Australia’s iron ore exports to China have risen by 20 per cent, stunning new figures show

China was supposed to be turning its back on Australia, but stunning new figures have revealed what’s really happening.

It should have been a month that signalled the start of a new era in China’s great escape from Australian exports, but stunning new figures show Beijing is going to have to wait a whole lot longer.

Beijing has been doing everything it can to drive the price of iron ore down and to shut down its reliance on Australia’s biggest export, iron ore.

But the latest trade figures from the Australian Bureau of Statistics show that Aussie exporters have been absolutely raking it by selling to the superpower — as iron ore sales surged a massive 20 per cent in May.

This iron ore trade, almost exclusively, has pushed Australia’s merchandise exports to a record $39.2 billion.

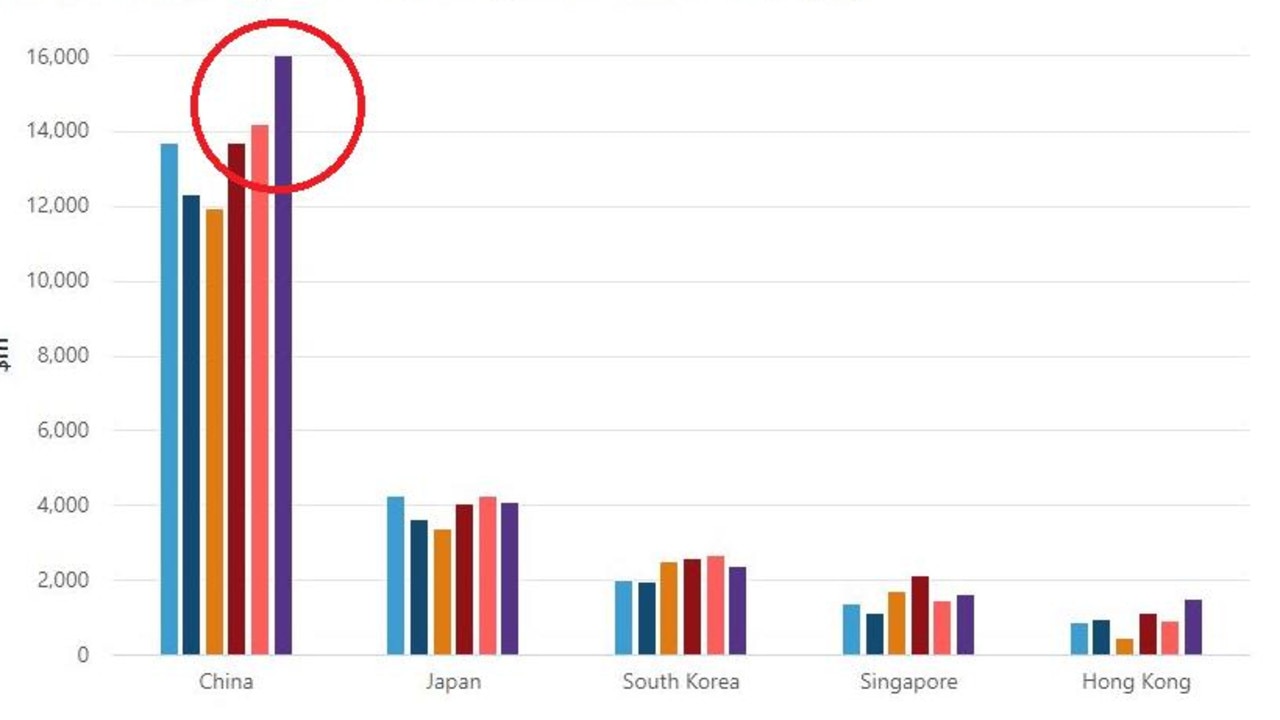

The figures show overall exports to China increased 16 per cent, driven almost entirely by the $2 billion lift in iron ore shipments and a 28 per cent increase in meat.

“The increase in metalliferous ores to China was once again driven by iron ore, up $2,087m (20 per cent) to $12,666m. This is the third consecutive record export month for both iron ore and subsequently metalliferous ores,” the Australian Bureau of Statistics preliminary merchandise trade data report said.

RELATED: Early sign China is headed for failure

“The increase in meat was driven by several categories, primarily frozen beef, and lamb cuts.

“Partially offsetting the increase was non-monetary gold exports declining $43m (-9 per cent) to $457m. This is the third consecutive month of non-monetary gold exports to China following no exports since December 2019.”

The stunning figures come after Australian exporters made $35.4 billion sales in April, the fourth-highest result on record.

China’s demand for iron ore, a vital steelmaking commodity, from Australia has been on the rise since its post-pandemic recovery and industrial stimulus kicked in a year ago.

With steel production ramping up to record levels China’s demand for iron ore has also shot up.

China Iron and Steel Association said this year’s crude steel production between January and May had already outpaced the same period last year by 13.9 per cent.

This means Australian iron ore exporters have been big winners, especially since the commodity hit a record high of US$230 a tonne in April.

Given the tensions that have transpired between Australia and China over the past year, it’s perhaps unsurprising that Beijing is not happy with the eye-watering price its paying for our iron ore.

In response it has come out several times with threats to bring down the price and ultimately hurt Australia — which makes about $136 billion a yeah from iron ore exports.

The superpower’s authorities came out swinging on Monday saying they had launched a major new investigation into iron ore prices – which continued to rise over the past month despite Beijing’s previous efforts to send them into downward spiral.

As the news broke early this week, the market appeared to have been spooked and iron ore prices took a tumble.

Chinese state media was quick to brag about the impact of the announcement on iron ore prices, stating that the iron ore futures closed 7.2 per cent lower on Monday on the Dalian Commodity Exchange.

However, there are already signs the market is not bowing down to China’s threats.

The price rose by an impressive 3 per cent yesterday, and today it has increased again by 1.8 per cent.

According to CommSec, today’s $3.90 rise means a tonne of the stuff will now fetch $216.60.

This is thought to be good news for Australia, particularly because it looks as if China is not slowing down in its steel production.

Australian Reserve Bank assistant governor Luci Ellis said in a speech to Ai Group on Wednesday that a spending shift from services to goods during the coronavirus pandemic had “tended to add to incomes in Australia”.

“The ratio of the prices of things we export to those of things we import – known as the terms of trade – is approaching the peak reached a decade ago, itself a 150-year high,” Dr Ellis said, according to the Australian Financial Review.