Interest rates and inflation could seal the federal election in 2022

There’s one thing that Prime Minister Scott Morrison has very little control over – and it is likely to be the very thing that seals his fate.

For over 25 years, the Coalition’s claims about its superior economic management skills have been key to the electoral fortunes of the Liberals and Nationals.

During the Howard years from 1996 to 2007, a key part of this platform was that a Liberal government would deliver low interest rates.

In the run-up to the 1996 federal election, then opposition leader John Howard released the Coalition’s housing policy, with the opening sentence reading: “A Liberal and National government will operate a well-managed economy and deliver low interest rates.”

Australians had seen interest rates rise to more than 17 per cent during the late 1980s, so the promise of lower rates proved to be part of a long-term recipe for electoral success for the Liberal Party.

In the 2004 campaign in particular, Howard heavily emphasised the lower interest rate narrative and it once again played a role in the Coalition being returned to power.

But during the 2007 election campaign, interest rates proved to be a detriment to the Coalition’s political fortunes rather than the boon they had been before.

Then, a little over two weeks before the nation headed to the polls, the RBA raised interest rates during an election campaign for the first time ever.

This was quite a blow to the Coalition which was already trailing in opinion polls. In the days that followed, Howard spoke on the issue during a press conference.

“I would say to the borrowers of this country who are affected by this change, that I am sorry about that,” Howard said. “I regret the additional burden that will be put upon them as a result.”

Could history repeat?

As the clock ticks down until the final possible date a federal election must be held by, May 21, 2022, all of a sudden Prime Minister Scott Morrison may be facing the same challenge as John Howard – a rate hike during an election campaign.

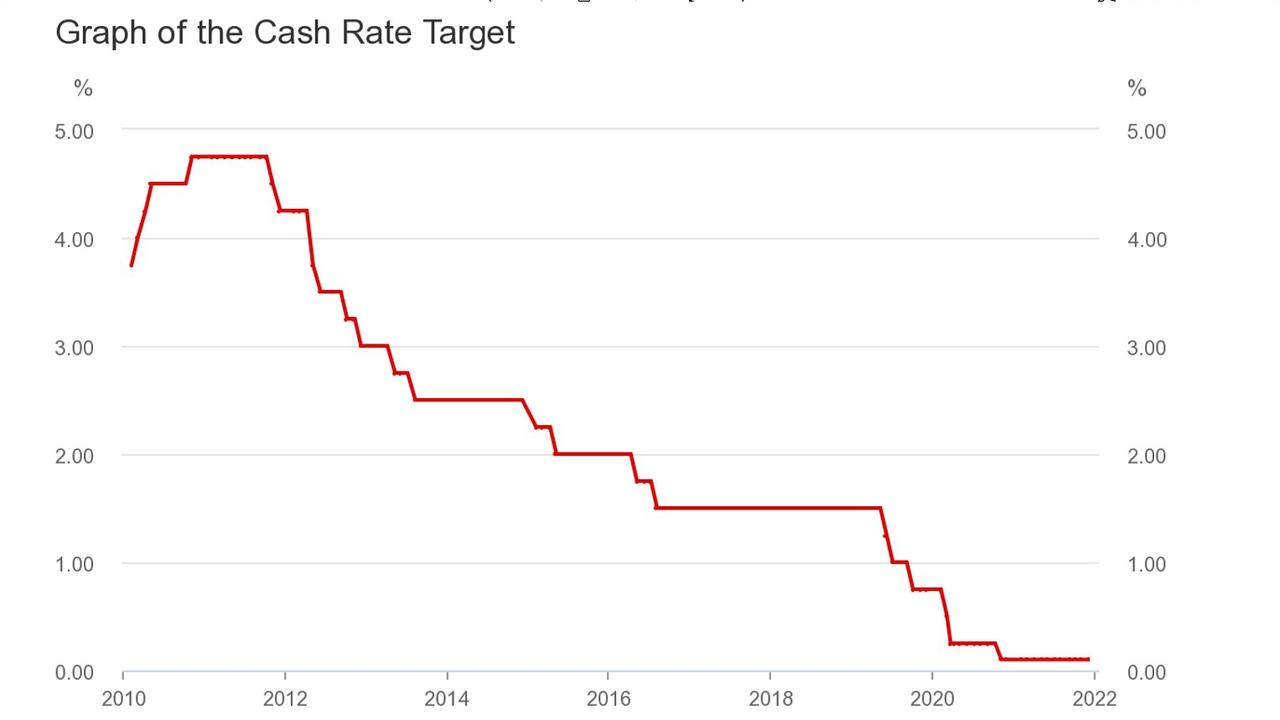

Since the Coalition was returned to power in September 2013, interest rates have gone only one way: Down.

When Tony Abbott defeated Kevin Rudd at the 2013 election, the RBA cash rate sat at 2.5 per cent. Today it is 0.1 per cent.

But if interest rate futures markets are right, it may not be for much longer.

Currently interest rate futures are pricing a full 0.25 per cent rate hike for the RBA’s July meeting, less than two months after the last possible election date of May 21.

This comes amidst a rapidly evolving interest rate narrative coming from global rate setter, the US Federal Reserve. In the minutes from their December 14-15 policy meeting, officials noted that it may become warranted to increase interest rates sooner than anticipated.

Interest rate futures markets are now pricing in a more than 75 per cent chance of a March rate hike by the Fed, including a 4.1 per cent of a 0.5 per cent hike.

Probability of a Fed hike in March has moved up to 75%... pic.twitter.com/9edptDyFam

— Charlie Bilello (@charliebilello) January 7, 2022

After no interest rate rises in more than 11 years, a rate hike may prove to be quite a shock to the electorate, particularly given the remaining economic uncertainties resulting from the pandemic.

The impact on households

When the RBA raised rates during the 2007 election campaign, the cash rate sat at 6.5 per cent. So when RBA hiked rates by 0.25 per cent, the impact was not especially damaging or out of the ordinary.

Based on the standard variable rate at the time, interest costs rose by just 3.2 per cent for the average mortgage holder.

With rates much lower this time, a 0.25 per cent increase in rates would result in an 8.25 per cent increase in the average household’s interest repayments.

But then there is also the psychological impact of rising rates, particularly for buyers who have recently gone all out on a mortgage in order to secure a home in the current rapidly appreciating market.

Many recent buyers were incentivised to pull the trigger on a property transaction by the Reserve Bank’s continued insistence that rates wouldn’t rise for at least another three years.

If that were to be proven spectacularly wrong as global inflationary pressures impact bank funding costs, some mortgage holders could end up quite shell-shocked by the unexpected blow to their household budgets and maybe even look for someone to blame.

While the federal government isn’t responsible for monetary policy and the setting of interest rates, that hasn’t stopped them from copping ire over rising rates in the past or promising that rates would be lower under their leadership.

Going forward

Whether interest rates will rise or not is likely to remain a matter of debate right up until the RBA finally pulls the trigger.

While the market is pricing in an aggressive rate hike cycle of three 0.25 per cent rises by the end of the year, it has been wrong about the direction of interest rates many times before.

Prior to the pandemic, Australia had already bet the farm on rising property prices and since then we have bet everything but the kitchen sink.

But should rates rise for the first time in over a decade even after repeated promises by the RBA they wouldn’t until at least 2024, just who will anger be levelled at?

In 2007 it was John Howard, as an election campaign rate hike made an already uphill battle even more challenging and contributed to one of the worst Coalition election defeats in recent memory.

Ultimately, there are a huge number of ifs and buts that need to go a certain way for a May 2022 rate hike to happen, but if they do, it could make the Coalition’s battle to win the election all the harder.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator