China’s risky move could cripple Australia’s iron ore exports

China’s property market is in ruins but now it’s “doubling down” with a risky move – and the impact on Australia could be catastrophic.

When the mining boom kicked off shortly after the impact of the global financial crisis began echoing around the world, some believed that it would last for decades and provide Australia with a veritable magic pudding of economic prosperity.

What many didn’t realise at the time was how quickly China would grow and what a huge role the property sector would play in Beijing’s strategy for the Chinese economy.

Between 2011 and 2013, China used more cement than the United States did in the entire 20th century, as it built homes for tens of millions of people and expanded its infrastructure at the fastest pace in history.

But all this growth has come at a cost, the Chinese property sector now accounts for almost 30 per cent of Chinese GDP, a figure higher than even the United States in the middle of its housing boom prior to the financial crisis.

With the news of mega developer Evergrande finally defaulting after months of speculation, the property driven growth engine of China’s economy is looking at best vulnerable. This is of significant concern for an Australia that is at times reliant on China taking up to half of its exports.

The property shell game

In recent months, the challenges faced by the Chinese property sector have intensified, as housing sales remain weak, property prices fall and the amount of unsold inventory continues to rise.

For Chinese local government this is of great concern. With an average of roughly 40 per cent of Chinese local government revenue coming from the sale of land, the souring mood toward property purchases should be hitting their bottom line hard.

But like so many things in China, things are quite a bit more complicated than that and quite a bit different to how they appear.

Rather than lowering prices to ensure that all land releases are sold to developers, or reducing the amount of land released significantly to maintain some form price equilibrium, Chinese local governments have turned to a novel but extremely risky solution.

In short, effectively buying their own land to ensure a stable stream of revenue.

By using local government financing vehicles (LGFVs) which are state owned enterprises, local governments can purchase their own land with borrowed money.

The scale of the issue

Between July and November LGFVs purchased 13.4 per cent of land releases on offer by value across China, with some regions relying more heavily on this type of activity than others based on local demand factors.

With confidence in the Chinese property sector hit most severely from September onwards, this figure would have arguably been even higher during the recent months of plummeting home sales and falling property prices.

China 70 cities MoM prices changes of Secondary Residential Prices

— Sunny’s (@sunchartist) December 15, 2021

3 cities Prices up

4 cities prices unchanged

63 cities prices were down pic.twitter.com/vM0GN7KIbH

To put these purchases into perspective, about 40 per cent of local government revenue is derived from land sales. Based on this share of revenue remain broadly accurate, about 5.3 per cent of local government revenue is now being derived by these governments effectively selling land to themselves.

Professor Michael Pettis of Peking University recently laid out the risks of this strategy in a thread on Twitter.

“These LGFVs are controlled by local governments and borrow under their guarantees, so that this effectively means that local governments are borrowing from the banks and treating the proceeds as if they were revenues.

“I am surprised this is allowed, but I guess local governments have little choice if they can’t otherwise sell enough land to meet revenue needs.

“But this represents a doubling down on the property sector. Why? Because if the property market revives, and prices continue to rise, the LGFVs can then sell the land on and make a profit. But if the property sector doesn’t revive, the LGFVs will be sitting on losses on which local governments will have to make good.”

The risks for Australia

Currently the different arms of the Chinese government are pulling in two completely different directions. On one hand local government are desperate to retain the key revenue source that high levels of property sector and high property prices provides.

On the other hand the central government led by President Xi Jinping remains adamant that “Housing is living in, not speculation”.

So far President Xi and the central government appears to be winning, with no bailouts forthcoming for the sector despite a growing glut of housing stock, falling prices and the potential for the ongoing crisis to become a greater threat.

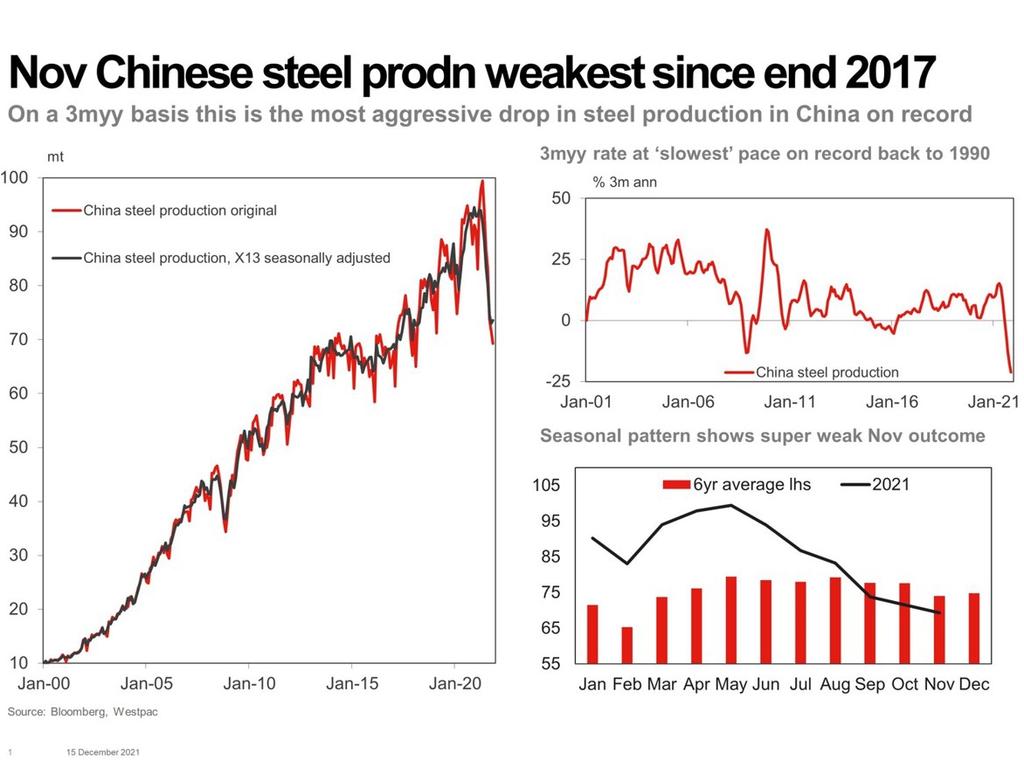

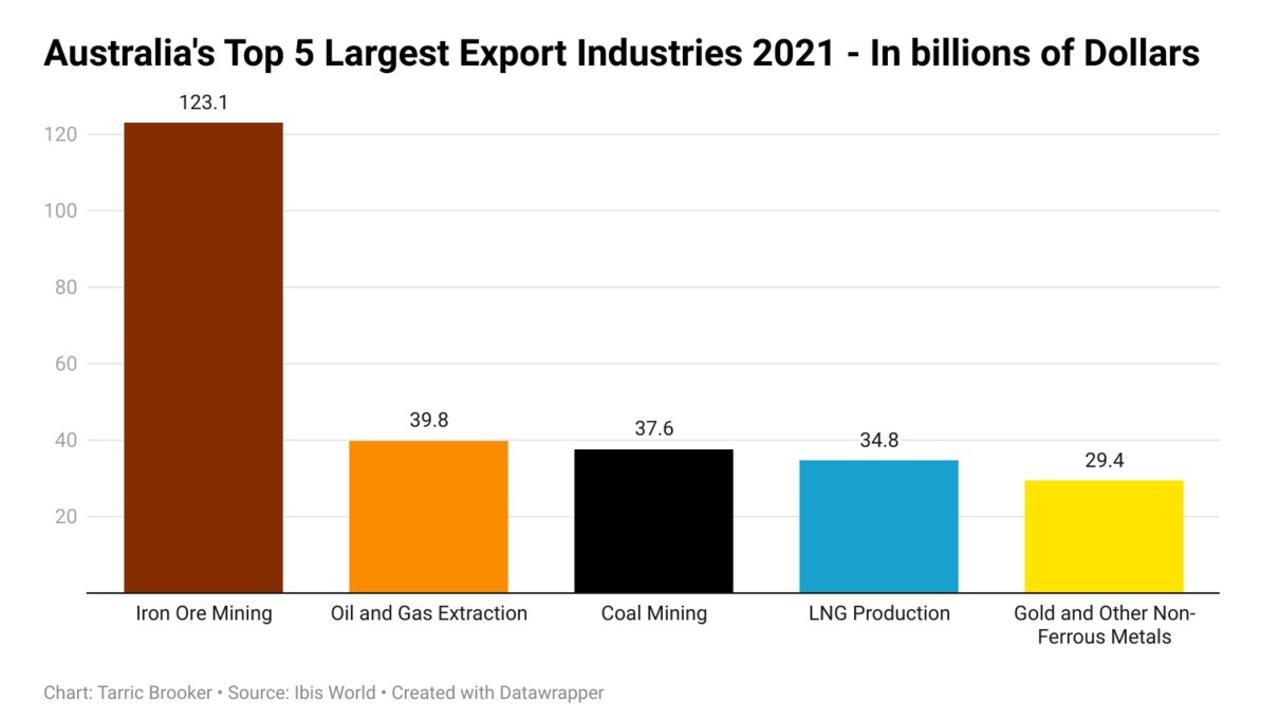

If Xi continues to refuse to change course, this has some concerning risks for Australia. Currently iron ore is the nation’s most valuable export by a country mile and despite the ongoing woes within the Chinese property sector, prices have remained remarkably strong.

But if the expected stimulus from the Chinese government doesn’t end up eventuating to the degree that markets are expecting, prices and export volumes could fall significantly.

What if the CCP blinks?

If Beijing chooses a different path, instead deciding that it cannot endure the ongoing economic pain from a struggling property sector in such a key year politically, the outlook is much brighter for Australia’s miners and the nation’s federal budget.

By choosing to add stimulus at a time when commodity prices indices are already near record highs, Beijing could end up providing quite the financial bounty for Australia despite the current ongoing tensions.

With 2022 a highly important year politically for President Xi and the CCP more broadly, the temptation to throw money at the construction sector to smooth out economic issues will be immense.

Not a magic pudding

While it’s possible the CCP may be forced to pull back on their current controlled demolition of the riskier elements of its property sector, Chinese commodity demand is not the magic pudding that it was once hoped.

It is a source of demand that has been revealed as on increasingly shaky ground, as local government in China fiddles with the normal rules of finance in order to buy land from itself to fund spending.

How long this type of activity can continue to grow the Chinese economy remains a source of debate among economists, but one thing is certain, the fate of the Chinese property sector and Australia’s economy are deeply intertwined.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator