things right for their customers.

“We will fix these problems and make them right without delay, to earn back the trust of the Australian public.”

The ABA said it will respond to specific findings in the interim report in coming weeks.

Michael Roddan 3.57pm: NAB chief’s weekend’s work

NAB chief executive Andrew Thorburn said he would be digesting the royal commission interim report over the weekend after blitzing through the summary this afternoon.

“I would like to thank the Commissioner for his thoroughness and diligence,” Mr Thorburn said. “For us at NAB, where we have made mistakes or done the wrong thing, we will own them and fix them,” he said.

The man who was expected to take Mr Thorburn’s job at the end of his tenure, Andrew Hagger, is leaving the nation’s fourth largest lender after being accused of failing to be open and transparent with ASIC when he was dealing with the regulator over the bank’s fees for no service scandal.

The royal commission heard NAB had withheld information from ASIC as to the size of its compensation bill for charging customers fees when they had received no service, which has blown out to almost $100 million

In a short statement after the release of the interim report, Mr Thorburn said Mr Thorburn said: “It is difficult to face the statement of ‘profits before people’, but this is exactly what we need to confront.” “Banking was built on putting people first and earning the trust of customers. We must return to these principles once again, rather than continuing to be short term managers,” he said.

3.54pm: Report ‘scathing’ says Frydenberg

The Royal Commission’s interim report, released today, is a frank & scathing assessment of the culture, conduct & compliance in the financial sector. pic.twitter.com/8IehO5FICm

— Josh Frydenberg (@JoshFrydenberg) September 28, 2018

Elizabeth Redman 3.47pm: CBA financial planning

Commonwealth Bank and its financial advice licensees had a “cultural tolerance” of risks and conduct that could hurt clients but which was to the financial advantage of the bank, Commissioner Hayne says in his report.

The culture is more focused on maximising revenue than providing the best possible service to clients, he writes.

He raised the question of how Commonwealth Bank charged clients fees for no service “to such a significant extent and over so long a period”.

Staff had remuneration and performance targets that did not ensure delivery of service, he noted.

The bank showed an unwillingness to give relevant information to clients in a readily understandable form without legislative intervention, he said.

It continues to earn grandfathered commissions, showing a culture “heavily weighted toward revenue maximisation, while placing less emphasis on client outcomes”, he wrote.

And from 2008 to 2017 the number of financial planners fell 25 per cent while the number of clients almost doubled.

Advice licensees did not have enough resources and failed to ensure financial services are provided efficiently, honestly and fairly, he wrote.

3.44pm: Shorten weighs in

Federal opposition leader Bill Shorten has weighed in on the report, saying Prime Minister Scott Morrison owes the nation an apology.

Scott Morrison owes the nation an apology for blocking the Banking Royal Commission for so long.

— Bill Shorten (@billshortenmp) September 28, 2018

3.38pm: ‘Day of shame’

CEO of the Australian Banking Association, former Queensland premier Anna Bligh, has described the arrival of Commissioner Hayne’s report as a “day of shame for the industry.

Here’s some footage of her press conference from Sky News Australia:

.@ausbanking's Anna Bligh: today is a day of shame for Australia's banks.

— Sky News Australia (@SkyNewsAust) September 28, 2018

MORE: https://t.co/4Zn0rN80nM #SkyLiveNow pic.twitter.com/av4zb9nEvK

Stuart Parker 3.25pm: Finance union responds

The Finance Sector Union of Australia says the commission report has revealed some “appalling” stories of corporate greed and a “disturbing lack of compassion for customers”.

“We agree wholeheartedly with Treasurer Josh Frydenberg that the culture, conduct and compliance of many of our financial institutions falls well below community expectations and standards,” said FSU national secretary Julia Angrisano.

“We know how that greed was allowed to spiral out of control. It was because of conflicted remuneration, a sales culture that put profits before people and senior bankers and executives of financial corporations who were content to ride the gravy train of multi-million dollar salaries and bonuses,” she said.

“Executives were driven by enormous salaries if they delivered short term profits. They did this by exploiting customers and bank staff.

“Bank workers who did their jobs diligently serving their customers were under extraordinary pressure to sell, sell, sell. Those who didn’t meet sales targets were driven out of the industry, or worse, lost their health and on occasion their lives.”

The FSU says once the final report is released, the government must make major changes, and ensure banks comply with them.

Michael Roddan 3.20pm: ‘Bad apples’ at NAB and CBA?

Commonwealth Bank and National Australia Bank executives were largely in the dark over their misdeeds, the royal commission has found, leaving bank chief under the impression that any misconduct was perpetrated by rogue employees or bad apples acting independently.

Commissioner Kenneth Hayne noted the inability of the major banks to understand the dramatic level of their own misconduct, describing the actions that the banks took after he asked for initial submissions of wrongdoing over the last decade.

While the royal commission probed 61 institutions from the banking, insurance and superannuation industries, the major financial institutions - ANZ, CBA National Australia Bank and Westpac and AMP - failed to properly respond to Mr Hayne’s request.

After receiving, in cases, only examples of conduct the banks had identified in its submission, Mr Hayne launched a second request for information, asking for detailed and comprehensive list of all conduct in the last five years that amounted to misconduct.

“CBA and NAB protested that the task was too large and could not be completed within the time allowed,” Mr Hayne said. Both banks then proceeded to submit large print out of “unhelpful” documents detailing information of every incident workers committed that may be a breach of the law.

CBA then submitted further tables of misconduct, with the admissions separated between its mortgage broking subsidiary Aussie Home Loans and the rest of the CBA business. NAB was forced to separately examine all its significant litigation reports through Australian court judgments, its breach registers, its reports to ASIC, APRA and the anti-money laundering regulator, the Financial Ombudsman Service, its annual statements of compliance and details handed over to the Australian Information Commissioner.

“The point to be made about the course of events is that at least CBA and NAB found it difficult to comply with the requests that I made,” Mr Hayne said. “Taken together, the course of events and the explanations proffered can lead only to the conclusion that neither CBA nor NAB could readily identify how, or to what extent, the entity as a whole was failing to comply with the law.”

“And if that is right, neither the senior management nor the board of the entity could be given any single coherent picture of the nature or extent of failures of compliance; they could be given only a disjointed series of bits of information framed by reference to particular events,” he said.

“Information presented in that way points too easily towards explaining what has happened as ‘a small number of people choosing to behave unethically’ or as the product of ‘people, policies and processes that existed with a pocket of poor culture in that area at that time’. The extent to which these issues extend beyond CBA and NAB remains to be explored.

Rosie Lewis 3.15pm: Labor’s response

Deputy opposition leader Tanya Plibersek has responded to the publication of the report on behalf of federal Labor. Here’s some footage from Sky News Australia.

.@tanya_plibersek: the Liberals fought 'tooth and nail' against the establishment of a royal commission. They wanted to protect the banks.

— Sky News Australia (@SkyNewsAust) September 28, 2018

MORE: https://t.co/4Zn0rN80nM #SkyLiveNow pic.twitter.com/egIvlb9mKr

Rosie Lewis has also filed some detail on the labor press conference:

Attempting to get on the front foot, acting Labor leader Tanya Plibersek announced a future Shorten government would set up a “financial services royal commission implementation taskforce” to “reform the culture of profit over people” in the sector.

The taskforce would be located within Treasury, Ms Plibersek said, and work closely with the Attorney-General’s department to implement the recommendations of the final banking royal commission report.

“The taskforce, of course, will work closely with victims and their advocates in recognition that the lived experience of the systemic misconduct in the banking sector should inform the response,” she said.

“Under a Shorten Labor government, Chris Bowen as treasurer will report to the parliament every six months on progress in implementation until the recommendations of the royal commission are fully implemented.”

Ms Plibersek said the Liberal Party had fought “tooth and nail” against the establishment of the royal commission for more than 600 days as she called for its extension so more victims from more places could be heard.

“Scott Morrison wanted to keep this shocking misconduct by the banks secret from the Australian public. This is the report that Scott Morrison never wanted. If it had been left up to Scott Morrison, banks would still be behaving this way,” she said.

“If it were up to him, the horrific stories would never have been told and the conduct would have continued. The Liberals have spent five years fighting for the top end of town. They delayed acting on the royal commission for 600 days. They voted against it 26 times. We know whose side they are really on.”

Rosie Lewis 3.12pm ‘Regulator working too closely with the sector’

Here’s some more from Treasurer Josh Frydenberg’s press conference, reported for us by Rosie Lewis:

Mr Frydenberg said the government would take the “necessary” action to restore the public’s trust in the financial system and reflected on Mr Hayne’s observation as to whether existing laws should be simplified, rather than adding extra layers of legal complexity.

“What is clear from this report is that too often the regulator would seek a negotiated outcome as opposed to taking the next step, which would be to litigate and make these entities face court,” he said.

“It was a strategy that they had which saw the regulator working too closely with the sector that they were regulating.”

The Treasurer said he was not surprised by the findings in the three volumes of the interim report, given what evidence had been put forward at “gruelling” public hearings to date.

“The behaviour that we have seen to date has been unacceptable. Fees charged to dead people, fees for no service, 300,000 plus breaches for providing insurance advice that was unsolicited and against the rules. Many other examples of conduct which is unacceptable,” Mr Frydenberg said.

“But now that it has been revealed, now that we have the interim report and next year the final report, it is incumbent upon those in the financial services sector and those regulators who are charged with enforcing the law, lift their game because the public deserve it and the public expect it.”

Elizabeth Redman 3.05pm: AMP’s ‘deliberate attempt to mislead’

Financial services giant AMP has a culture and governance practices that show “insufficient concern for adherence to the law” over its charging customers fees for no service and then dealing with the corporate regulator in a way that was not “forthright and honest” commissioner Hayne said in his interim report.

The group’s financial planning boss Jack Regan told the commission the group made as many as 20 false or misleading statements to ASIC about the issue, and Mr Hayne saw no reason to doubt his evidence, adding that the statements could even be seen as “a deliberate attempt to mislead”.

Senior staff at AMP knew about charging fees for no service, internal lawyers warned it was a breach of the law, and some junior staff even warned it was a breach, he said.

The conduct shows a “persistent and prevalent attitude of senior persons within AMP that it is acceptable to deal with ASIC other than frankly and candidly”, he said.

2.55pm: What can be done?

Here’s a bit more from the report’s executive summary, under the heading:

What can be done to prevent the conduct happening again?

As the Commission’s work has gone on, entities and regulators have increasingly sought to anticipate what will come out, or respond to what has been revealed, with a range of announcements. These include announcements about new programs for refunds to and remediation for consumers affected by the entity’s conduct, about the abandonment of products or practices, about the sale of whole divisions of the business, about new and more intense regulatory focus on particular activities, and even about the institution of enforcement proceedings of a kind seldom previously brought. There have been changes in industry

structure and industry remuneration.

The law already requires entities to ‘do all things necessary to ensure’ that the services they are licensed to provide are provided ‘efficiently, honestly and fairly’. Much more often than not, the conduct now condemned was contrary to law. Passing some new law to say, again, ‘Do not do that’, would add an extra layer of legal complexity to an already complex regulatory regimen. What would that gain?

Should the existing law be administered or enforced differently? Is different enforcement what is needed to have entities apply basic standards of fairness and honesty: by obeying the law; not misleading or deceiving; acting fairly; providing services that are fit for purpose; delivering services with reasonable care and skill; and, when acting for another, acting in the best interests of that other? The basic ideas are very simple. Should the law be simplified to reflect those ideas better?

Rosie Lewis 2.50pm: Frydenberg flags new laws

Josh Frydenberg has flagged new laws or tougher existing laws to crack down on misconduct by the banks as he releases the 1000-page interim report that “shines a very bright light on poor behaviour of our financial sector”.

The Treasurer also said the corporate regulator would receive a “favourable hearing” from the Morrison government if it required more resources to enforce the law and crack down on a culture of greed.

“Banks and other financial institutions have put profits before people. Greed has been the motive, as short-term profits have been pursued at the expense of basic standards of honesty. Too often simply selling products and services have become the sole focus of attention,” Mr Frydenberg said.

“This interim report also makes clear that, while behaviour was poor, misconduct when revealed ‘either went unpunished or the consequences did not meet the seriousness of what has been done’.

“The Commissioner [Kenneth Hayne] makes a series of significant observations with respect to the effectiveness and the ability of regulators to detect, monitor and enforce compliance with the law. ASIC, the Commissioner points out, rarely went to court to seek public denunciation of and punishment for misconduct. Indeed, in his words, ‘little happened beyond an apology from the entity, drawn out remediation, and an infringement notice or an enforceable undertaking that acknowledged no more than ASIC had reasonable concerns about the entity’s conduct’.

“Significantly, the Commissioner observed infringement notices, impose penalties that were immaterial to the large banks. Again, in his words, ‘too often, entities have been treated in ways that would allow them to think that they, not ASIC, not the parliament, not the courts, will decide when and how the law will be obeyed or the consequence of the breach remedied’ … This is clearly unacceptable and cannot continue.”

Melissa Yeo 2.49pm: ASX reacts

Trading Day reports: Details from the first report from the financial services royal commission have buoyed financial stocks in afternoon trade, all the majors staging a turnaround despite being called out as “a frank and scathing assessment of culture, conduct and compliance of our financial system”.

Commonwealth Bank is leading the gains, up 1.83pc, NAB by 1.87pc, Westpac by 1.27pc and ANZ by 1.15pc.

Michael Roddan 2.43pm: Banks decided when and how laws would be obeyed

The Australian’s Michael Roddan has filed on the publication of the report:

The banking royal commissioner Kenneth Hayne has said it was not just “greed” that drove the banking misconduct, but a soft-touch treatment by financial regulators allowed the banks to believe they could decide when and how laws would be obeyed.

In the royal commission’s interim report released today, Mr Hayne begged the questions “why” and “what now” after completing the first six months of his investigation into the financial services sector.

“Why did it happen? What can be done to avoid it happening again? These are now the key questions,” Mr Hayne said, introducing the 1000-page report.

The commissioner said that while “too often, the answer seems to be greed” and “the pursuit of short term profit at the expense of basic standards of honesty”, there was a need to probe why particular events came about.

“When misconduct was revealed, it either went unpunished or the consequences did not meet the seriousness of what had been done,” he said, singling out the Australian Securities & Investments Commission for failing to take the banks to court regularly, and in the case of the Australian Prudential Regulation Authority, at all.

Treasurer Josh Frydenberg said the interim report is a “frank and scathing assessment of the culture, conduct and compliance of our financial system”.

“Australians expect and deserve better,” he said.

“Significantly, the Commissioner observed infringement notices, impose penalties that were immaterial to the large banks,” Mr Frydenberg said.

“In his words, “Too often, entities have been treated in ways that would allow them to think that they, not ASIC, not the parliament, not the courts, will decide when and how the law will be obeyed or the consequence of the breach remedied,” he said.

“This is clearly unacceptable and cannot continue,” he said.

“The question that needs to be asked is how did this culture of greed and selling as the dominant focus, how was that allow to permeate the sector to produce adverse outcomes for consumers without being stamped out earlier and without the penalties that exist to be properly enforced,” he said.

Follow Michael’s developing report here.

2.40pm: ASIC rarely went to court

Here’s some more from that executive summary:

Banks, and all financial services entities recognised that they sold services and products.

Selling became their focus of attention. Too often it became the sole focus of attention.

Products and services multiplied. Banks searched for their ‘share of the customer’s wallet’.

From the executive suite to the front line, staff were measured and rewarded by reference to profit and sales.

When misconduct was revealed, it either went unpunished or the consequences did not meet the seriousness of what had been done. The conduct regulator, ASIC, rarely went to court to seek public denunciation of and punishment for misconduct. The prudential regulator, APRA, never went to court. Much more often than not, when misconduct was revealed, little happened beyond apology from the entity, a drawn out remediation program and protracted negotiation with ASIC of a media release, an infringement notice, or an enforceable undertaking that acknowledged no more than that ASIC had reasonable ‘concerns’ about the entity’s conduct. Infringement notices imposed penalties that were immaterial for the large banks. Enforceable undertakings might require a ‘community benefit payment’, but the amount was far less than the penalty that ASIC could properly have asked a court to impose.

2.35pm: Why did it happen?

Here’s a Tweet from Sky News Australia political reporter Annelise Nielsen.

#BankingRC report is out! Exec-summary gets right to it:

— Annelise Nielsen (@annelisenews) September 28, 2018

"Why did it happen? Too often, the answer seems to be greed–the pursuit of short term profit at the expense of basic standards of honesty. How else is charging continuing advice fees to the dead to be explained"@SkyNewsAust

Meanwhile, The Australian’s Samantha Hutchinson is at Treasurer Josh Frydenberg’s Melbourne press conference, which is continuing at the moment.

I'm in Melbourne where @JoshFrydenberg says an interim report from the Royal Commission into banks has delivered a "scathing" assessment of the sector; driven by greed and a practice of chasing short-term profits at the expense of customers #springst #auspol pic.twitter.com/fPRTzqNtk0

— Samantha Hutchinson (@SHutchinsonNews) September 28, 2018

2.33pm: Driven by greed

Here’s a snap on the report’s contents from AAP’s Megan Neil:

Misconduct by banks and major financial institutions has all too often been driven by greed, banking royal commissioner Kenneth Hayne QC says. Mr Hayne in his interim report said too often, the answer to why misconduct happened seems to be greed - “the pursuit of short term profit at the expense of basic standards of honesty”.

He said when misconduct was revealed, it either went unpunished or the consequences did not meet the seriousness of what had been done.

2.31pm: Questions to be answered

The Interim Report of the Financial Services Royal Commission is now available. The Economics Committee, now Chaired by @TimWilsonMP, has announced that Australia's four major banks will be questioned on the contents of the report in hearings on 11, 12 and 19 October.

— Australian House of Representatives (@AboutTheHouse) September 28, 2018

2.27pm: Executive summary

Here are the first few lines of the executive summary of the commissioner’s report, setting out how he will address the issues:

The Commission’s work, so far, has shown conduct by financial services entities that has brought public attention and condemnation. Some conduct was already known to regulators and the public generally; some was not.

Why did it happen? What can be done to avoid it happening again? These are now the key questions.

In this Interim Report these questions – ‘why’ and ‘what now’ – are asked with particular reference to banks, loan intermediaries and financial advice, with a view to provoking informed debate about both questions.

2.21pm: Interim report published

Commissioner Kenneth Hayne’s interim report has been published publicly.

The document is available on the commission’s website, which appears to be struggling under the weight of public and media interest at the moment.

We’ll have some details for you very shortly.

2.13pm: Today’s findings: what they’ll cover

A reminder that today’s interim report doesn’t cover evidence and submissions for all the hearings to date.

Instead it covers four rounds of hearings:

- consumer lending,

- financial advice,

- loans to small and mediums-sized businesses,

- and financial services in regional and remote communities.

The most recent insurance round is outside the scope of today’s report and investors in the sector are perhaps a little relieved, with shares in major insurers all up on the ASX today, from Suncorp, which had gained 0.38 per cent this afternoon to QBE, which has put on 1.87 per cent.

1.37pm: Not all is lost on banks, says Macquarie

Cross-posting here from our Trading Day blog, where we’re reporting that Macquarie analysts say there’s still value in banks at current levels despite the fallout from the royal commission.

In a preview to the interim report, which is expected to be handed down this afternoon, Macquarie says the commissioner is likely to target culture, conduct and remediation process rather than prescriptive measure around lending practices.

“We see scope for banks to unwind some of their recent underperformance as fears of particularly adverse set of recommendations subside,” Macquarie says.

The banking sector has historically traded at 22 per cent discount to the 5-year average of the All Industrials, but current levels have it trading at a 37 per cent discount.

“While we believe the current market conditions justify a bigger discount due to the increased level of regulatory scrutiny, higher compliance costs, bank levy, and weakness uncovered by the Royal Commission, we believe that 5-10 per cent discount to the 5-year average is justifiable. Given the sector is currently trading at ~37 per cent to the broader Industrials, we see value at current levels.”

Overall shares in the four major banks cooled slightly after lunch after more positive trading earlier in the day. Westpac has been the exception, with its shares having now dropped close to 1 per cent for the day.

- WBC was down 0.98 per cent at $27.35

- CBA was up 0.31 per cent at $70.30

- ANZ was down 0.11 per cent at $27.76

- NAB was up 0.02 per cent at $27.34

1.00pm: Hayne delivers report to GG

ABC News has spotted royal commissioner Kenneth Hayne delivering his report to Governor General Sir Peter Cosgrove.

Tradition reigns in the vice-regal world, and so Commissioner Hayne has delivered the report in person, carrying what looks like a fairly heft volume on his lap as his car entered the grounds of Government House.

So the wheels are in motion, but the report will still need to be tabled in Parliament before it’s given over to the public.

Word is that Treasurer Josh Frydenberg has scheduled a press conference for 2.15pm this afternoon.

Have just seen video of Commissioner Kenneth Hayne delivering the interim #BankingRC report to the Governor-General in Canberra. It looks thick. pic.twitter.com/4jMfeRNbho

— Michael Janda (@mikejanda) September 28, 2018

Michael Roddan 12.45pm: New rules for advisers

Coming on the heels of the news that financial advisers are leaving the major financial players in numbers comes that announcement that dodgy financial advisers will be fined or kicked out of industry associations under new compliance schemes to be put in place by January 2020.

ASIC expects the new schemes to conduct at least one “thematic” review of problems in the industry off their own bats every year, it said in a new regulatory guide released today ahead of the banking industry royal commission interim report.

ASIC expects industry associations will have to overhaul their existing disciplinary schemes to meet new independence requirements, including an independent chairman and consumer representation.

The new rules for compliance schemes are part of laws, introduced after a series of scandals in the sector revealed a bonus-hungry culture rife with rip-offs, that bring in a compulsory code of ethics binding all advisers.

Under the new rules, compliance with the code, which is being developed by the Financial Adviser Standards and Ethics Authority, is to be monitored by bodies set up by industry.

All advisers are to subscribe to a scheme by November 15 next year, ASIC said.

Michael Roddan 11.35am: Planners flee finance majors

Financial planners are continuing to flee major financial institutions at the same time as a flood of punters withdraw their savings from Australia’s major wealth managers, as the damage wrought in the wake of the Hayne royal commission starts to mount for the finance sector.

Banking analysts are also flagging growing expectations of more lawsuits, regulatory penalties and customer refunds.

Ahead of the release of the interim report for Kenneth Hayne’s inquiry into the financial system today, UBS analysts have warned that the trend of advisers leaving large institutions is “entrenched” while prospects of further pressure on profits is more than likely.

The news comes after some of the largest banks and wealth managers, AMP, National Australia Bank and ANZ suffer a sharp reduction in cash flows over the March quarter.

The overall wealth management sector was hit with its first quarter of net outflows in six years.

Collectively, the sector lost $570 million in cash flows, the first quarterly loss since March 2012.

The bleeding of cash comes as billions of funds are withdrawn from for-profit wealth managers and moved across to the not-for-profit industry superannuation fund sector, which emerged from the royal commission unscathed.

UBS analyst James Coghill said while there were “wider industry” issues at play, AMP was particularly susceptible to squeezed profit margins after it lowered its fees on its flagship MySuper products for the first time since inception. Mr Coghill also said this margin pressure would worsen if the royal commission clamped down on grandfathered commissions.

Mr Coghill said AMP shares were likely to tumble a further 13 per cent, leaving the stock down 50 per cent from before the royal commission began. He said AMP would have a “long and bumpy pathway to recovery”.

The downgrade came on the back after Westpac late last night announced a $235 million writedown in cash earnings, to cover provisions for customer refunds for advice fees charged where no service was provided, stoking fears that other banks will unveil further customer-related provisions.

ASIC expects total repayments were to exceed $1 billion.

11.30am: German trouble for Macquarie chiefs

While it has largely escaped the attention of the royal commission, Macquaire has still found itself in hot water. Michael Roddan and Ben Butler report that Macquarie boss Nicholas Moore and incoming CEO Shemara Wikramanayake are likely to be named as suspects by German prosecutors investigating a dividend tax scam.

Both are “likely to be formally classified under German law as persons of interest or suspects” so that they can be interviewed by the Cologne Prosecutor’s Office as part of a group of up to 30 people involved in the transaction, Macquarie said in an ASX statement.

11.15am: Predicted findings

Richard Gluyas reported this morning that the main policy issues expected to feature in the report include responsible lending, as well as governance failures and remuneration structures in the advice industry, including grandfathered commissions.

There’s an overwhelming belief in the market that the report will recommend a crackdown on responsible lending, with poor bank systems and processes one of the main contributors to excessive debt held by vulnerable borrowers.

11.10am: Is this right?

Andrew White writes in The Australian this morning that for the second time this millennium, the financial services industry and the wider community are waiting with bated breath on the outcome of an inquiry into a rolling financial catastrophe.

Anticipation of strong action against the banks, insurers and wealth managers has built to fever pitch ahead of the Hayne royal commission’s interim report today. As the hearings have rolled on this month a denouement of sorts is expected for an industry whose greed and disregard for the consumer has been laid horribly bare.

In 2003 there was a royal commission into the collapse of HIH Insurance that is often credited with setting up a regulatory approach that helped Australia avoid the worst ravages of the global financial crisis.

But 15 years on, the evidence would suggest some of its most important findings and insights have been forgotten or overlooked in the first place.

Retired Justice Neville Owen delivered three volumes to the then Howard government resulting in, among other things, an overhaul of the Australian Prudential Regulation Authority, criminal charges for three colourful business characters and the birth of modern corporate governance standards.

But after fulfilling the strict terms of his brief to explain the collapse and recommend steps to reduce the chances of such a catastrophe happening again, Owen also had his own observations. They concerned the morality of the people involved in the business and are directly relevant to the conduct the Hayne royal commission has been examining. They should have rung in the ears of the financial services industry that now looks destined for a prolonged period of re-regulation and tough enforcement.

Read Andrew’s full analysis here.

11.05am: Recap – APRA orders culture reviews

This morning Michael Roddan revealed that Australia’s biggest financial institutions and super funds have been forced by the prudential regulator to ram through an in-depth review of their culture and governance before the royal commission ends next year.

After copping heavy criticism over the course of the commission over a lack of enforcement in the financial sector, the APRA has demanded Westpac, ANZ and NAB Bank mimic the landmark cultural investigation of CBA the regulator launched late last year.

Along with the major banks, some of the nation’s biggest union and employer-backed super funds — such as the $40 billion Hostplus, $35bn fund Cbus and $50bn REST super fund — have also been asked by APRA to review their culture.

Under-strain wealth management giant AMP has also been roped in to review its culture.

11.00am: Recap - Westpac flags surprise $235m hit

Yesterday afternoon Westpac flagged a surprise $235 million writedown to its annual result, reflecting provisions for recent litigation and the cost of remediating a range of advice and product issues.

While two-thirds of the impact from the writedown will be recorded as a revenue hit, with the remainder affecting the cost line, Westpac (WBC) said after the close of the market that costs associated with responding to the royal commission were not included.

The writedown covers fee refunds for advice that was never provided by the group’s salaried financial planners, refunds for inadequate financial advice from Westpac planners, and additional provisions to resolve legacy issues as part of the bank’s detailed product reviews.

You can read Richard Gluyas’ full report here.

Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, insurance round hearings

Wednesday 19 September: ‘Delays dog insurance claimants’

Tuesday 18 September: ‘It wasn’t my finest hour’

Monday 17 September: ‘Unlimited cover’ meant $1000

Friday 14 September: ‘A very unusual case’

Thursday 13 September: ‘This is absolutely bullying’

Wednesday 12 September: ‘May discriminate, impact profit’

Tuesday 11 September: ‘Warning signs were all there’

Monday 10 September: ‘I’d sack them’

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout