Australian property prices: Regional renaissance unearths towns with extraordinary price growth

Housing values in parts of Australia have been rising at the fastest annual pace in 35 years, and now the over-achieving regions have just been unearthed in a new report.

It comes as no surprise that regional property is booming, but where the over-achieving addresses are has now been unearthed in a major new report.

Housing values in regional Australia have been rising at the fastest annual pace in 35 years, having risen 28.5 per cent in the year ending October 2021, according to Realestate.com.au’s PropTrack Regional Australia Report.

RELATED: Exact moment house prices began to soar

How to get into the property game before 30

Surprise new suburb joins exclusive $2m club

The study showed that house hunters outside of the capital cities are facing low supply and high competition, especially in hot “commuter towns” where paying well above the advertised price is the new norm.

“A clear stand out across all metrics is the hunt for the best of both worlds in terms of affordability and lifestyle in commutable regions. City skippers have paid up for fringe commutable regions but also amenity and lifestyle,” said Eleanor Creagh, senior economist at PropTrack and the report’s author.

“In areas that tick those boxes; demand, sales and prices have boomed — in fact so much so that the price growth has been entirely exceptional relative to the history of these suburbs,” Ms Creagh added.

One particular high-achieving region that stood out for Ms Creagh was the Illawarra south of Sydney.

“In terms of the level of demand and across just about every kind of metric the Illawarra region just dominated,” she said.

“Not just with demand but where buyers are paying the highest above listing price, where sales volume have surged and where inquiry has grown.”

“When you look at that region, you’ve obviously got Wollongong there as well which is a CBD in its own right. So some of these top performing regions are not just being sought-after by people looking at commuting back to Sydney. You’ve now got people looking to relocate entirely; to work in other industries that might be less prone to telecommuting,” Ms Creagh said.

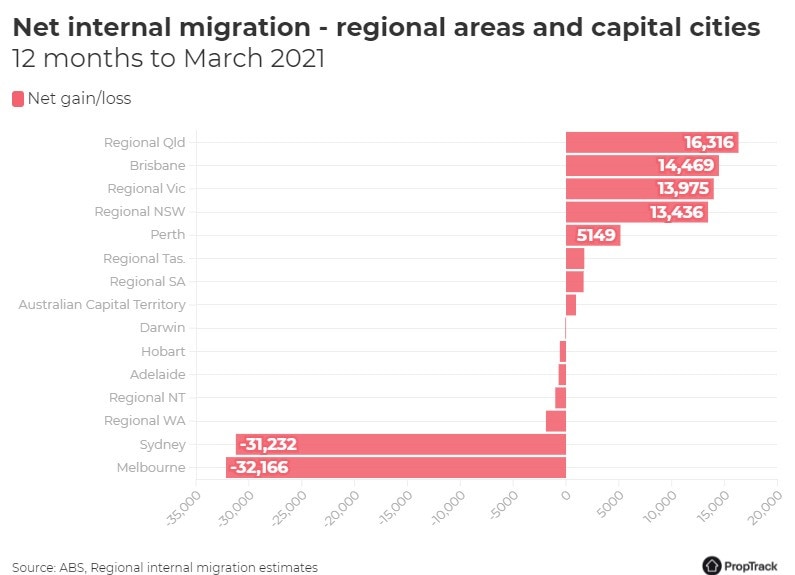

The escape from the cities was the most extreme on paper since the Australian Bureau of Statistics began taking records in 2001.

“In the March quarter of this year, data from the ABS showed capital cities recorded a net loss of 11,800 people – more than double the decade average and the largest quarterly loss on record,” Ms Creagh explains.

“And this was prior to the arrival of the delta variant. Though we do not yet know for sure if this trend continued through the rest of 2021, with another round of lockdowns and the continuation of remote working trends, it is likely to have persisted.”

Where buyers are paying over and above the ticket price

Regional NSW takes the crown when it comes to exceptional house price growth, up a whopping 35.2 per cent over the past 12 months and 8.71 per cent during just the third quarter this year.

“People are looking for lifestyle regions especially based on the coast with all those amenities they expect of a big city. A lot of regional NSW areas have that in spades. This report shows that, in general, people are willing to stretch their budget to afford those benefits like a larger block size, more space at home – all those things we know people have prioritised post Covid like a home office, or garden,” she said.

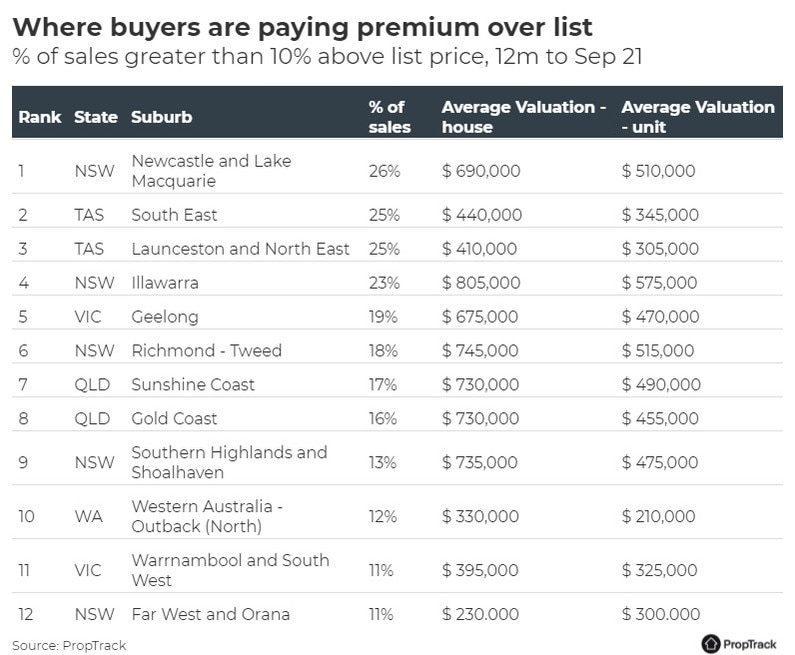

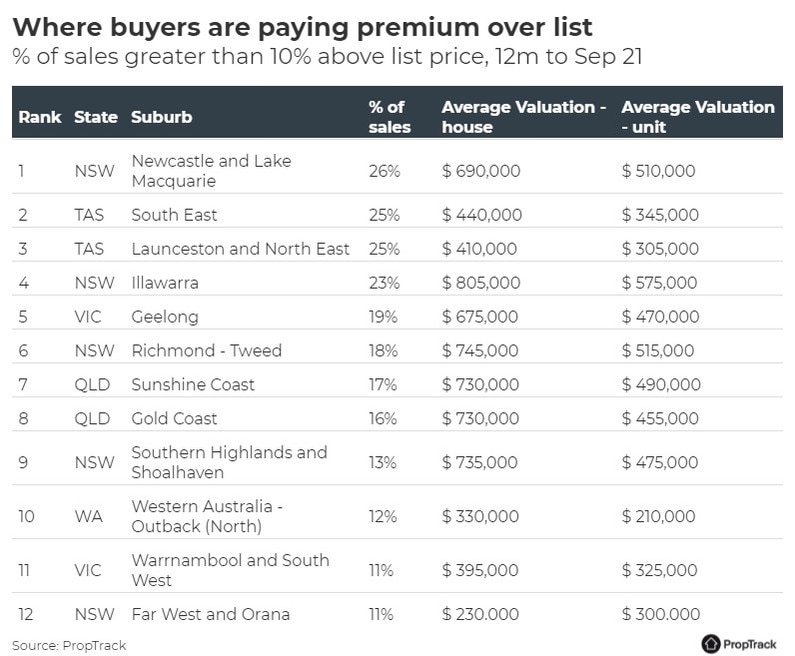

The comprehensive report clocked the regions where buyers were most likely to be paying 10 per cent or more above the advertised price.

Newcastle and Lake Macquarie topped the list with 26 per cent of sales selling over vendor expectations. The South East region of South Australia, as well as Launceston and Tasmania’s North East both came in at 25 per cent and the Illawarra in NSW at 23 per cent. Geelong south of Melbourne took out the fifth spot at 19 per cent.

“When it comes to where the biggest premiums over list price are being paid, it’s the Gold Coast, Sunshine Coast and Illawarra regions. That is good news for potential sellers, but not so much for buyers. Diminished supply of properties for sale and the extremely elevated demand has created a tough market for buyers, pushing prices higher in these regions,” Ms Creagh said.

Where housing prices are really gathering steam

Most regional towns have experienced exceptional growth over the past 12 months, however some locations have really gathered unprecedented momentum.

Mining town South Hedland in Western Australia historically experiences 6 per cent annual growth according to PropTrack data, but in the last year the median house price has jumped a whopping 58 per cent to $350,000.

San Remo, a small coastal town 124kms south east of Melbourne has a track record of increasing by eight per cent in a year, but in the year to November 2021 increased by 55 per cent to $810,000.

Unsurprisingly, Byron Bay in northern NSW also saw the median house price soar with a leap of 56 per cent to $2.8225 million in a year.

“Runaway price growth has largely been fuelled by low interest rates, but clearly the Covid-induced city exodus is playing a part,” Ms Creagh explained.

“Strength in mining has also contributed to above trend price growth in the likes of South Hedland. Port Hedland is the largest global shipping hub for iron ore,” she added.

When it came to a single in-demand state, Queensland clearly won the race according to Ms Creagh.

“The popularity of Queensland is again evident when we look at most-inquired suburbs, and clearly a top destination for potential first-home buyers with more than half the top inquired suburbs in the Sunshine State.

“This is likely a by-product of increased internal migration and the ratio of housing prices in greater Sydney and Melbourne to Queensland increasing to almost two times, making Queensland a top destination in the pursuit of relative affordability combined with lifestyle and amenity,” she said.

Ms Creagh added that while the regions had experienced unprecedented demand and price surges, the cities are still commanding top dollar.

“Post Covid, ongoing favourable housing market conditions in regional areas with attractive relative price differentials is likely to continue to attract people from capital cities, particularly if remote working trends continue.

“Though it must be reminded, metro areas still remain the most popular residential choice, and home to the largest proportions of respective state populations. And city populations will also continue to grow with the resumption of international migration.”

Originally published as Australian property prices: Regional renaissance unearths towns with extraordinary price growth