Real reason behind ScoMo’s fat budget

A budget tactic to win votes has still seen ScoMo’s approval dwindle behind Labor. But here’s why the PM may still push for a 2021 election.

A budget tactic to win votes has still seen ScoMo’s approval dwindle behind Labor. But here’s why the PM may still push for a 2021 election.

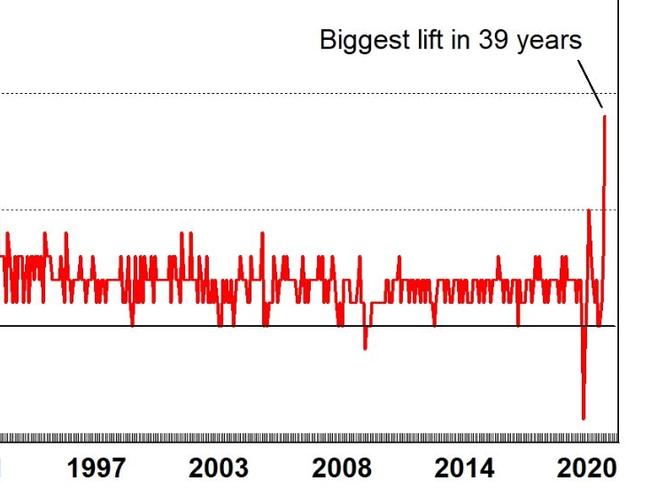

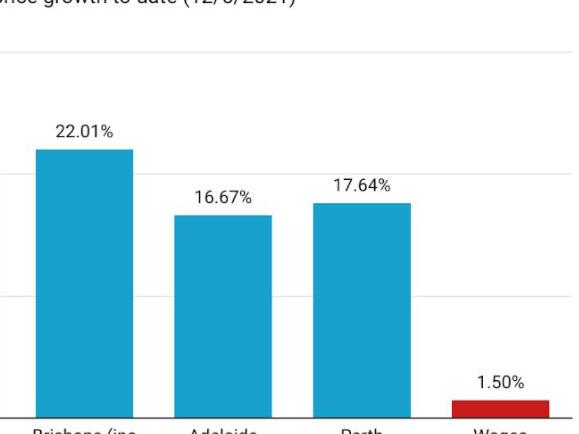

House prices are rising at the fastest rate since the late 1980s. But it might only be the first stage of the rocket that is the nation’s property boom.

Cryptocurrency is seeing a turbulent time already but after recent events with Elon Musk and China, its future could change completely.

An expert predicted scenario could see the average Aussie mortgage repayment rise by over half, leaving thousands in mortgage stress.

One tweet from Elon Musk caused the world of cryptocurrency to go into meltdown. Now his former fans are fighting back with an aptly-named coin.

China has said one thing, but is doing something different – spelling good news for Australia. But it could all be part of a sinister plan.

It’s a worrying stat hidden in the budget that will impact hard working Aussies – with young people hit the hardest.

A China-Australia conflict has been described as a “high likelihood” that could happen “quite soon” – and there’s one key flashpoint at play.

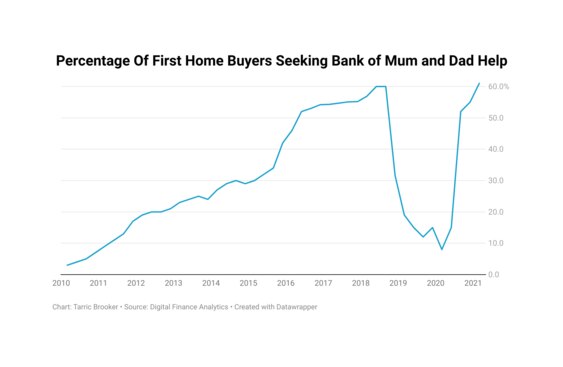

There is more grim news for Aussies looking to buy their first home, with booming property prices reaching dizzying new heights.

There’s a new global crisis that threatens our economy and could see Aussie troops deployed. Yet it’s not really talked about.

Original URL: https://www.news.com.au/the-team/tarric-brooker/page/25