Australia’s lockdowns could lead to negative interest rate

As more of the country gets locked down there’s an economic consequence that will bizarrely see house prices rocket further.

As Australians continue to attempt to come to grips with the emotional, mental and financial rollercoaster ride that is the Covid-19 pandemic, we have seen on multiple occasions exactly how quickly our circumstances can change.

In just a few days, the zero covid existence that most Australians have enjoyed for the vast majority of the pandemic can be broken. Replaced by lockdowns, uncertainty and everything that goes with it.

As Australia’s circumstances continue to rapidly evolve, so too does the outlook for interest rates. Just days prior to Sydney heading into its current protracted lockdown, interest rate futures markets were pricing in multiple rate hikes in the next few years.

This outlook has changed dramatically since it became clear Sydney’s lockdown would be protracted and that there were rising risks of Delta variant driven lockdowns across the country.

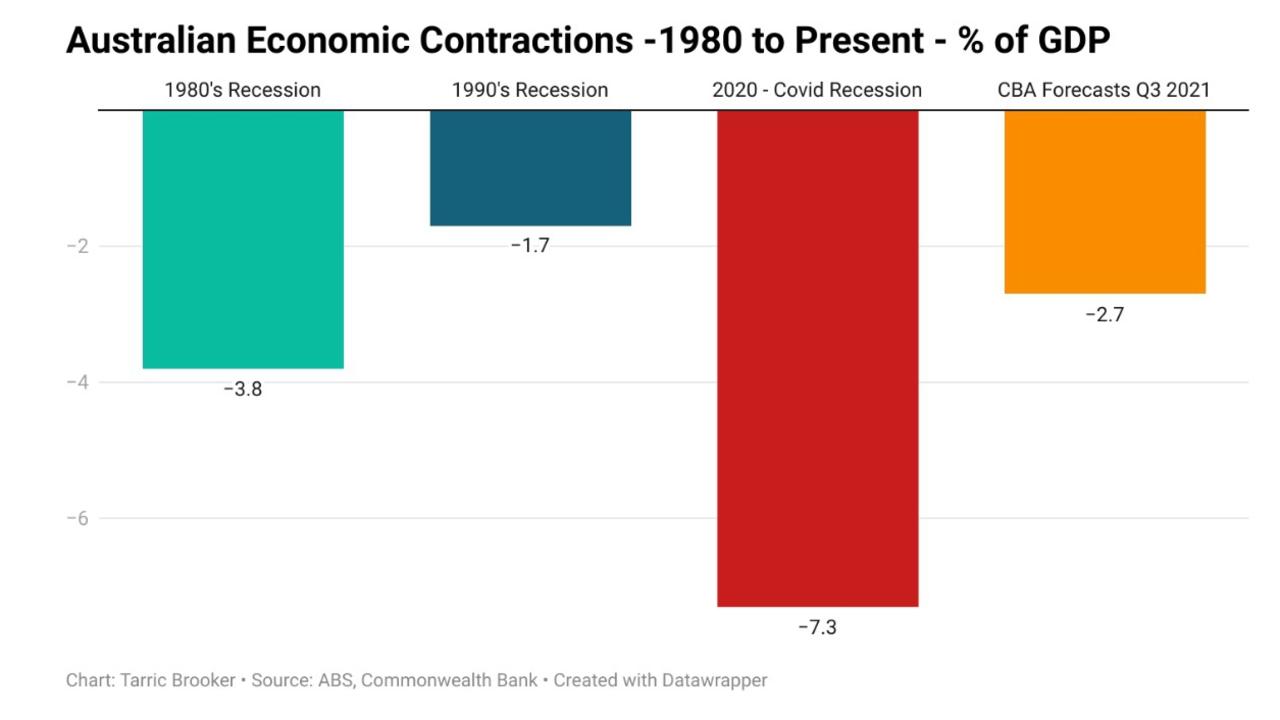

According to analysts from the Commonwealth Bank (CBA) the nation’s economy is expected to contract by 2.7 per cent in the September quarter. To put that into perspective, throughout the entirety of the 1990s recession GDP fell by a total of 1.7 per cent.

RELATED: NZ move a disaster for Aussie mortgages

A negative cash rate

With Sydney’s lockdown expected to last until mid-November as a base case according to CBA, they have changed their outlook and now expect that the first rate hike by the Reserve Bank won’t come until May 2023.

But even before it became clear that Sydney’s lockdown would be measured in months and that it would drag significantly on the fortunes of households, banking regulator APRA was already telling the banks to prepare for a negative RBA cash rate.

As concerns emerge about the strength of the global economic recovery from the pandemic, the RBA isn’t the only major central bank considering a negative interest rate future.

In February, the Bank of England gave UK banks six months to prepare to implement negative interest rates.

In Japan, Denmark and Switzerland, they’ve had negative interest rates for years.

While the effectiveness of negative interest rates on boosting economic growth is questionable and a source of significant controversy, it remains the likely next move for central banks when the next crisis does come.

As multiple Chinese mega cities once again look to limit transportation and consider restrictions amid an outbreak of the Delta variant, the vulnerability of Australia’s and the world’s economic recovery is becoming clear.

RELATED: China addictions boosts Aussie economy

The China effect

It was once said that “if China sneezes, Australia catches a cold” (in economic terms).

Leaving aside the irony of that statement amid a global pandemic that began in China, the impact of massive Chinese government stimulus is fading and economic data in the Middle Kingdom continues to deteriorate.

For the Australian economy, a significant slowdown in China could scarcely come at a worst time. According to CBA, up to 300,000 jobs could be lost due to Sydney’s protracted lockdown, leaving Australia an increasingly economically divided nation where some states streak ahead, while others fall behind.

Despite forecasts of a strong economic rebound for the nation’s economy in the December quarter, if lockdowns continue for longer than anticipated or a global slowdown begins to impact our economy, a double dip recession is a very real possibility.

With these scenarios presenting a series of potentially extremely challenging circumstances, the prospect of the RBA turning to negative interest rates presents both a silver lining and a hurricanes worth of dark storm clouds depending on your perspective.

If the RBA was to cut the cash rate to below 0 per cent, it’s likely that this would not only send housing prices further skyrocketing, but likely all the way into a neighbouring galaxy if the economic circumstances were not too dire.

RELATED: ‘No idea’: Sign Aussie economy is doomed

Skyrocketing house prices

If rates headed lower to the lowest level they would probably ever reach, Aussie mortgage holders and homeowners could gain trillions of dollars’ worth of collective equity in their homes.

But for prospective first home buyers and those who do not own homes, it would be yet another swift kick to their fortunes, particularly for those in areas impacted by the ongoing lockdowns.

If you had of told someone two years ago that a global pandemic, forecasts of 300,000 lost jobs and the possibility of a double dip Aussie recession would skyrocket housing prices, you would have got laughed out of the room.

However, with interest rates at record lows and the possibility of rates going even lower or even negative, that is where we are at.

For the global economy more broadly, in many ways we are back in early to mid-2020. China is closing down transport between some of its cities, the virus is running rampant throughout much of the world and uncertainty continues to build about the global economy’s future.

As for Australia, with Sydney, Victoria and parts of Queensland in lockdown, our future is also growing increasingly clouded.

What is clear is that like the rest of the pandemic so far, big winners and big losers would be created if a scenario of a negative cash rate were to become a reality. The only question is who the winners and losers will be.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator