Warning as economic time bomb looms

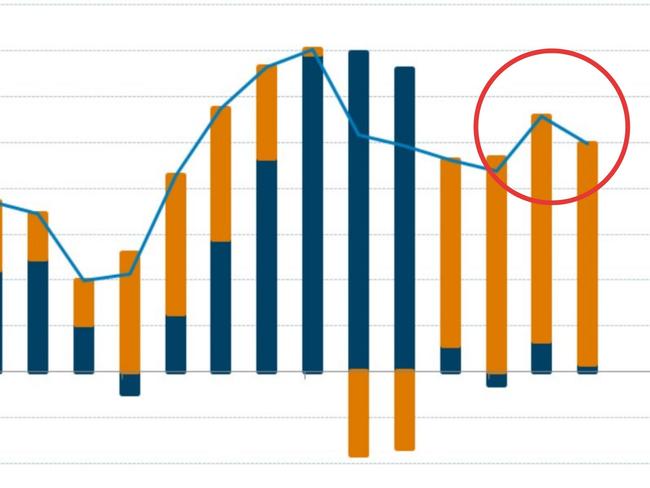

The next six months will test the risky decision that Australia made to rely on this one thing to boost its economy.

The next six months will test the risky decision that Australia made to rely on this one thing to boost its economy.

There’s one thing that Prime Minister Scott Morrison has very little control over – and it is likely to be the very thing that seals his fate.

Cryptocurrency has been volatile in recent times but the collapse of one country’s currency shows exactly what could happen to crypto in the future.

It’s a huge risk to the Australian economy going into 2022 and this financial disaster shows no sign of stopping.

China’s property market is in ruins but now it’s “doubling down” with a risky move – and the impact on Australia could be catastrophic.

Young people are often cited as the biggest victims of skyrocketing house prices but there’s another age group being hit harder than others.

Most people didn’t even know this essential product even existed – but now there’s a shortage it will have a huge impact on Aussies.

After a “prosperous pandemic”, the reality for Australia looks set to hit – and our biggest weakness is about to be exposed.

It’s a political hand grenade of an issue in the US and now it looks set to dominate in Australia too. So far the attempt at a solution is laughable.

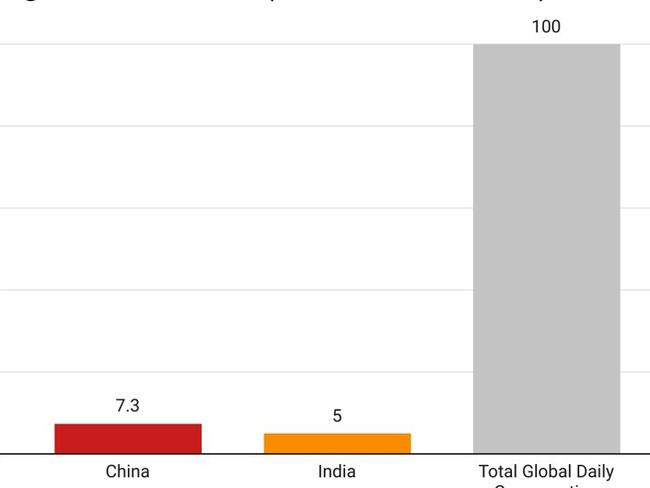

As tensions rise with China, Australia is searching for other revenue streams – but the numbers simply don’t add up.

Original URL: https://www.news.com.au/the-team/tarric-brooker/page/20