Surprise impact of house price rises on Boomers

Young people are often cited as the biggest victims of skyrocketing house prices but there’s another age group being hit harder than others.

In Australia there is a common thread running through much of the commentary on the housing market, that rising home prices are a good thing.

At first glance this doesn’t seem like an especially contentious claim, after all property prices have continued to rise in Australia for over a century and roughly two in three households own a property.

But when you start to dig deeper and examine the impact on households across Australian society, it becomes clear that there are very real costs of rocketing property prices that most Australians end up paying for in one form or another.

Unexpected collateral damage – retirees

When one thinks about the impact of high property prices on society, it generally conjures an image of a young couple attempting to buy their first home, yet retirees are increasingly collateral damage of housing price booms of the past.

While on paper many of these property owners would be well off, with some well into the realm of multi-millionaires, in reality your home being worth a huge sum of money is more or less meaningless unless you’re willing to sell it and move into another home.

As of 2015, 12 per cent of Australians over the age of 65 have mortgage debt compared with just 7 per cent of households in that age demographic back in 1990.

This figure is also likely distorted by households withdrawing part of their superannuation as a lump sum in order to pay off some or all of their remaining mortgage once they hit retirement.

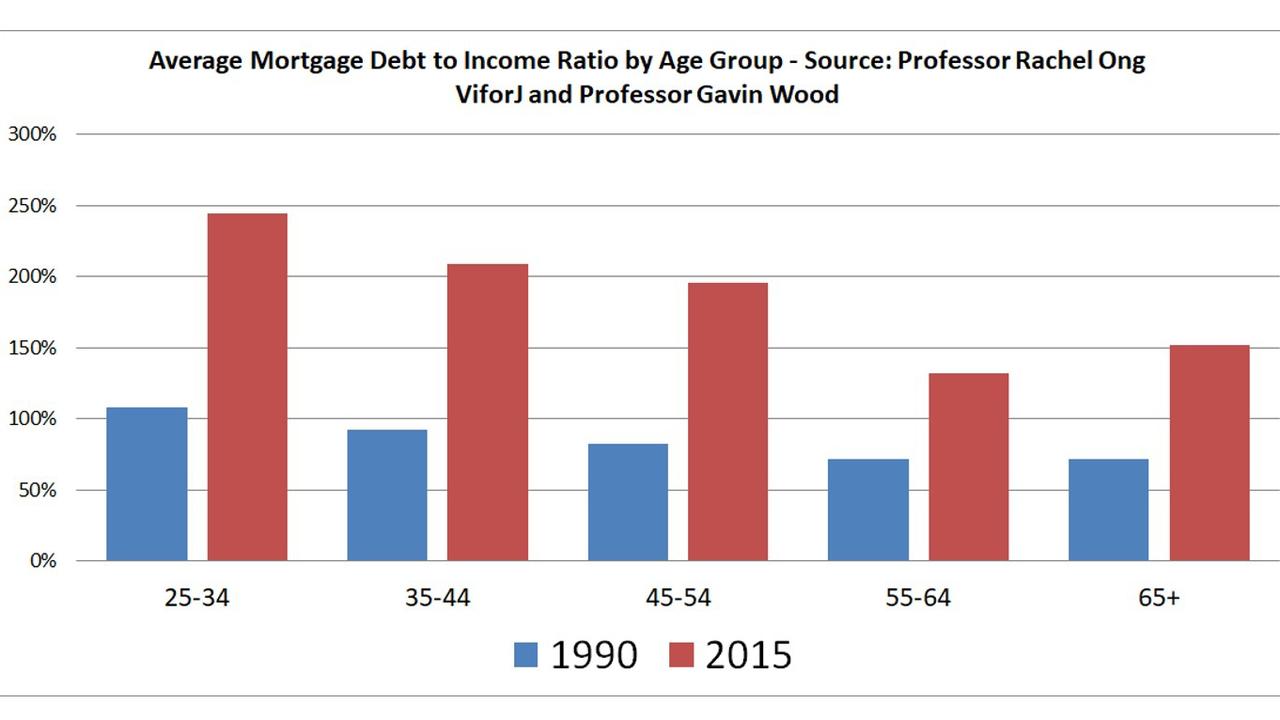

According to research by Curtin University Professor Rachel Ong ViforJ and RMIT University Professor Gavin Wood, the level of mortgage debt retirees were carrying into retirement as a percentage of their income has also risen significantly.

In 1990 the level of mortgage debt carried into retirement was 72 per cent of household income. As of 2015, that figure had more than doubled to 152 per cent of household income.

Yet, Australians retiring with mortgage debt is not the legacy of today’s housing price boom or even the one before that, its driven by mortgages taken on years ago when prices were a fraction of what they are today.

First home buyers

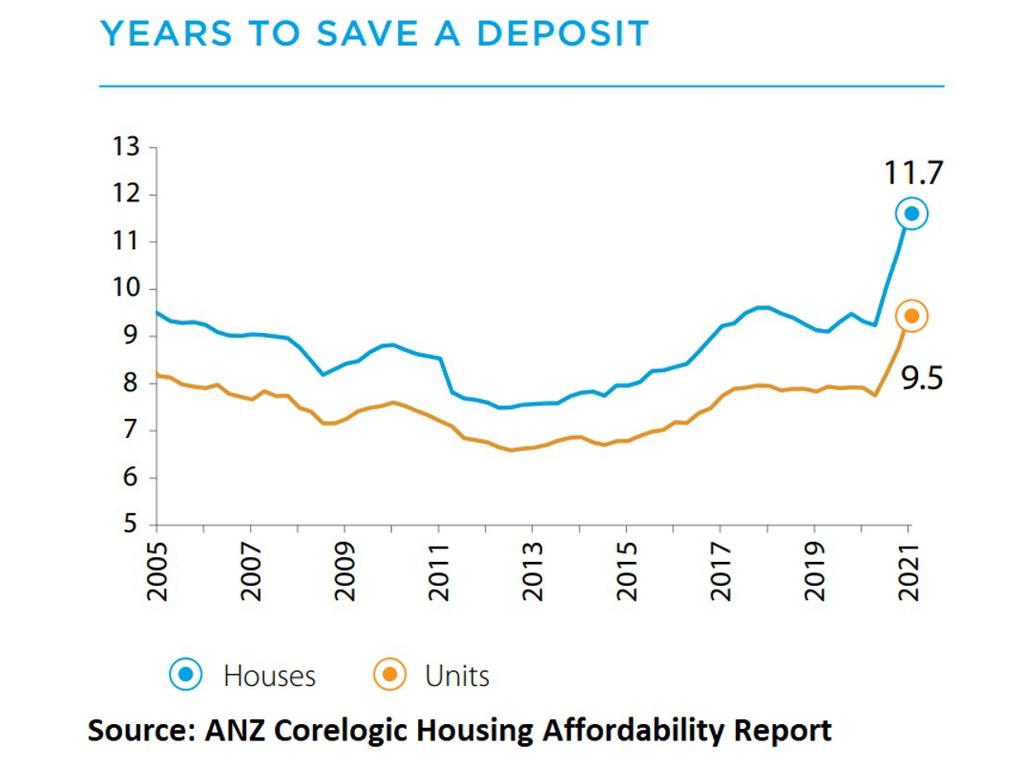

In the recent ANZ CoreLogic Housing Affordability report, it was revealed that as of June 2021 it takes the median Australian household 10.8 years to save a deposit for a house.

Sydney once again took the crown as the nation’s most unaffordable capital, with it taking 16.6 years for the median Sydney household to save a deposit for the median house.

Leaving aside the fact that if prices were to continue to rise as at a level consistent with historic rates, it would be impossible for the median Sydney household to ever save for a deposit on a median priced house, even a 16-year wait to save a deposit has major consequences down the track.

According to a 2020 study conducted by Money.co.uk across 25 nations, Australians on average are 36 years old when they purchase their first home.

With first home buyers increasingly taking on 30-year mortgages in order to spread the high cost of a home over the maximum possible duration, this leaves little room for error, hardship or life’s unexpected twists and turns.

Bar some sort of major shift in Australian wage growth over the coming decades, this would likely add to the proportion of retirees, retiring with a large amount of mortgage debt.

But it’s not just first home buyers in the capital cities struggling like in years gone by. With working from home becoming increasingly popular and many looking for a more affordable home, property prices in regional Australia have skyrocketed, pricing out locals looking for a home for their family.

In regional NSW it now takes 11.7 years for the median household to save a house deposit, longer than in almost all of the nation’s capital cities with the notable exceptions of Sydney and Melbourne.

The idea that households could simply move en masse to the regions for a lower cost of living hasn’t survived contact with the post-pandemic reality.

Prior to the pandemic it provided a way out of the high cost of living in the capitals for thousands of Australians a year. But as that number expanded exponentially due to the pandemic, it instead spread the very same rising cost of housing, which many were looking to escape.

The broader cost

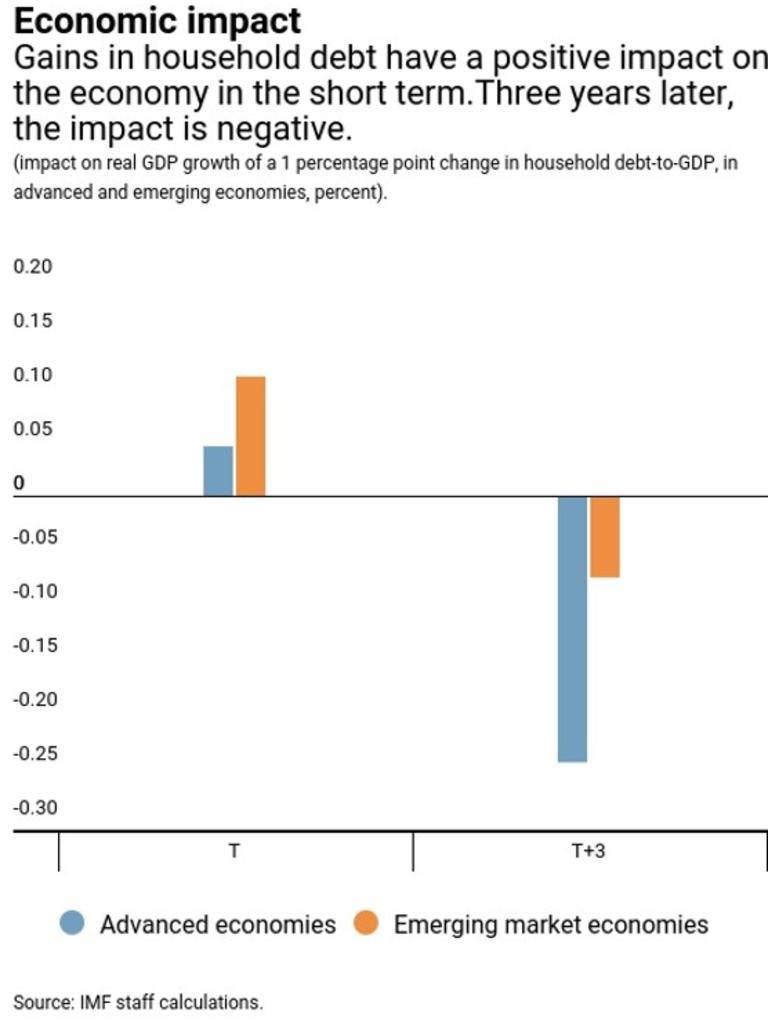

According to a study performed by the International Monetary Fund, a 1 per cent increase in household debt to GDP decreases inflation adjusted growth by 0.25 per cent as of three years later.

In effect the more a nation’s households spends on servicing their debts, the less money is spent on consumption in businesses throughout the economy.

Australia’s household debt to GDP ratio is one of the highest in the world at 123.4 per cent of GDP. Based on the IMF’s findings and those of other organisations who echoed their conclusions, the nation’s household debts are a significant drag on the economy.

While roughly two thirds of Australians benefit from rising housing prices through the ownership of their home, most arguably lose out in the form of weaker economic outcomes that play a role in influencing everything from economic opportunities to wage growth.

First home buyers may be the ones that bear the brunt of the very clear symptoms of high housing prices in the here and now, but in the long run the data shows many of us end up paying for it in one way or another.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator