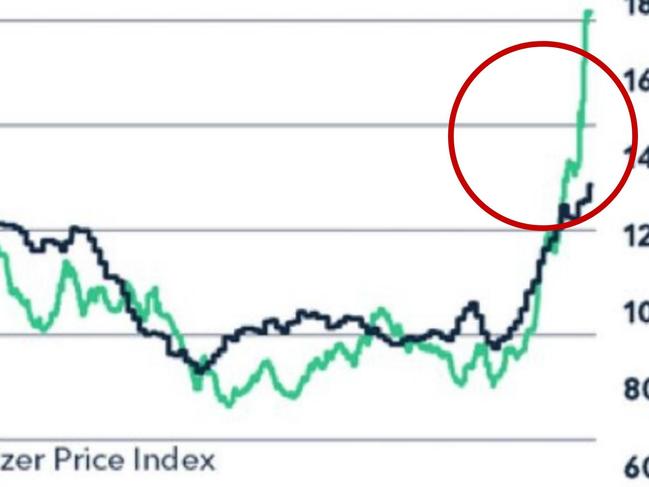

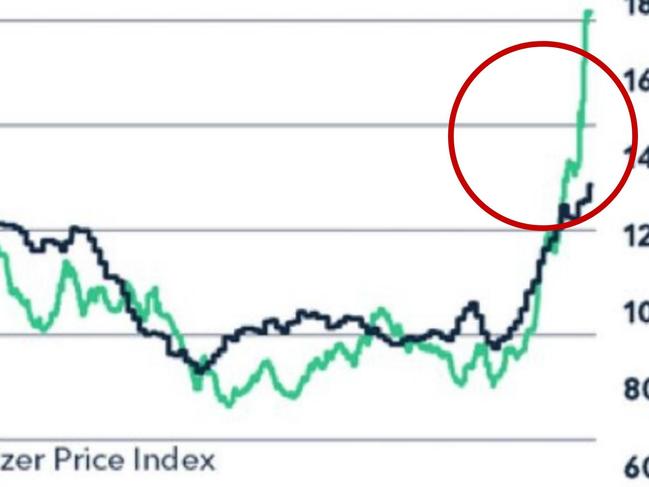

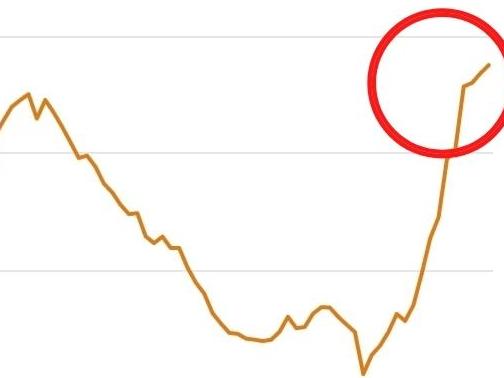

Chart shows we’re in for a savage 2022

It’s a product we take for granted but the global rising cost of one thing could leave Aussie with a lot less money to play with.

It’s a product we take for granted but the global rising cost of one thing could leave Aussie with a lot less money to play with.

When this decision was made, Australia was on the brink of disaster – but 18 months on, it could be the thing that sends our economy spiralling.

The Chinese government was just trying to avoid economic pain. It worked in the short term. Now the consequences have arrived.

Two very serious issues have combined to create a mega disaster that will impact Christmas, and is likely to last well into 2022.

Two very serious issues have combined to create a mega disaster that will impact Christmas, and is likely to last well into 2022.

A decision that was made to ensure Australia stayed afloat during the pandemic is now wreaking havoc in the economy.

There’s been a dramatic change as great uncertainty grows over what inflation and interest rates will do to the Australian economy.

After almost two years of economic instability and a pandemic, the next fear is that hyperinflation could be coming for us.

China’s property market is on the brink of collapse and if Beijing decides to take a particular route to recovery then Australia could benefit big time.

Despite rates sitting at a record low, in the past year the “time to buy a dwelling” index has plummeted. Here’s why.

Original URL: https://www.news.com.au/the-team/tarric-brooker/page/21