Iron ore export numbers show how reliant Australia is on China

As tensions rise with China, Australia is searching for other revenue streams – but the numbers simply don’t add up.

In the years since the global financial crisis, Australia’s economic reliance on China has only continued to grow with each passing year.

In the 2007-2008 financial year, around 13 per cent of Australia’s exports were bound for the Middle Kingdom. By the time China’s share of Aussie exports peaked last year, it was roughly half.

With tensions between Canberra and Beijing running hotter than they have in decades, Australia finds itself in the unenviable position of not only being reliant on China for economic prosperity, but facing a potential double whammy should commodity prices fall.

This is part of what makes the woes facing the Chinese property development sector so concerning, particularly for Australia.

While it is likely it will be some time before the full effect of the downturn in the Chinese property sector is felt in Australia, there are signs that the impact could be quite severe if Beijing doesn’t step in and bail out the industry.

Fall in construction continues

According to data released by China’s state-run National Bureau of Statistics, new construction starts fell by 33.1 per cent year on year in October and falls currently appear to be continuing to accelerate.

If this downturn in new construction starts is a sign of things to come, this is a slightly worse outcome than the worst case scenario put forward by US investment bank Goldman Sachs in a report in September.

Based on the worst case scenario of a 30 per cent downturn in Chinese housing starts contained in that report, Chinese demand for iron ore would drop by around 12 per cent.

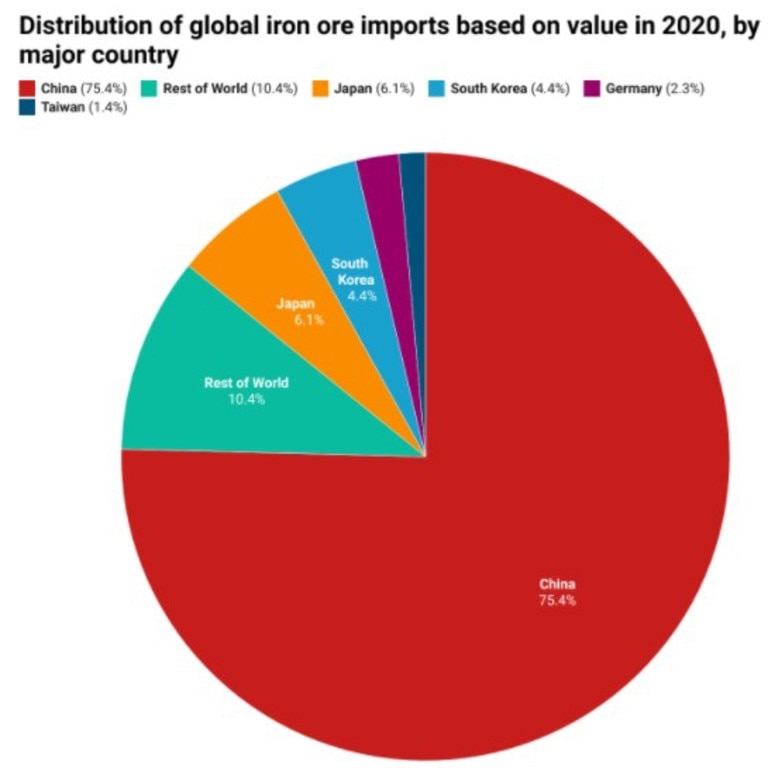

Given that in 2020 China accounted for over three-quarters of all global iron ore imports, the impact on iron ore prices and volumes would be significant.

Currently, iron ore exports are three times larger than any other export industry, followed by thermal and coking coal. A severe downturn would hit Australia right where it hurts – the Treasury’s bank balance.

With Chinese construction starts down by 33 per cent year on year in October, the continued controlled demolition of the riskier elements of the Chinese property sector could see a slowing China impact on commodity prices and the Aussie economy sooner rather than later.

With the Australian economy more reliant than ever on China and the export of bulk commodities, the downturn in the Chinese property sector has left many looking for an alternative destination for the nation’s bounty of natural resources.

Since the pandemic began, the Chinese government has engaged in a number of punitive trade actions against Australia, targeting everything from barley to wine as part of its diplomatic battle with Canberra.

So far the impact on Australian industry more broadly has been far less significant than initially feared, as exporters generally found other markets to purchase their produce, with a few select exceptions.

Alternatives to China?

The relative ease with which exporters found new markets for their produce has left some wondering if a similar course could be pursued to minimise the impact of a downturn in the Chinese property sector.

Alternatives like exports to India or to the United States have been raised as a potential solution to the problem.

After the recent passing of US President Joe Biden’s $US1.2 trillion ($A1.67 trillion) infrastructure stimulus bill, there is the expectation that America will need a great deal of additional raw materials like iron ore and other bulk commodities.

Unfortunately for Australia, despite India being a growing economic powerhouse and the eventual increase in American bulk commodity demand, it’s all relative.

A challenging reality

In 2019 India imported just 2.1 million tonnes of iron ore due to its large domestic supplies of the bulk commodity. In the US, imports were in a similar ballpark in 2019, recording 3.98 million tonnes of iron ore entering the States.

By contrast, China imported 1.17 billion tonnes of iron ore in 2020, including 712.4 million tonnes from Australia alone.

In a hypothetical scenario where both India and the US ramped up steel production by 10 per cent on 2020 levels, their total demand for iron ore would increase by 28.7 million tonnes and it’s possible much of this could be secured from domestic producers.

Meanwhile if a 15 per cent drop in Chinese housing starts was to be realised, total demand for iron ore would drop by over 100 million tonnes.

This scenario is less than half the impact on iron ore demand that would be experienced if the current 33 per cent drop in housing starts is a sign of things to come.

And the crunch in Chinese steel production still points to further weakness in iron ore prices. Supply/ demand based fair value model points to iron ore sub $80. Midpoint of fair value in October at $60 with upper end of forecast range at $78. pic.twitter.com/GnH3D64aao

— Robert Rennie (@Robert__Rennie) November 15, 2021

It’s too late now

In recent decades, Australia’s economy has become ever more reliant on China and mineral exports to underpin the nation’s prosperity.

While pursuing a different economic course in which Australia is less reliant on China would be welcome, it would also take years to begin to see major results.

For now at least Australia has well and truly hitched its wagon to Beijing, and in particular its construction sector.

Whether Chinese President Xi Jinping will continue with the controlled demolition of the risky elements of the Chinese property sector as the costs continue to mount, remains to be seen.

It’s entirely possible falling housing prices and plummeting housing starts could force him into taking a different course, but then again it may not.

As the future prosperity of Australia’s economy hangs in the balance over decisions made in Beijing, one thing is certain. If President Xi presses on with his controlled demolition of the property sector, a booming India nor President Joe Biden’s infrastructure stimulus package can rescue Australia from its reliance on China.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator