Aussie wage growth expected to remain at record low as house prices rocket

It’s a worrying stat hidden in the budget that will impact hard working Aussies - with young people hit the hardest.

In recent months, the mood of consumers and businesses surrounding the nation’s economy has turned to a state of euphoria, with most confidence indexes currently sitting at or near decade highs.

The Morrison government’s big spending in the 2021 federal budget is likely to provide support for this view of the economy, but buried within the hundreds of pages of the budget documents a far more challenging reality is found.

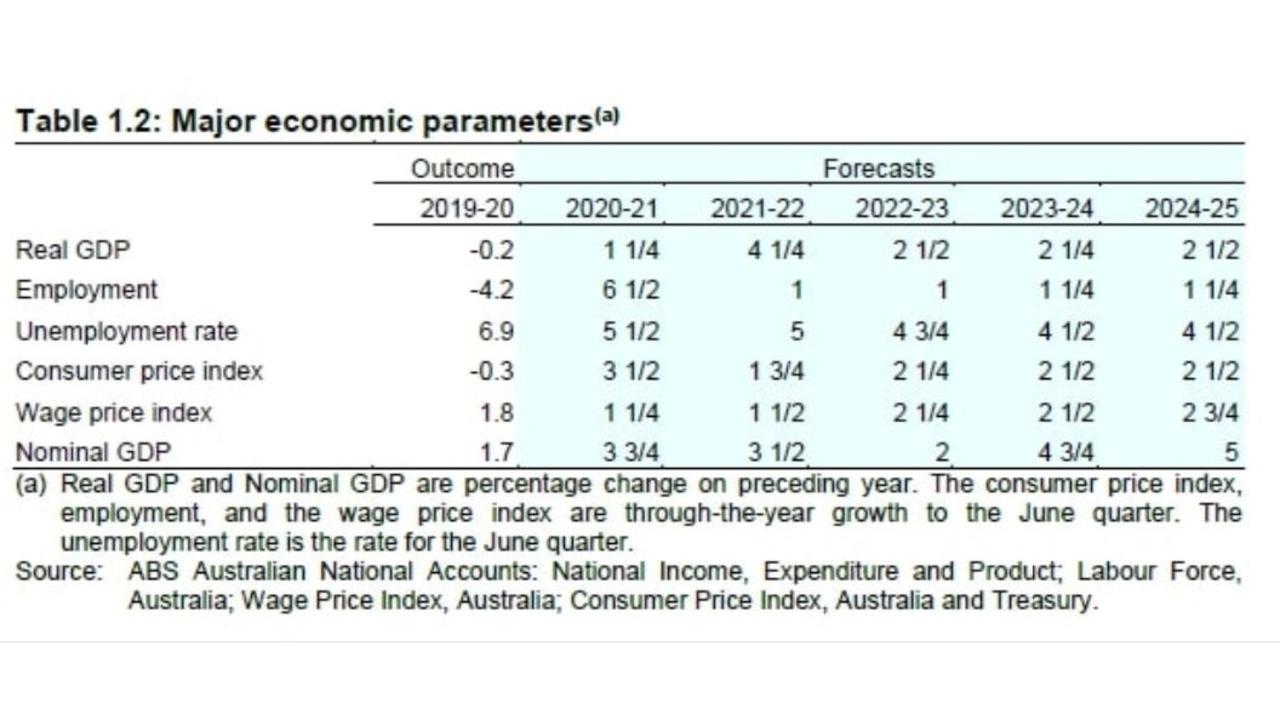

According to Treasury forecasts wage growth is expected to remain at a near record low 1.5 per cent for the 2021-22 financial year, before slowly rising to 2.5 per cent by the 2023-24 financial year.

RELATED: Budget misses big budget housing opportunity

Wages are going backwards

In inflation adjusted terms the forecasts are even less impressive for Aussie workers. Between July 2020 and July 2025 inflation adjusted wages are expected to have gone backwards. With households having less purchasing power for their pay packets, than they did five years prior.

Even after taking out the shock to wages that resulted from the pandemic up until July this year, inflation adjusted wages are expected to grow by a cumulative total of 0 by the middle of 2025.

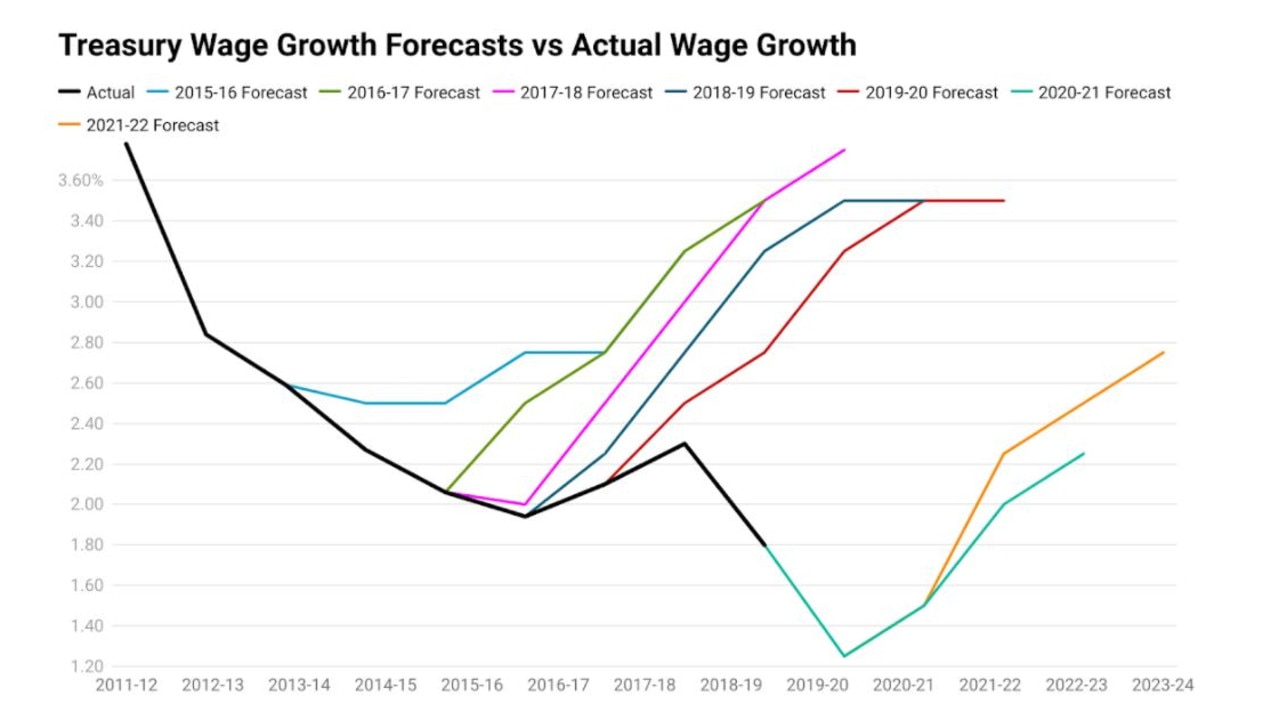

However, it’s important to keep in mind that Treasury are not known for the accuracy of their wage growth forecasts. For years, they have significantly over-estimated the level of wage growth the economy would deliver.

For example in the 2017-18 budget, Treasury forecasted that in the 2019-20 financial year, wages would grow by an extremely strong 3.5 per cent. In reality wages grew by just 1.8% per cent almost half of what Treasury estimated.

RELATED: How budget will hit homebuyers

Wages stagnate and house price skyrocket

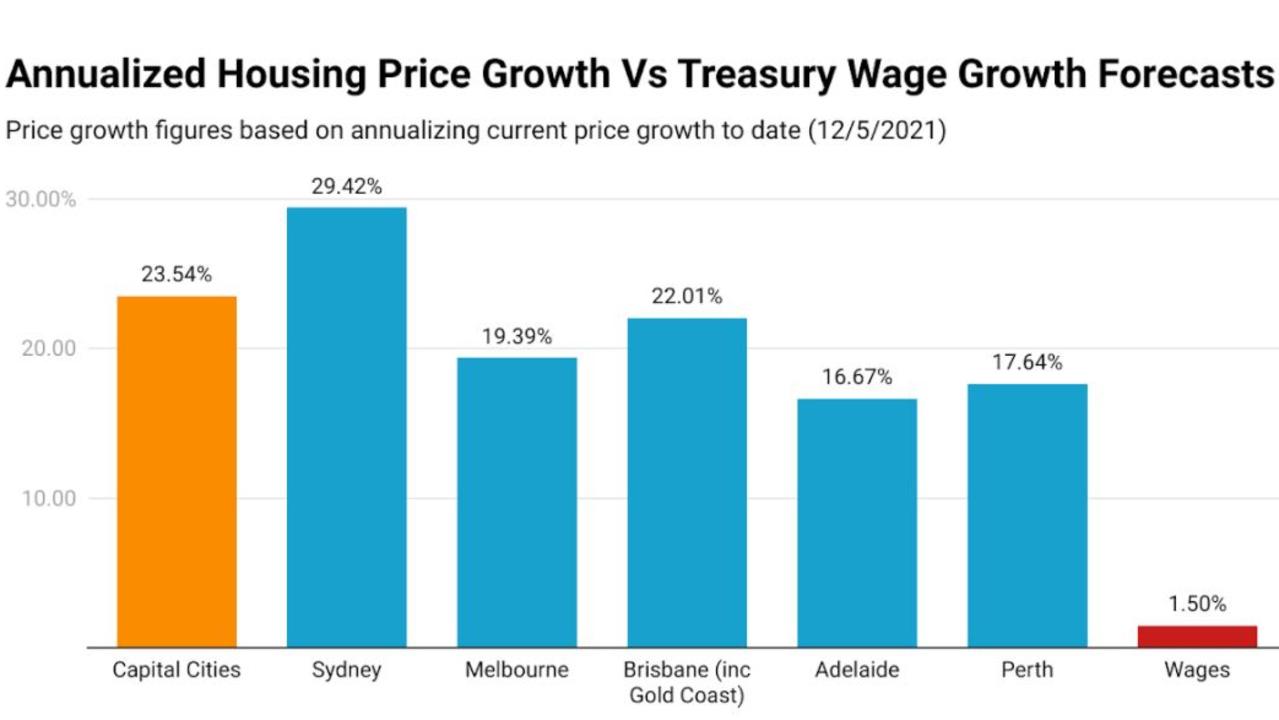

In the property market things couldn’t be more different, with property prices currently rocketing at the fastest pace since the late 1980s.

According to figures from housing price data provider CoreLogic, since the start of the year capital city home prices have risen by 8.4 per cent. With Sydney recording the strongest growth, with prices rising 10.5 per cent and Perth the relative weakest with prices increasing 6.3 per cent.

If prices continue to rise at a similar pace across the rest of the year, capital city home prices will sit a whopping 23.5 per cent higher on January 1 2022 than they did at the start of this year.

Through a combination of low interest rates, government incentives and pandemic driven demand, a housing market where capital city home prices rise more in percentage terms in 24 days than wages grow in a year, has been created.

But where does this leave the property market, can prices continue to rocket in the long term even as wage growth remains relatively anaemic, even under the most optimistic estimates?

It’s possible, but they will likely increasingly need to do so without first home buyers providing the market with a boost.

House prices rising too fast for savers

According to figures from Domain, surging home prices are driving up the required size of home deposits far faster than the vast majority of prospective first home buyers can save.

In Sydney the required size of a house deposit has risen by $20,614 in the past 3 months alone, requiring home buyers to save $1,586 per week just to maintain the size of their deposit, relative to rapidly rising home prices.

Nationally, the required size of a house deposit rose by $9,706 in the past quarter, requiring buyers to save $746 per week to maintain the buying power of their deposit.

Considering it already took over a decade to save a 20 per cent home deposit in some capital cities according to figures based off a 2019 report from ANZ, it’s clear that many prospective first home buyers will soon find themselves priced out of the market.

Bank of Mum and Dad

In their attempts to get into the market amidst skyrocketing prices, first home buyers have already turned to ‘The Bank of Mum and Dad’ in order to have a shot at buying their first home.

Figures from research firm Digital Finance Analytics (DFA) showed that the number of first home buyers receiving help from their parents to buy has risen to over 60 per cent, with the average amount of support being provided sitting around $90,000.

As prices continue to march higher, the number of first home buyers and even owner occupiers able to clear these hurdles will continue to dwindle, as the bank of Mum and Dad gets tapped out, and buyers are increasingly unable to keep up with rising deposit requirements.

With wages growth expected to remain relatively weak for years to come even based on the most optimistic estimates, rising housing prices are leading to a market increasingly divorced from the incomes actually earned by households.

Prices may continue to rise for quite some time as indicated by record levels of new housing loans currently being written.

But in the longer term they may face an uphill battle against years of weak real wages growth, millions of Aussies priced out by high prices and a tapped out Bank of Mum and Dad, no longer able to come to the markets rescue.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator