Macquarie CEO, successor likely to be named in German tax probe

Macquarie’s outgoing CEO and his successor are likely to be named as suspects in a German tax scam probe.

Macquarie boss Nicholas Moore and incoming chief executive Shemara Wikramanayake are likely to be named as suspects by German prosecutors investigating a dividend tax scam, the bank says.

Both are “likely to be formally classified under German law as persons of interest or suspects” so that they can be interviewed by the Cologne Prosecutor’s Office as part of a group of up to 30 people involved in the transaction, Macquarie (MQG) said in a statement to the stock exchange.

The statement was released this morning ahead of the tabling in parliament this afternoon of an interim report from Kenneth Hayne’s banking royal commission that is set to be the focus of intense industry, political and media attention.

Macquarie has so far avoided being called to answer questions in the witness box at any of the royal commission’s public hearings.

The investigation centres around a claim that major international investment banks exploited laws in the German tax code that supposedly allowed two separate parties to claim ownership of dividends that were in fact only paid once, entitling both parties to a tax credit.

Germany put the illegality of the transactions beyond doubt in 2012 by amending its tax laws, meaning the cases hinge on whether the practice was legal before the legislative change.

German authorities have been targeting a number of international investment banks over tax evasion they believe has cost the country more than £10 billion in an investigation that has sparked raids in 14 countries over the last four years.

Transactions combed over by the Cologne Prosecutor’s Office over the last half a decade include ones handled by Macquarie, Goldman Sachs, Bank of America, Barclays and BNP Paribas, which are alleged to have been shorting sales just before dividend time.

The scandal has been coined as the “Cum-Ex” trade, referring to a Latin phrase meaning “with-without” in a nod to the missing dividend payments in the trade.

The manoeuvre typically involve banks, brokerage firms, hedge funds and wealthy individuals entering into agreements to buy, borrow and sell shares during a brief window of time around a dividend payout.

Companies withheld the taxes on the dividends and the custodian investment banks sent out certificates to shareholders they could redeem at the tax office.

Macquarie said although the Cologne Prosecutor’s Office is investigating the bank’s transaction, none of its “current” staff members have been interviewed to date. But it said the authorities “will want to interview the individuals involved in the transaction, which may number up to 30 people”.

Macquarie said it expected Mr Moore and Ms Wikramanayake to be questioned, as they were “staff involved in the approval process”.

“In order to interview all these individuals, they are likely to be formally classified under German law as persons of interest or suspects,” Macquarie said.

The investment bank said it will “continue to co-operate fully” with the German authorities.

It also said it withdrew from the transactions in 2012 and as part of a “robust review” at the time, the bank “received extensive external legal advice in relation to its involvement and believed that it was acting lawfully”.

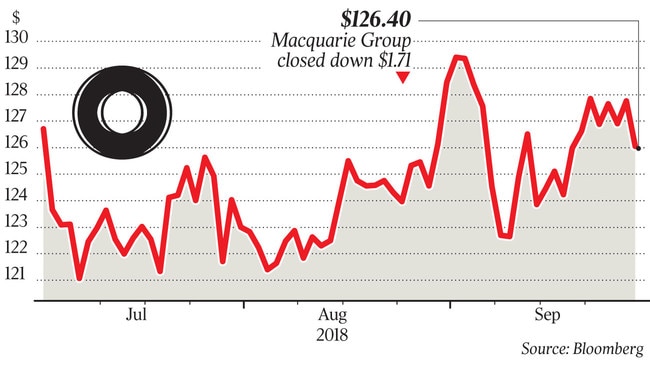

In July, Macquarie announced Mr Moore, one of Australia’s highest paid executives, would pass the baton to Ms Wikramanayake after ten years in the role. Ms Wikramanayake is currently the head of Macquarie’s $470 billion asset management division.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout