Housing affordability: Major dwelling dilemma hitting regional Australia

Housing affordability has deteriorated so much in pockets of regional Australia, that some locals would need to devote almost three quarters of their income to mortgage repayments just to buy.

Housing affordability has deteriorated so much in pockets of regional Australia, that some locals would need to devote almost three quarters of their income to mortgage repayments just to get onto the property ladder.

Nationally, the ratio of housing values to household incomes reached a new record high in June, according to data in the latest ANZ CoreLogic Housing Affordability Report.

RELATED: Buyers see biggest wave of homes in a decade

Tenant leaves young buyer $50k out of pocket

‘Essentially free’ vacant lots drives bidding war in QLD’s outback

The findings reveal just how dire the dwelling dilemma is, as the number of years it takes to save a deposit, and the portion of income required to pay rent also hitting worrying highs.

The only metric that didn’t prove concerning was the portion of income required to service an existing mortgage, thanks to record low interest rates.

“Affordability challenges in regional Australia have been exacerbated by Covid-19, where normalised remote work trends and appealing coastal or tree change settings became ‘pull’ factors of demand,” Eliza Owen, head of research Australia at CoreLogic explains.

“Meanwhile, high capital city property prices, and the higher incidence of strict social distancing restrictions, became ‘push’ factors, driving people away from major cities.”

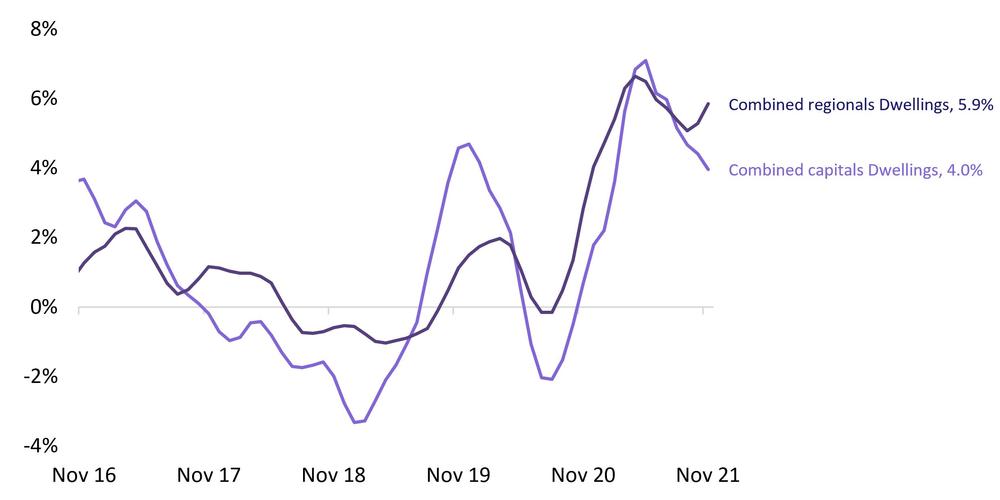

In the year to March 2021, the escape to the country increased by 5.9 per cent, while the number of people actually leaving regional Australia for the capital cities fell by 3.5 per cent in the same period.

Ms Owen said the combination of more people arriving in regional Australia – and fewer people leaving for the cities – had created a surge in housing demand that resulted in slim pickings for buyers and renters.

The data showed that as of November 28, the amount of homes for sale across regional Australia remained a whopping -36.9 per cent below the five-year average, with just under 60,000 properties available to buy.

MORE: Aussie homes’ shock $1.77 trillion surge

House has beer garden dedicated to Stone & Wood

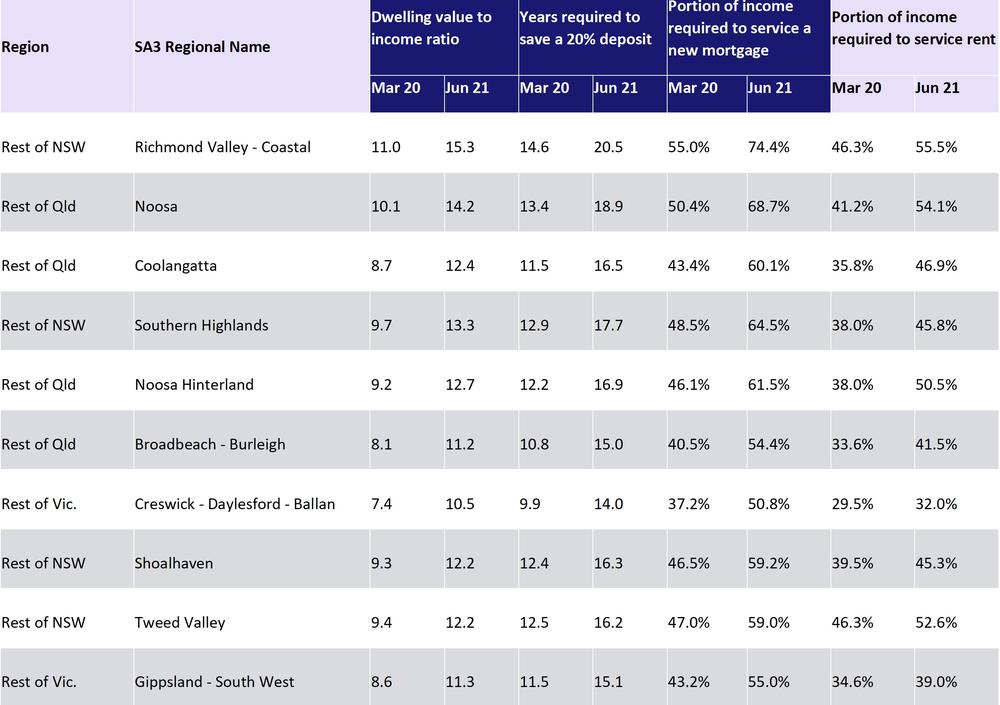

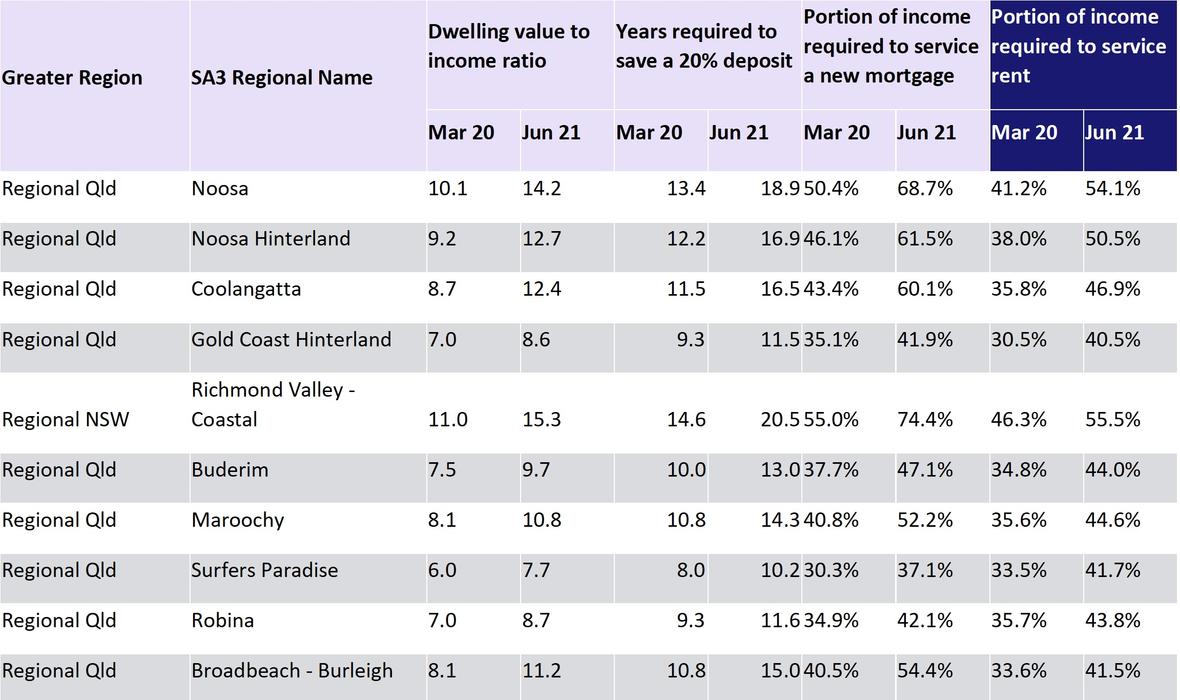

After crunching the numbers on 130 regional sub markets, the ANZ CoreLogic Housing Affordability Report revealed a top 10 list of towns where affordability has deteriorated the most.

Richmond Valley was the most impacted with the portion of income required to service a new mortgage sitting at 55 per cent in March 2020, but up to 74.4 per cent by June 2021.

“It is unsurprising that this market has topped the list. The Richmond Valley Coastal market, which includes Byron Bay, document the area as subject to high levels of investment for short term holiday accommodation, and attracting residents on high incomes, which can lead to longer-term residents and local service workers being priced out.

In fact many of the areas on this list, which have seen the biggest rise in metrics since Covid-19, have seen similar trends,” Ms Owen added.

Noosa, on Queensland’s Sunshine Coast north of Brisbane had the second worst affordability, with the figure jumping from 50.4 per cent up to 68.7 per cent.

Coolangatta on the NSW/Queensland border saw affordability slump from buyers needing to spend 43.4 per cent of their income on a new home loan prior to the pandemic to 60.1 per cent by mid this year.

New renters in the same regions are also spending a greater proportion of their salary on paying the rent than they would have in 2020.

Australia’s national housing value growth figure is beginning to slow down, rising 1.3 per cent higher for the month, according to CoreLogic’s November home value index.

That November result was the softest outcome since January, when values rose by just 0.9 per cent, and far below the monthly peak of 2.8 per cent in March.

Cameron Kusher, director of economic research for realestate.com.au’s data arm, PropTrack, said even though price growth has come off the boil, affordability will continue to be a major issue heading into 2022.

“Although the pace of price growth is expected to slow, prices are still anticipated to rise over the coming year in both the regions and cities. From an affordability perspective, this will make little difference to current owners buying or selling in the same market, but it will have repercussions for first-home buyers attempting to enter the market,” he said.

“Prices have already risen and are expected to continue to rise in 2022 at a faster pace than wages, which in-turn will make it harder to enter the market.

Affordability and lifestyle will likely continue to be drivers for property seekers in 2022 and regional markets will continue to outperform capital cities.,” Mr Kusher added.

He said first-home buyers will still be the most impacted by the affordability imbalance, but said there are some factors that could balance the scales in their favour, if only slightly.

“Tighter credit conditions and higher prices may discourage those looking to upgrade from moving and instead reconsider renovating where they currently live.”