‘Our own tariffs:’ Aussies vow ban on US goods

Australians have come out in droves promising to stop purchasing American products, however one economist urged shoppers to “think strategically”.

Australians have come out in droves promising to stop purchasing American products, however one economist urged shoppers to “think strategically”.

Fed-up Australians set to pay more for electricity want to know one thing as they try to work out where the extra money is going to come from.

Cash-strapped Aussie households are being warned they will soon face higher electricity costs.

People are getting ripped off by dodgy repair works in the wake of natural disasters, the Insurance Council of Australia has warned.

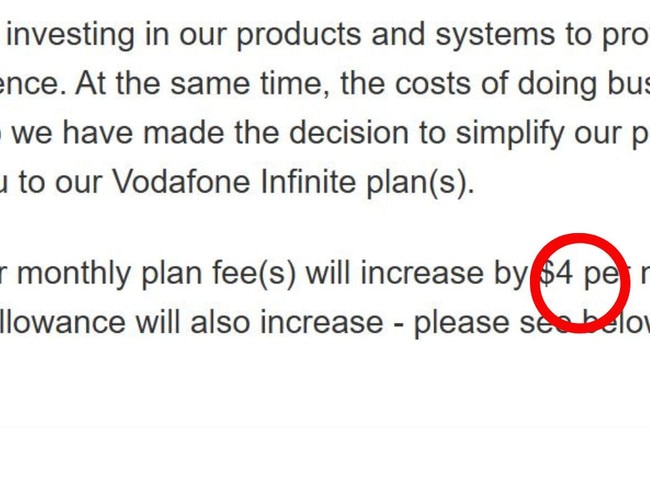

Customers with one major telco have been told prices will be hiked on this item as the company moves to ‘simplify’ its range.

As Gen Z increasingly grapple with whether they’ll ever achieve the ‘Australian Dream’, one man claims it’s the “easiest it’s ever been” to buy a home.

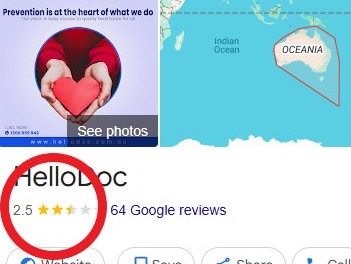

An Australian man has revealed his distressing experience over a negative online review he left and the fallout that occurred from it.

A midwife has exposed the “shocking” reality facing thousands of Aussies right now, saying it is leaving her and others like her with just one choice.

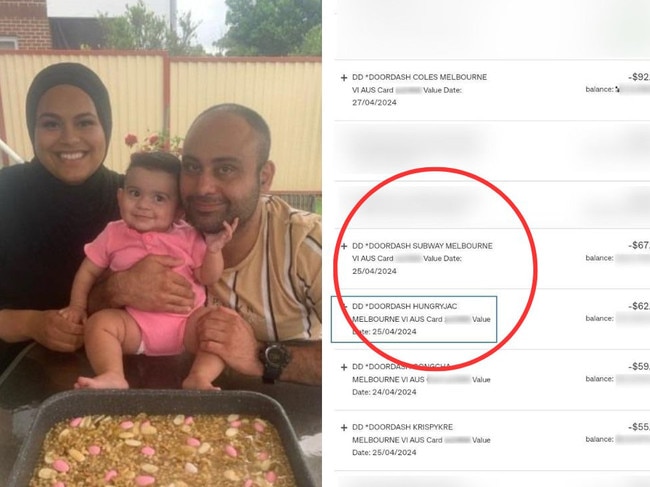

Scammers had a field day using this Aussie dad’s credit card details — then the bank turned around and said it must have been him who had done it.

A young Aussie family has revealed the drastic measures they’ve taken to relieve some financial stress.

Anthony Albanese has put insurers on notice, urging them to “do the right thing” and “restore some of their reputation with the public”.

An influencer has shared the wild reason she’s been told her husband will leave her exposing a wider issue.

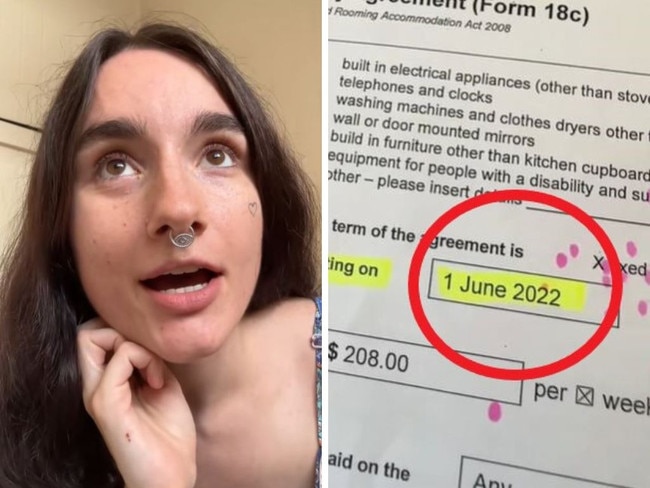

Dodgy landlords and real estate agents trying to bully tenants into paying a higher rate have all but been eliminated from one state.

Insurance companies say there are three key things Aussies in the firing line of Tropical Cyclone Alfred need to do.

A key group is yet to see real relief from the RBA’s recent rate cut, a big four bank has revealed.

A Millennial woman has sparked a financial debate by revealing why her friend called her “lazy”.

As millions of residents brace for Tropical Cyclone Alfred to make landfall on Friday, experts have issued an ominous warning as the stock market reacts.

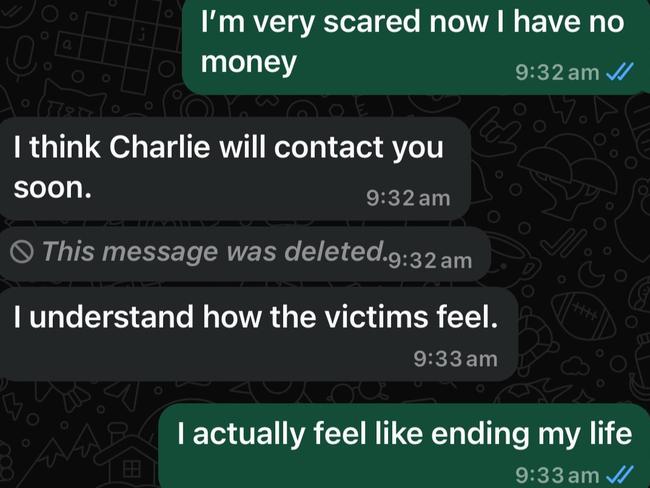

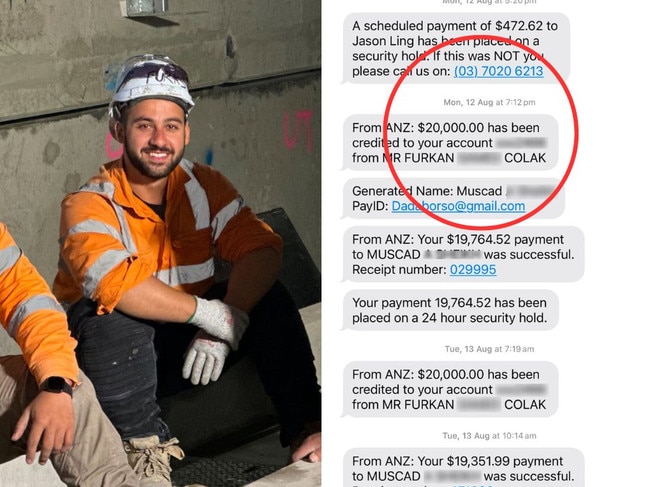

While he lost a bunch of money, it was what he uncovered next that left him disturbed at how easy it was to get away with a crime.

Tropical Cyclone Alfred has exposed a major issue millions of Australians face as it looms ever closer to the east coast.

Aussie grocery giants face being broken up or paying hefty fines for price gouging under a wild election proposal from one party.

Cash-strapped Aussies weighing up whether to maintain one expense have been tipped over the edge by the biggest price rise in seven years, a survey claims.

Australia’s love of sport has helped lift consumer spending for January as cost-of-living pressures ease.

A young Aussie shared how much her upcoming wedding is going to cost and, while some called it “realistic”, others were shocked at their budget.

The Australian housing market has surged on the back of interest rate cuts, completely reversing a soft start to the year.

Rate relief for millions of Australians starts on Friday as the first of the big four banks finally pass on the RBA’s rate cut to mortgage holders.

Money expert David Koch has issued a warning to millions of Aussies facing a price hike on their private health insurance.

These Aussies are earning a good salary but there’s a dark secret they are hiding that is causing devastation.

Scammers are becoming increasingly sophisticated but the corporate watchdog is fighting back, taking down more than 130 scam websites a day.

About 15 million Australians will see an increase to their private health insurance premiums from April 1. Here’s how much they’ll rise by.

A NSW man has been left in tears after facing a cruel reality when it comes to paying off his mortgage.

Mortgage holders hoping for back-to-back rate cuts have taken a hit after the latest inflation figures were released.

Woolworths has been counting the cost of industrial action, which took a dent out of the supermarket behemoth’s bottom line.

A young mum has shared her dismay after copping a brutal bill from Centrelink, after what she claims was a “severe error” on their end.

Commonwealth Bank boss Matt Comyn has backed cash, saying his bank will provide it to customers even as customers preferences change.

Australians are set to work longer as rising cost-of-living sees them put off their retirement.

Telstra downgraded the upload speeds for thousands of its Belong NBN customers without telling them or lowering the price.

Frustrated Aussie savers have been urged to get one up on banks who have left them in the dark by doing one thing.

Australia’s consumer watchdog says customers’ concerns in the supermarket and retail sector remain a key priority in the year ahead.

It’s only going to get worse for Aussie savers already on their knees after the Reserve Bank’s decision to cut interest rates.

Australia’s cost of living crisis is out of control – but something truly bizarre is happening while so many of us are feeling the pinch.

Pensioners, renters and students will receive a big income boost next month. Here’s what you need to know.

Big four bank Westpac will cut 190 Australian jobs in its customer solutions division and move them offshore just days after announcing a bumper profit.

Aussies are facing a harsh choice when it comes to cost of living and staying healthy.

Australia’s wage growth has slowed in the December quarter, which while welcome news for the RBA, shows the peak in earnings growth might be over.

Aussie households are feeling the pinch, with a single rate cut unlikely to relieve them of their mortgage stress.

The Reserve Bank of Australia has switched things up, meaning eager homeowners will have to wait a little longer to find out if they will get another rate cut.

Households are tipped to have a bit more in their pockets after the RBA’s first rate cut in four years, but just how much you will save will depend on the size of your loan.

The minor party has proposed a five-pronged attack to lower rising insurance premiums which they say could save households a total of $4bn.

Unions and interest groups ratcheted up the pressure on the Reserve Bank ahead of its decision to cut interest rates.

Insurers have been put “on notice” as Australians struggle to find affordable policies in an increasingly unpredictable climate.

Competition among mortgage providers has spurred a big four bank to cut its variable interest rates ahead of tomorrow’s RBA decision on the cash rate.

Homeowners are blindly allowing the banks to rip them off by up to $10,000 a year by failing to do one crucial thing.

Consumers are regularly paying more than they should to use their own money with a debit card, but current laws render the consumer watchdog useless to investigate.

Banks are cutting one particular offering as they gear up for the Reserve Bank of Australia to do the same to the cash rate.

Australia is fighting back against cyber security threats, and this world-first move against scammers is leading the way.

Uncertainty over US President Donald Trump’s current tariff policies could push back the RBA’s plans to cut rates in February, economists warn.

Hannah Blass was earning six figures and living the good life but her bank balance was also spiralling “out of control” because of one habit.

The site of an iconic Australian festival is up for sale along with a main stage graced by international superstars – and it’s much more affordable than you might expect.

Educators have issued a desperate plea after a new report revealed the growing disparity between the funding for private and public schools.

Another of Australia’s big four banks has cut interest rates for one group of borrowers, ahead of the RBA’s highly anticipated February meeting.

Aussies putting up with higher house prices are still getting into the market as investors get out of the way, new research shows.

An Australian family lost $2.5 million – life savings accumulated over 30 years – and they uncovered staggering failures across major banks.

CBA has announced an eye-watering half-yearly profit despite citing cost-of-living concerns for customers.

One demographic has emerged as the most popular target for scammers – and it’s not who you would think.

Fresh government data has shined new hope on the great Australian dream, proving you can still buy a home in a popular city for under $1m.

Treasurer Jim Chalmers said he is asking for a “commonsense” change that will help more Australians purchase their first home.

A petition to save cash through guaranteeing access to the tender and relevant banking services has surpassed 200,000 signatures.

Another major financial institution has changed its rates ahead of the Reserve Bank of Australia’s decision on the official cash rate.

Angry residents have fronted a chaotic council meeting where members voted in favour of a huge rate hike after a $122 million pool redevelopment debacle.

Another Aussie builder has gone bust, leaving home buyers in the lurch and creditors owed millions.

At a secret location in Sydney, experts have revealed the terrifyingly simple way Australians are being fleeced more than any other country by scams.

Some Australians are facing huge debts following a record credit card spend over the Christmas period.

New legislation is holding Buy Now Pay Later providers to Australian credit licence standards in an attempt to protect consumers.

An Aussie has been left ashamed and embarrassed after he was caught out by a devastating incident twice, which has turned his life upside down.

A famous influencer has revealed the huge life change she has been hit by, and why some followers are calling it her “downfall”.

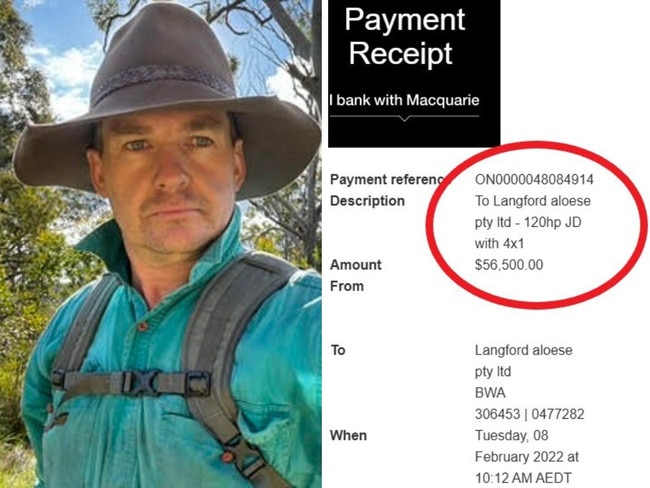

A 26-year-old Aussie tradie has issued a warning after losing $58,000 to a scam that anyone could fall for.

A veteran police detective has revealed how cops are being frustrated and overwhelmed by a serious crime and their hands are being tied to even investigate it.

International retailers Temu and Shein have risen rapidly in Australia, but that could be short lived. Here’s why.

The $200,000 was from a life insurance policy but ended up in the pockets of scammers – and that was only the “tip of the iceberg”.

Australians are falling for scams within a matter of seconds, with a top cybercrime cop issuing a chilling warning.

Original URL: https://www.news.com.au/finance/money/costs/page/3