Banking royal commission live: insurance hearings

Insurer Youi has been taken to task for its slow response and shoddy treatment of two storm damage victims.

Senior counsel assisting the royal commission Rowena Orr QC is taking the commission through case studies related to natural disaster insurance. Broken Hill resident Sascha Murphy was the first case study to give evidence, followed by Glen Sutton, who lives near Airlie Beach.

Earlier, counsel assisting Mark Costello questioned of IAG’s Benjamin Bessell about add-on insurance sold through the motor trade.

4.40pm: Claimants wrongly blamed

In February this year, the person the Suttons hired to deal with Youi on their behalf, made a submission to the royal commission and sent Youi a copy of the submission.

The chief risk officer at Youi asked for a summary of the case and subsequent internal Youi emails blame the Suttons for the delays.

Ms Orr asks if the emails misrepresent the true position of Youi’s handling of the claim. Yes, Mr Storey replies.

4.35pm: ‘Over-dramatising’

Mr Sutton made a complaint to Youi in November last year. Ms Orr brings up an internal Youi email discussing the complaint. The loss assessor’s response to the email was that he “would deal with the facts”.

He says: “The insured has a habit of over-dramatising everything and creating an environment where you feel like approving it just so you can move forward. It’s a common trait among people trying to get more than what their coverage allows.”

That was not appropriate communication, Mr Storey agrees.

The person dealing with the complaint said she was organising the temporary accommodation for the client and the only suitable accommodation was a six-month contract. She asked the loss assessor to give a rough timeframe of how long the work would take. The loss assessor said it would take 10 weeks to complete the work.

Youi never responded to the complaint in writing as it was required to do to comply with the code.

4.10pm: Roof tarp took a month

A second builder came out and a tarp was fitted around the hole in the roof - this was a month after the cyclone. Mr Storey doesn’t know why this wasn’t done earlier.

A third company was then instructed to perform a make-safe at the property. The make safe description included that the tarp needed to be re-fitted. The tarp that had been originally fitted had come loose. Did Youi do anything to ensure the Suttons’ property would remain watertight? Were any steps taken to expedite the repairs to the roof? No

As the months wore on, water kept getting into the property.

In July a restoration company visited the property and told Youi the technician had removed all ceilings on the lower floors. It said works couldn’t commence until the roof was fixed.

The replacement of the tarp wasn’t authorised until January.

In November the loss assessor forwarded an email from the Suttons to the builder and said to ignore the emotional aspects of their email but to replace the tarp on the roof.

4.10pm: Cyclone repair delays

We’re now on to Mr Sutton’s claim. His home was damaged by tropical cyclone Debbie. The Suttons made a claim in March last year and the repair works are yet to commence. There were long periods over the past year in which the roof was not covered and now there is mould in the house.

Is it acceptable that the Sutton’s are still not back in their house? No, Mr Storey says.

Is it acceptable that Youi repeatedly delayed reimbursing the Suttons for the temporary accommodation payments? No, he says.

Does he accept that Youi failed to conduct its complaints handling process in a fair and transparent manner. Yes he does.

We heard earlier that when the cyclone hit it took off part of the roof of his house. Youi tried to organise a make safe on that day but because of the storm no one was able to go out. A few days later Youi arranged for builders to go and conduct the make safe.

On March 31 the builder sent an email to the state home assessing manager for Qld, Catherine Aherne. He outlined the issues with the roof and gave a quote of $2000.

On the same day the builder called and said the $1000 limit would be exceeded because of the height of the house. Anything above $1000 required further authority from Youi. So the builder didn’t cover the roof that day.

The builder didn’t conduct any drying work that day. Youi doesn’t currently have any policies or procedures relating to mould but is looking into it. Did Youi take any steps to check that action had been taken to stop mould growing? Mr Storey doesn’t know.

4.00pm: Rain exposes shoddy repairs

Back to Ms Murphy’s claim and when it rained in Broken Hill on November 15 2017. Youi’s notes from phone recordings show Ms Murphy’s partner rang at 5 in the evening and advised water was coming into the house, proving repairs had not been done properly.

After that phone call Youi arranged for another builder to go out and conduct a make-safe.

On November 16, Youi was told more than a make-safe was required as builder A had walked off the site.

Did Youi apologise to Ms Murphy and her family? Yes, it has, Mr Storey says.

The roof was repaired in May this year and internal repairs are still ongoing.

Because of the delays Ms Murphy and her family were exposed to lead for longer than they should have been, Ms Orr puts to Mr Storey.

Mr Storey says he is not a lead expert but says it seems so.

3.55pm: Complaints process non-compliant

We’re now getting to the bottom of the missing document. It was included in an updated statement submitted to the commission yesterday and was annexed to Mr Sutton’s case in the submission rather than Ms Murphy’s.

Ms Orr moves on to the review Youi has undertaken of its complaints handling processes and the findings prepared by Youi’s compliance department. The document shows that awareness and understanding of the complaints handling process was described as limited and “significant improvement” to the training, recording and reporting of complaints information was required. As a result Youi’s complaints process was considered non-compliant. It listed significant areas of concern and action items that run over four pages.

Youi will implement those action items, Mr Storey confirms. He is taking the findings very seriously, he says.

3.40pm: Youi admits being ineffective

A letter from Youi to the royal commission dated June 22 outlined the timeline of the complaint made by Ms Murphy and the subsequent follow up by Youi, including that one of the phone calls between Youi and the Murphys was conducted by a Youi employee on a mobile phone that was not recorded. We hear that since then, another note was identified by Youi in regards the complaint but it seems this was not provided to the commission.

Ms Orr moves on.

She goes to the brief letter Youi sent to the Murphys in response to their complaint. Mr Storey agrees that it was not an adequate response.

We are back on to the insurance code of conduct and the section that deals with complaints.

One of the clauses says it will conduct complaints handling in a fair and transparent manner. It also says Youi will respond to the complaint within 15 days and it will respond in writing as well as the reasons for the decision taken.

The letter from Youi did not set out its decision or the reasons for the decision. Mr Storey agrees that Youi didn’t handle the complaint effectively. Youi should have escalated the complaint, he says.

3.35pm: No check on roof

Ms Orr brings up further emails from the loss assessor that detail Ms Murphy is pregnant, the family is being exposed to lead, the builder has “packed up” and she is going to go to the ombudsman.

Mr Storey said in his written statement that Ms Murphy informed Youi of the lead issues on October 20th. The emails Ms Orr has just shown the court are from October 6th.

Youi took action to close up the roof on October 9th even though they had asked the builder to tarp the roof on October 5th. Was that acceptable, Ms Orr asks. No, Mr Storey says. Did Youi follow up after October 9th to make sure the roof had been tarped? No, Mr Storey says.

Youi also didn’t tell builder A that their conduct was unacceptable.

On October 9 Youi asked builder A for a new quote on the repair works to bring the roof up to code. On October 19th the variation was authorised. The work increased the cost by $2000. The following day builder A went back to commence the repair works and then told Youi it had identified further issues and the repair costs would be significant.

On October 20, Youi internal emails show Ms Murphy was complaining about the health risk and her concerns were not being addressed. After that, Youi arranged for four days’ temporary accommodation. Youi took no steps to check that the roof had been put back properly before the family were told they could move back into the home.

On October 30, Ms Murphy said she wanted to make a formal complaint. The complaint was six pages long and detailed all of the issues with the builder and that her partner was having to do work to make the property safe.

On November 7, Youi called the Murphys “to understand the complaint”. A follow up call later that month was not recorded by Youi, the court hears. There was a note that outlined how the Youi staff member addressed the complaint. There’s some confusion here as the commission doesn’t appear to have been given access to this note. Mr Storey tries to recall what the note said.

3.25pm: Youi ‘didn’t do enough’

Ms Orr goes back to the email that mentioned the failure of builder A to get relevant insurance was a breach of Youi’s service level agreement. Why didn’t Youi terminate the agreement then? Mr Storey can’t answer that.

After Ms Murphy paid the excess and signed the statement of works, builder A said the repairs would start within the month. Builder A was required to start the repairs within 10 working days. They started four months later. The work was required to be completed 20 days after starting. We heard earlier that Ms Murphy is still having issues with getting all the repairs completed to an adequate standard.

In the four months between Ms Murphy signing the document and the works commencing, what did Youi do, Ms Orr asks. Not enough, Mr Storey says. Youi chose this builder and Youi was responsible for ensuring the works were done in a timely manner. Did Youi do enough to address the delays? Not at all, Mr Storey agrees.

Ms Orr brings up an email from Ms Murphy’s partner to Youi. He says he had been told he needed to pay $775 so work could start within 4 weeks ago. That was seven months ago, he says. By this stage the roof was half fixed.

The material emailed by Ms Murphy’s partner to Youi included the documents from the builder that required them to pay $3000 for “private works”.

2.59pm: Builder was being managed out

Ms Orr brings us to two emails: in May 2017 a home procurement manager sent an email to “builder A” asking for details of the warranty insurance that he had in place for all building works in Broken Hill.

Later in May, an internal email outlines builder A’s response. The builder said some job insurance was retrospective, which the procurement manager said was unacceptable. He also repeats that the builder is on suspend and being “managed out”.

Another email is shown to the court. Builder A provided the information to Youi as requested, including that relating to Ms Murphy’s claim.

The response from Youi is that it raises red flags and puts Youi and its customers at risk. The gap in the insurance process is a breach of Youi’s code and state legislation, Youi says.

Other internal emails show that RACV had ‘just given builder A the boot’.

So by this time Youi was obviously concerned about builder A but didn’t allocate a new builder to Ms Murphy.

Builder A was removed by Youi in March 2018, Mr Storey thinks.

Youi never told Ms Murphy about the issues with builder A. Should it have, Ms Orr asks. It certainly should have, Mr Storey replies.

He accepts that Youi should have allocated another builder to Ms Murphy’s claim.

2.54pm: No regrets from Ken Henry

Outside the commission, NAB chairman Ken Henry has told The Australian’s Richard Gluyas that he has no regrets about driving the consensus that led to the chief executives and chairs of the four major banks writing to Scott Morrison to call for a royal commission.

“I have no regrets if the industry has been embarrassed,” he said.

“The industry should accept that there are good reasons for its embarrassment and it should respond accordingly.”

2.41pm: Problem builder had been suspended

Ms Orr goes into detail on Ms Murphy’s claim.

In January last year Ms Murphy made a claim on her home insurance policy following a hail storm in Broken Hill, where she lives with her partner and four children.

A summary of the claims record is shown to the court. It outlines the hail damage to the property that Ms Murphy described to Youi in the initial phone call.

The claim was allocated to a “loss assessor”: this person would attend the property, validate the loss, prepare a scope of works, request estimates from builders and allocate the work to one of the builders.

The assessment report from the assessor shows that under the ‘make-safe’ section it says “nil”. “Make-safe” is a temporary repair to ensure no further loss. There’s no check to make sure a ‘make-safe’ is performed as part of the claims process. Mr Storey says he will consider changing this, following the evidence he heard today. There were no make-safe works carried out at this initial stage of Ms Murphy’s claim.

Two builders went out and inspected the property. One of the builders was Australis, the second builder is subject to a non-publication direction. They will be referred to as “builder A”. The report from builder A detailed the hail damage and set a scope of work with a quote of $25,778. There was no mention of the roof not complying with the code.

Builder A was selected for the job because their quote was more competitive. Australis’ quote had come in at just over $26,944. The loss assessor had estimated the works at a little over $27,000.

By this stage a number of customers had already complained to Youi about builder A.

By the time the Murphys had paid the excess and returned the signed scope of works, issues had been raised with Youi specifically about builder A in regards Broken Hill claims.

An internal Youi email from May 2017 that Ms Orr shows the court says that going forward builder A and another unnamed builder are not to be assigned to Broken Hill claims. It says builder A has been based on “suspend” in the region.

2.22pm: Are they covered?

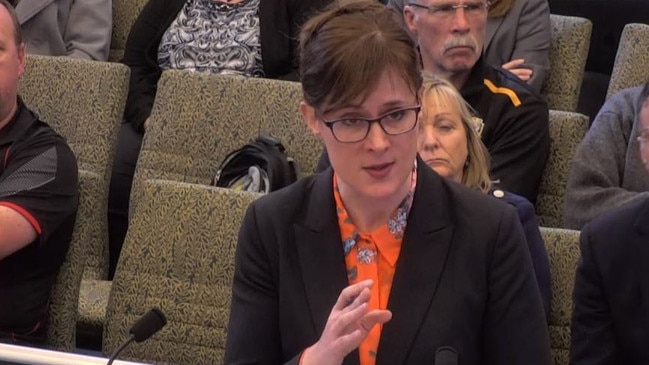

We’re back after lunch and senior counsel assisting Rowena Orr QC is questioning Youi’s chief operating officer for claims services, Jason Storey, about the two case studies we heard earlier today.

Ms Orr runs through the policy of Ms Murphy, from whom we heard earlier, as well as exclusions listed in the product disclosure statement. There is an exclusion for costs resulting from a building not being compliant with the most recent building code. Does this mean that a large portion of Youi’s customers are not covered based on that exclusion?

Mr Storey suggests that’s not what the exclusion means, but eventually admits that may be the effect.

Is that a fair term, Ms Orr asks. He believes it’s required and a term that insurer should have. It depends on how it’s applied in the claims process, he adds.

Ms Orr puts it to Mr Storey that it’s an unfair term to include in the contract, but he doesn’t accept that.

Youi doesn’t always apply that exclusion, he says. Internal guidance for Youi’s claims assessors shows that “built to code” and “betterment” are subjective. Mr Storey is unable to say how long those guidelines have been in force.

The only way customers would know if they’re covered if their home doesn’t comply with the current building code would be if they make a claim.

Has Youi considered changing the exclusion? It hasn’t been considered to date, Mr Storey says. Mr Storey thinks the current wording may not be satisfactory.

1.15pm: Youi’s Jason Storey appears

Jason Storey, Youi’s chief operating officer for claims services, takes the stand. He’s held his position since August last year.

Ms Orr begins by asking Mr Storey general questions about Youi’s obligations in handling insurance claims. Youi subscribes to the general insurance code of practice but Mr Storey doesn’t know how long it has subscribed to that code.

Section seven of the code says Youi is required to conduct claims handling in an honest, fair, transparent and timely manner. The code also emphasises the importance of not leaving a customer in financial hardship. It requires Youi to respond to catastrophes in a timely, efficient way in a compassionate manner.

Mr Storey says the evidence of Ms Murphy and Mr Sutton does not meet the requirements of the code in regards responding to catastrophes. “We certainly have a lot of work to do there,” he says.

Mr Storey appears unsure as to the consequences of failing to comply with the code. He says it would be recorded as an incident of non-compliance. It would be tabled in information provided to the code administration committee. In response, the committee can ask for more information.

He agrees Youi didn’t act in good faith in handling the claims of Ms Murphy and Mr Sutton.

Youi’s own code of conduct says says Youi has a set of distinct core values and a unique business vision. The first value listed is “awesome service”.

Mr Storey agrees that Ms Murphy and Mr Sutton didn’t receive awesome service.

12.57pm: ‘Bullied and intimidated’

Ms Orr now asks about dealings with Youi on temporary accommodation.

Since the cyclone, the Suttons have lived in temporary accommodation. They’re in their fourth rental because Youi told them they should only look for short-term accommodation.

Youi didn’t assist in finding accommodation. The Suttons needed a furnished house that would accept animals, which was very difficult.

The Suttons had to pay all of the upfront costs and every two weeks they were to send an email to Youi asking for the money to be reimbursed for the rental payments. At the beginning they were paid back within weeks but eventually they were months behind in reimbursing the cost of the rental accommodation.

The Suttons had to redirect funds from their offset mortgage account and savings account to pay for the accommodation. They told Youi this and that it had affected the cashflow in their business. Youi hasn’t reimbursed the costs for moving accommodation each time either.

The repairs haven’t commenced yet, Mr Sutton says. He has no idea how long the work will take. The tarp has been replaced with a metal roof sheet; this was done around early August.

Since Youi became aware that Mr Sutton was going to give evidence at the royal commission, their conduct has changed. They are now in credit for their rental accommodation and he now gets regular updates and phone calls.

The claim has been “mishandled from the beginning, it’s a shambles” Mr Sutton says.

“We’ve felt very bullied and intimidated. We were made to justify everything... they were almost telling us the extra delays were our fault.”

As she did with Ms Murphy, Ms Orr asks Mr Sutton why he wanted to tell his story to the commission. “We are just the tip of the iceberg,” he says, explaining that there are many people in the same situation.

Ms Orr has no more questions and Mr Sutton is excused.

12.48pm: Substantial damage

In late November Mr Sutton sent an email to Youi. He said: “My faith in Youi has plummeted to zero. I feel as if we have been abandoned by Youi.”

The tarp was not replaced until January this year. Every time there was rain it would pour through and create more damage. “There was black mould growing on the ceiling.”

Ms Orr now asks Mr Sutton about his dealings with Youi on the works that needed to be done to repair the damage.

In the weeks following the cyclone, several builders came out to have a look at the work and prepare quotes. The builders all said the job was “way too big for them”. They were only looking for “small, quick in and out jobs”.

The last builder who came through said an engineer and possibly consultant needed to come out and assess the building.

Eventually the Suttons received a building contract and scope of works from a builder.

Ms Orr brings up the scope of works. In the section dealing with the roof it said: replace roofing batons, refit flashing. Mr Sutton says that was totally insufficient, the entire roof needed to be replaced. Mr Sutton many years ago worked for a roofing manufacturer and says his knowledge of roofing was substantial.

Youi arranged for a builder to inspect the roof and prepare a report. The report was “totally inadequate”. “I was disgusted,” he says. Almost all of the roof was affected by the cyclone. Parts of it were twisted and bent, screws were loose, but none of that was mentioned in the report. The builder said he hadn’t been into the roof to have a look so couldn’t comment on the structure of it.

Mr Sutton asked Youi to organise an engineer to look at the roof. A few weeks later the engineer came out, another few weeks later the engineer sent in the report. His conclusion was that the entire roof needed to be replaced.

Youi then sent an updated scope of works and the entire work would be replaced. Mr Sutton and his wife signed a contract for the work to be carried out.

There was no date of commencement or completion. The contract was signed in August 2017. By October no work had begun. Mr Sutton emailed Youi “many times” to express his frustration.

In one of the emails sent in October 2017 he says it is 200 days since the house was damaged by cyclone Debbie. He mentions the mould-ridden carpet and that they were very concerned about returning to the house. He also complained about the lack of communication.

They got an email from Youi about termite damage to the house in November last year. Youi said the Suttons needed to fix the termite damage before it would commence its repair works. Youi also raised the possibility of a cash settlement for the claim.

“I was completely taken aback... I was totally shocked”.

At this point they had heard there were others in the area having similar difficulties and they decided to engage a company to act on their behalf.

They were told they should get a microbiologist report done and an independent building report done, at a cost of $10,000 to the Suttons.

12.31pm: Glen Sutton’s case study

Glen Sutton takes the stand. Mr Sutton lives in Cannonvale, which is adjacent to Airlie Beach. He has lived at his current house since 2014. It’s two-storey, with a metal roof. His home insurance is with Youi.

Tropical cyclone Debbie came through Cannonvale in March 2017. He and his wife went to a neighbour’s house to ride out the cyclone. Shortly after the ‘eye’ of the cyclone they went out and looked at the damage to their house. Part of the front bedroom roof had blown off.

After the cyclone had passed through they went back to the house. The bedroom was inundated with water, the ceiling had collapsed and water had flooded through to the kitchen.

Mr Sutton and his wife have been dealing with their insurance claim since then.

The Suttons were unable to live in their house following the damage. They are still not back in their house.

A few days after the cyclone, Youi organised two men to come out and do “make-safe” works. The men went in and realised the damage was worse than they had been informed. They had only been allocated eight hours to do the work and they said they couldn’t do the work in that time. They did a general clean-up, removed the damaged upstairs ceiling and put it in a pile in the lounge. They didn’t deal with the hole in the roof, the water in the house or the damaged wood.

A month later some more workers came out and removed plasterboard in the upstairs and downstairs living areas. Again a general tidy up was done, but no drying work.

Around this time someone came by and put a tarp up over the roof. At first it stopped rain coming in but it only lasted a few weeks. Once there was a bit of wind the tarp was torn to shreds. Mr Sutton told Youi this several times and asked them to replace it.

By November last year the tarp still hadn’t been replaced. “It was tattered to ribbons,” Mr Sutton tells Ms Orr.

The Suttons attended the house regularly to see what was happening. In November 2017 his wife visited the house and videoed water pouring through the hole in the roof through the bedroom and down to the kitchen. She was very distressed, Mr Sutton says.

12.21pm: ‘We had to stay on their case’

What would you say about the way Youi handled your insurance claim, Ms Orr asks.

“It wasn’t done very well, we constantly had to check everything. We had to stay on their case and assert ourselves.”

“It’s been very stressful, we’ve felt powerless at times.”

Ms Murphy is excused.

12.19pm: Roof still not repaired

Around this time Ms Murphy contacted the financial services centre and lodged a complaint with Youi in November 2017.

Ms Orr brings up the complaint notice: it outlines all of the issues.

The financial services centre told Ms Murphy Youi would have to respond within 15 days.

Within that time there was rain in Broken Hill. Rain had come through four rooms in the house and had damaged the lounge, hallway, bathroom and kitchen.

Ms Murphy called Youi that night. She was unable to get in touch with her assessor but spoke to a customer representative. No one came to help with the water coming into the house. “It was very frustrating, we ended up using a baby bath to catch the water”.

A different builder came and looked at the possibility of putting plastic sheeting on the roof but said the area was too big.

Ms Murphy called Youi to discuss her complaint but they said they couldn’t discuss it with her. She received an email response to her complaint but she didn’t see it as it went into her junk folder.

In January of this year another builder came out and did a scope of works but it didn’t include any provision for the internal damage done to the house.

Ms Murphy’s partner replied to Youi and listed a number of items that were not listed in the scope of works. They said it would be fixed but that the Murphys needed to sign the scope of works and the internal damage would be dealt with later.

The roof was finally repaired in May this year. There were a couple of issues that came up: “they’re getting fixed soon”, Ms Murphy says.

The internal damage repairs are not complete either. Ms Murphy expects the damage to be completely repaired in about 6 weeks.

To recap, the hail storm, which also damaged the family’s car, occurred in November 2016.

12.11pm: Roof still not fixed

Two weeks later the roof was still off and Youi said the builder would come back to finish the job. The builder came back when Ms Murphy was at work. After taking off some of the wood that was holding the roof up they showed her partner some of the structural issues and said they weren’t going to do any further work.

They had put a couple of holes in the ceiling inside the house. There was dirt everywhere, Ms Murphy says. In her hallway, kitchen, bathroom, there was no air conditioning, and she just didn’t want her kids in that house anymore. She was very angry and stressed.

She called Youi again. She asked for alternative accommodation and again explained her concerns over the lead levels.

Youi agreed to temporary accommodation, which Ms Murphy found. The family stayed in a cabin in a caravan park for four nights and then Youi contacted them to say the roof had been covered and the air conditioning was back on so they could move back in.

The temporary job they had done “was woeful,” Ms Murphy said.

The roof was flapping in the wind. She was scared and not very happy about the temporary roof. “My children were scared, my eldest son refused to go to the bathroom... he was too scared to be in there alone”.

12.05pm: ‘Too scared to sleep in the house’

After that the builders said they wanted another $3000 and wanted half before they would do any further work.

This revelation brings disapproving shakes of the head from several of the onlookers seated behind Ms Orr.

Ms Orr brings up an email from the builder dated October 4 2017. It mentions the “private works” the Murphys were having done and asks for the 50 per cent payment.

Attached to the email was an invoice for $3,675, with the 50 per cent deposit required. Ms Murphy couldn’t afford to pay that amount. She rang Youi and told them what happened. They said not to pay it, that they would deal with it.

The roof being off was “scary”, Ms Murphy said. “My children were too scared to sleep in the house, they moved into the same bedroom and put their beds together”. Ms Murphy was four months pregnant at the time.

The lead dust was also coming into the house through the open roof and Ms Murphy was concerned about the impact on her family.

Ms Murphy told Youi her concerns about incoming rain and Youi said to call the builder. He said he was watching the weather radar and if it looked like rain was coming he would come out and put a tarp on the roof. No one came out and it rained a little bit.

Ms Murphy at the time complained to Youi about how long the work was taking and her concerns about the lead.

11.58am: Scopes of work

After the assessor came to her house, Ms Murphy was sent two scopes of work from two different builders. There was no quote or price provided. Youi suggested which builder the Murphys should go with. Ms Murphy tried to contact the builder to find out more about the scope of works but no one ever called her back.

Ms Murphy wanted to know if the structural issues were included in the scope of works and would be covered. But the builders wouldn’t discuss that with her. Her partner was concerned about the delay being caused by her calling the builders so they just decided to go with that builder.

Ms Murphy had to work extra shifts to get the $775 together to pay for the excess. At the time her daughter was having her lead levels tested, which came back as being high. The lead levels in the soil around her property were also found to be very high. Ms Murphy was told by the EPA the ground would have to be dug up and replaced with loam but they couldn’t do it straight away; they had to wait until the roof was fixed. Ms Murphy was told not to let her children play in the backyard due to the lead contamination. She told the builder that, hoping it would make the work go faster.

Ms Murphy called the builder multiple times to try get a start date for the works. The builders pushed back the start date a number of times. “It was very frustrating”. The claim was put in at the end of last year and the excess was paid within a few months. The builder started work in the start of October. They pulled the roof off and said they weren’t going to do any more and the structural issues were too much for them and they didn’t have enough money to do the work. They took off the air conditioner from the roof and the family had to open windows and doors to cool the house, despite the lead contamination. Only one bedroom was still covered, Ms Murphy saw after the builders had left.

11.48am: Broken Hill case study

Ms Sacha Murphy takes the stand. Ms Orr begins by asking her about Broken Hill. It’s three hours away from Mildura; it’s hot and arid. Ms Murphy has lived there for 16 years and she lives there with her partner and four young children. She’s lived in her current house since November 2009; it’s a small three bedroom home.

There are two mines in Broken Hill and issues with lead contamination. The lead comes off the mine and the lead particles are in the air and settle on any surface. The lead levels of children under 5 are monitored annually at least. If a child’s lead levels test higher they are tested more regularly and also lead testing is done at the relevant property. Two of Ms Murphy’s children have tested positive for high lead levels.

The lead smart initiative in Broken Hill provides education to parents and mine workers on how to avoid lead in the home. It is done in partnership with the EPA. Testing is done on lead levels in soil and remediation work is carried out if necessary.

Ms Murphy has a home and contents insurance policy with Youi that she took out in 2012. In 2016 she also had a car insurance policy with Youi. In November 2016 there was a hail storm in Broken Hill.

The hail storm damaged her car: “It looked like a golf ball”. It also damaged her house, though that wasn’t clear at first. It was later found there was damage to the roof of the house and shed.

Ms Murphy made a claim on the car insurance policy and also later on the home insurance policy, once the damage to the house had been identified. An assessor from Youi came to assess the damage.

She told the assessor and builders she was concerned about structural issues that became evident earlier when solar panels were put in. The assessor said it would be brought up to code. Ms Murphy didn’t realise any extra would have to be paid for that work. No one told her she would need to pay any money other than the excess for the repairs.

11.37am: Natural disaster case studies

Ms Orr turns to the particular case studies. The first relates to the conduct of Youi in relation to two claims: one in relation to damage caused to a home by to Cyclone Debbie and the other related to damage caused by a hail storm in Broken Hill.

In March 2017, Cyclone Debbie made landfall in Qld. The cyclone caused damage and flooding with 2300 homes damaged and 14 fatalities. It was the second most expensive cyclone in Australian history. It saw more than 75,000 insurance claims lodged, with a value of $1.77bn.

The commission will hear evidence from Mr Glen Sutton, who made a claim with Youi following the cyclone.

In November 2016, a hailstorm struck the town of Broken Hill. It resulted in extensive property council, with hail the size of golf balls. Approximately 52,000 insurance claims were lodged for an insured loss of $597 million. Six months later 53 per cent of claims remained open.

The commission will hear evidence from Ms Sacha Murphy, who made a claim with Youi following the storm.

Another case study relates to AAI, which trades as Suncorp. On Christmas Day 2015 a bush fire in the Wye River broke containment lines and spread rapidly. Over 511 claims were lodged for an insured value of $110m.

In this case study the commission will hear evidence from Mr Gary Dransfield, the CEO insurance for Suncorp.

A third case study relates to the conduct of AAI in relation to its handling of a claim related to flood. In April 2015 storm and flood damage in the Hunter Valley saw 135,000 claims lodged for a value of $949m. The commission will hear evidence from Ms Bernadette Heald, who made a claim, and Mr Dransfield.

11.26am: Natural disaster claims

We’re back after a short recess and senior counsel assisting Rowena Orr QC begins by outlining the handling of claims related to natural disasters and extreme weather events.

Over the past two decades insurance losses arising from these events totalled $25bn. These events also have a significant social impact. When a natural disaster occurs individuals rely on insurers. The value of insurance claims following the widespread flooding in Qld in 2010 and 2011 was $2.4bn.

The coming two case studies will focus on home insurance.

Ms Orr points out the issue with the definition of ‘flood’ in insurance policies. Six months after Cyclone Yasi, 64 per cent of claims remained open, she says.

In its submission to the commission CBA acknowledged that its conduct fell below community standards and expectations and that the complexity of determining whether damage was cause by flood, which was not covered, or flash flooding, which was covered, led to confusion and delay in finalising claims.

Allianz said in its submission it introduced flood cover in 2012 but the cover could increase premiums by 2000 per cent.

In 2012 the insurance contracts act was changed to require a standard definition of flood.

The commission received a statement from a legal aid solicitor, Paul Holmes. Following cyclone yasi and floods in 2010 and 2011 he said the key issues included the varying definitions of flood and insurance documents being complex and difficult to understand. He told the commission the downside having a standard definition of for people in Qld is flood insurance is very expensive.

He said disputes about the scopes of works to be performed by repairers were common and that disputing the scope of works could be expensive. He referred to insurers offering cash settlements as a way of getting disputes off their books.

A NSW legal aid solicitor, Brenda Staggs, also submitted a statement to the commission. Following the blue mountains bush fires, legal aid identified a number of issues, including the issue of underinsurance.

John Durie 11.14am First commission report expected soon

The market is expecting the first report from the banking royal commission on Friday week, the day before the AFL Grand Final.

It’s the first chance for the banks to get some idea what Commission Kenneth Hayne is planning.

His final report is due in February next year.

With the exception of NAB, which has continued a business as usual approach, the other big banks have kept public discussion to a minimum while the Commission is proceeding.

But the interim report, which will focus on the first four sessions, will provide some guidance for the banks.

The financial year for three of the big four ends also on September 28, allowing them to include some commentary in their full year reports and annual meeting later in the year.

NAB today released new guidelines for executive pay in line with APRA’s recommendations.

11.08am: Should these products be sold?

One suggestion for reform in the market is that there be a deferred sales model, which Mr Bessell thinks would be a good idea. Simplified product disclosure statements and a more proactive approach would assist, he adds.

Another option would be to stop the products being sold.

What’s Mr Bessel’s view on that?

He can’t comment on that because it goes to the consumer’s view. If the products were structured differently they could be of greater value, he says.

QBE identified one of the reasons for its conduct being that the products were sold under a general advice model, so it was inappropriate for the authorised representative to decide whether the product was suitable to the consumer. That wasn’t discussed by Swann but IAG has considered it across insurance products.

Mr Bessell is excused.

11.02am: Remediation program

Mr Costello turns to the remediation program: In December 2017 ASIC announced that IAG would remediate 67,960 customers at a cost of $39 million.

The program will in fact cost a little less than that, because 64,187 customers will be remediated, Mr Bessell says.

In its media release, ASIC said the program would include refunds for seven types of issues.

The issues identified included situations where it was unlikely the customer could claim because the insured amount of the car was more than was borrowed; where gap cover was unnecessary because the customer had comprehensive cover; and that customers who didn’t receive rebates when they paid out their loan early.

Swann is in the process of remediating those customers

Why were customers sold products that fell into one of those categories, Mr Costello asks.

It was a combination of product design and customers not fully understanding the products being purchased and the environment in which they were being sold.

IAG is about half way through the remediation program and expects to complete it by January next year.

Mr Costello asks if Mr Bessell thinks a significant number of the products were of questionable or little value to customers?

They could be configured to offer better value to customers, Mr Bessell concedes.

The bulk of the refunds relate to over-insurance as opposed to duplicate insurance, he adds.

Mr Bessell doesn’t agree that one reason the conduct occurred was because the products were sold by authorised representatives with no effective supervision by Swann but agrees that Swann was selling the products at a time when it was focused on market share and that it didn’t develop products based on the needs of consumers.

The incentives that were in place were high but in-line with market, Mr Bessell says.

10.50am: Letter from ASIC

In September 2016 ASIC released its report and Peter Kell sent a copy to IAG’s chair.

Mr Kell said the purpose of the letter was to ensure IAG was aware of the need for systemic changes in the design and sale of the products. Mr Kell said insurers had been on notice for several years regarding the sale of add-on insurance and that ASIC would take enforcement action where needed. He also said he was concerned about the time taken by insurers to make changes.

IAG’s chair said the board was overseeing steps being taken to address concerns.

Mr Bessell also wrote to Mr Kell on the same day. He says he provided a more detailed response on the chair’s behalf that listed the specific activity being undertaken.

ASIC wrote to Swann in May 2017 and identified 32 issues across 5 products.

How involved was IAG in Swann’s negotiations in respect of the resolution program? Heavily involved, Mr Bessell says.

Towards the end of 2016, IAG took the view that it needed more formal engagement with ASIC to resolve the matters.

Swann operated under a devolved business model, Mr Bessell says. It was effectively a standalone business. But IAG’s chair was a member of the Swann board from 2013.

10.37am: No consumer consideration

Mr Costello puts it to Mr Bessell that from 2013 IAG knew there was an interest in add-on insurance products and rather than investigating the products or techniques within its own business, Swann chose to engage through the Insurance Council

Mr Bessell says there was a great emphasis on commissions at the time and if one group was to reduce commissions first that would impact the business. Swann couldn’t maintain its market position if it unilaterally reduced the commissions it paid.

Mr Costello brings up a Swann risk analysis from 2016 that shows the risks were listed as risks to the business, rather than to consumers.

The Ignition program ran until at least June 2016, despite ASIC’s concerns.

A report for the IAG risk committee from July 2016 reviews Swann’s CCI and add-on insurance. It says to avoid putting Swann out of step with the rest of the market it would delay making changes until ASIC put forward its views on the insurance council’s proposal. It also says Swann has been lobbying ASIC for some time to regulate commission for add-on insurance products. It says IAG has limited governance over the sales practices of add-on insurance through car dealers. Mr Bessell accepts that was the case.

By August that year IAG had proposed a remediation program to ASIC.

10.22am: ASIC scrutiny

In 2013, ASIC started looking into the add-on insurance market.

Mr Costello brings up an internal IAG email that refers to the ASIC review and that an emerging risk was increased regulation on the sale of consumer credit insurance as well as the reputational impact in being associated with a product that doesn’t always benefit customers.

In June 2015, Mr Bessell, who had been in his role for just a month, was seeking information on any dialogue Swann had had with regulators by that date.

An update on two of ASIC’s projects, consumer credit insurance and insurance sold in car yards, is circulated within Swann. In emails, Swann staff discuss the reviews and that ASIC will continue to pay close attention to these issues. The general manager of Swann at the time met with Mr Bessell to discuss ASIC’s reviews.

Later in June Mr Bessell sent an email within IAG and said the process of engagement with ASIC was going well. The engagement at this point was through the Insurance Council and Swann was part of a working group with the Insurance Council and the engagement in the months following. An industry-wide approach was being supported by the industry and commission capping was being discussed, Mr Bessell says.

Part of the problem was the commission structures were either inappropriate or not competitive for the product providers, but none of the insurers were willing to ‘move first’, Mr Costello says. Mr Bessell agrees. The industry position was that the matter needed to be dealt with holistically, by the industry as a whole rather than one by one.

Mr Bessell formed a view that Swann tethering itself to the Insurance Council was one of the reasons for its delay in dealing with some of the matters.

By September 2015, IAG was aware that ASIC held serious concerns about add-on insurance products. ASIC was frustrated the industry wasn’t moving quickly enough.

Around the same time, IAG acknowledged in an email to ASIC that many of its CCI products had not kept pace with social change and technological developments.

By December 2015 IAG was aware that the sale of Swann add-on insurance through motor vehicle dealers may have contravened regulatory requirements, Mr Bessell explains. That was following a meeting with ASIC in which it had said there may be issues within Swann that needed to be addressed.

10.00am: Audits weren’t done

Mr Costello and Mr Bessell are now arguing over how many audits were done or if they were carried out at all. Mr Bessell eventually agrees that to his knowledge no audits were carried out, only an electronic questionnaire was provided. There was also no monitoring to ensure required refresher training was completed.

Mr Costello narrows down the timeframe: between 2013 and 2017 Swann didn’t have adequate arrangements to ensure its authorised reps complied with financial services law.

Mr Bessell says he can’t agree with that and then clarifies that it sounds like a legal question, he’s not sure he knows the answer.

At its peak Swann had 3000 authorised representatives around the country that were selling add-on insurance. They were incentivised by commissions and Swann’s ‘Ignition Program’, which gave sales people further bonuses in the form of points they could use to buy products.

If there was an authorised representative in a dealership that was making representations to a consumer about a product that were wrong, the only way Swann would have known is if the consumer complained.

Mr Bessell agrees that wasn’t good enough but he’s not sure that Swann’s processes fell below the required standards. He says he was disappointed by what he read in the report.

Year by year, Mr Costello puts it to Mr Bessell that Swann didn’t have adequate risk management systems at the time. Mr Bessell agrees.

9.51am: Questionnaire was compliance

IAG’s executive general manager for business distribution, Benjamin Bessell, is back on the stand and counsel assisting Mark Costello begins by asking him about commissions and incentives for dealers.

Mr Bessell says he’s aware that there is a cap on the amount of commissions that can be paid on consumer credit insurance products. IAG notified the commission in June that Swann Insurance made payments to 34 authorised representatives that may have exceeded the cap. 153 payments totalling $6.792m was paid of which at least $5.985m related to consumer credit insurance products. How did this breach happen?

As part of the incentive agreements, there is a product-mis bonus. Mr Bessell believes that when an aggregate premium view was taken and an additional premium paid, a further commission may have been applied.

An IAG report from January 2017 is shown to the court. It relates to Swann’s processes when it owned a motor vehicle distribution business and was prepared by the chief risk office. The motor vehicle distribution business was sold in August 2016, so this is a backward-looking report.

The background to the report is ASIC’s release on a report on add-on insurance. Under ‘conclusion’ it says Swann had a ‘light touch’ on monitoring authorised representatives. It says there was increasing risk as well as increasing scrutiny from the regulators and Swann ‘has not responded to this changing level of risk’.

It also says authorised representatives were not recording potential breaches so Swann had no oversight. It says no face-to-face audits were carried out in relation to compliance with Swann’s guidelines. Instead a questionnaire was distributed with little follow-up.

As at January 2017 and before, Swann didn’t have adequate processes in place to ensure its reps were complying with the law, Mr Costello says. Mr Bessell disagrees, saying there was general training provided as well as a questionnaire.

Mr Bessell argues that ‘light touch’ is a fair assessment but there’s a difference between light touch and non-compliance. He says it was a minimum requirement.

Do you think if Swann had been more proactive Swann might not now be in the position of having to remediate in excess of $30m, Costello asks. Mr Bessell ‘can’t say for sure’ but agrees they could have been more proactive.

9.23am: Preview

Good morning and welcome to the eighth day of the insurance round of hearings at the financial services royal commission.

IAG’s executive general manager for business distribution, Benjamin Bessell, returns to the stand this morning to face further questioning over add-on insurance. Once he finishes giving evidence, the court will hear from two case studies: Sacha Murphy and Glen Sutton.

If time permits, this afternoon we expect to hear evidence from Youi’s chief operating officer for claims, Jason Storey, and Suncorp’s CEO for insurance, Gary Dransfield.

Yesterday we heard how Allianz pressured consultancy EY to amend its “independent” reports into the insurer’s compliance and risk operations and also killed a separate Deloitte report that probed its compliance and control failures, all because they were too critical.

Allianz chief risk officer Lori Callahan admitted that asking Deloitte to retract its report “was not my finest moment”.

Ms Callahan also told the commission she had no idea how many compliance incidents from the past six years Allianz needed to report to the corporate regulator.

Join us at 9.30am for live updates.

Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, insurance round hearings

Tuesday 18 September: ‘It wasn’t my finest hour’

Monday 17 September: ‘Unlimited cover’ meant $1000

Friday 14 September: ‘A very unusual case’

Thursday 13 September: ‘This is absolutely bullying’

Wednesday 12 September: ‘May discriminate, impact profit’

Tuesday 11 September: ‘Warning signs were all there’

Monday 10 September: ‘I’d sack them’

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout