Horror reason woman making $180k is broke

These Aussies are earning a good salary but there’s a dark secret they are hiding that is causing devastation.

A sinister trend is emerging where women are increasingly becoming the moneymakers in Australian families but are then subjected to heinous economic abuse – where they can’t even afford a cup of coffee.

These women are high flyers – earning six figure salaries and managing million dollar budgets at work — yet find themselves in a relationship where their partner stops paying the mortgage without warning, the bills pile up, debts are taken out in their name and savings transferred out of joint accounts.

Amanda* is one Australian woman whose “nervous system has been absolutely shot” by being in a “financially controlling marriage for a really long period of time” despite earning $170,000.

She separated from her husband — who she describes as a “narcissist” – two years ago.

He lived in her house for three years rent-free but the economic abuse ramped up after the birth of their daughter. A business deal her husband entered into — and she knew nothing about – went bad. He lost $270,000, some of which had been taken out against their mortgage.

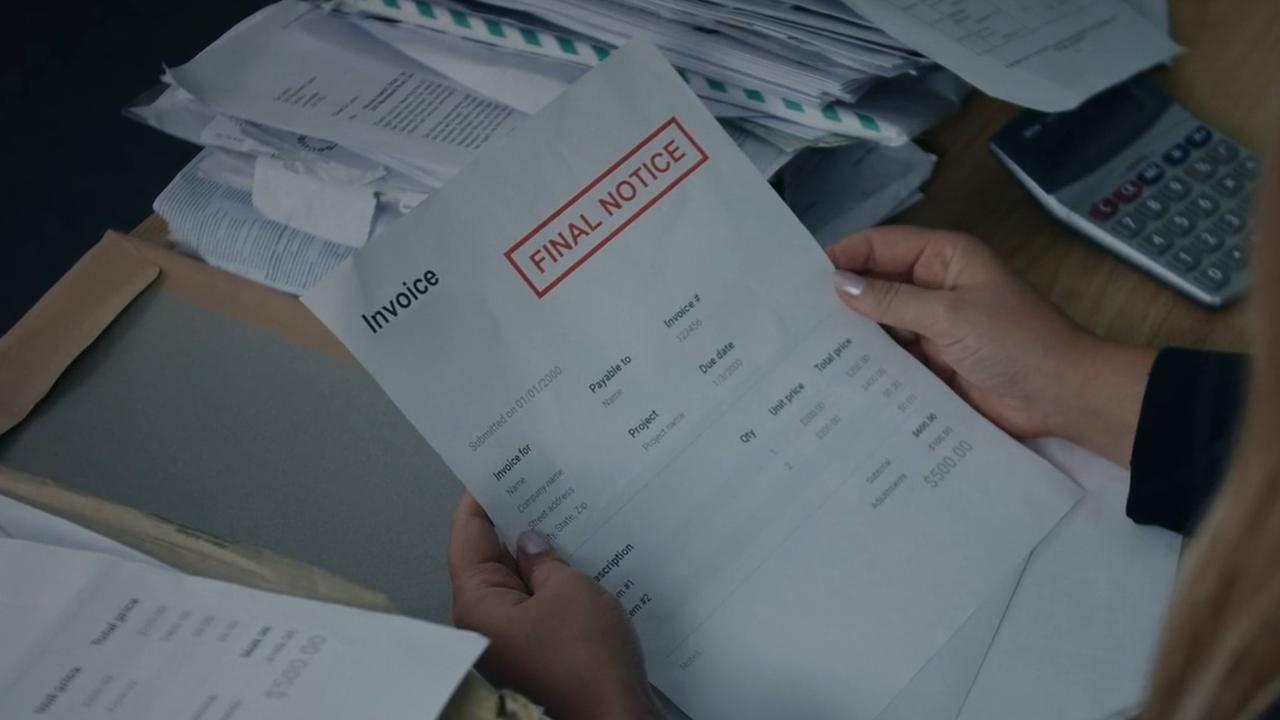

“I’ve been in absolute financial distress for 10 years. He stopped paying all the bills, the mortgage, everything and we separated and he moved out,” she told news.com.au.

“His credit rating was shot and he convinced me to take out a loan for a caravan and lived in the caravan. He then took it hostage and stopped paying for it.

“I was paying the full mortgage, he wasn’t paying anything. Not the health and house insurance, every bill and I was getting further and further behind.”

Then there is Jade*. She’s a successful health professional who earns $180,000 but also suffered economic abuse.

After the birth of her second child, her husband just stopped paying the mortgage.

“I didn’t notice for several months as the way the accounts were set up there was a buffer in there,” she told news.com.au.

He partner of more than a decade then stopped paying shared bills or anything to do with the children and she instigated a separation.

“I needed to sell the house as I was the only one paying the mortgage and couldn’t afford to do so. He blocked the sale of the house and I had to go through legal means to allow a court order to sell the house,” she revealed.

Shared health insurance was also cancelled by her husband without her knowing.

“The refund cheque was sent to him and he pocketed that, so the children and I were left uninsured and he received the funds,” she added.

“When we separated he took what he called his savings – in excess of $100,000 from our joint bank account – and I could have had legal recourse to get that back from him. But I really wanted him out of my life and to start afresh.”

Do you have a story? Contact sarah.sharples@news.com.au

He also got almost half of her superannuation which she said was “a real kick in the guts”.

The 43-year-old said she felt economic abuse was misunderstood and missing from the conversation when it came to domestic violence in Australia.

“At the time it was very difficult, I had two children under three and I was trying to provide for the kids and going through an acrimonious divorce,” she said.

“It was just exhausting. I didn’t feel – because it was a bit of an unusual situation as most of the gender roles are reversed in that regard – there was a great understanding of what I was going through.”

She said she would receive text messages describing her as a “disgraceful and shameless human being”, who was only focused on being a career woman.

“Despite the fact I paid for everything, he expected me to be the full-time mother as well as work to pay everything, which was impossible,” she added.

The healthcare worker said the economic abuse continues even years after their divorce.

She said her ex-partner doesn’t contribute to school costs, medical or dental bills, clothes or for activities like swimming lessons for the children.

Add to that she said she has to pay him child support but it is difficult as each year their exact salaries are revealed in documentation from the government agency that administers it.

“I would then get verbal abuse about how I make so much more money than him and you can afford this, like really low grade ongoing abuse about that those things,” she said.

“It’s facilitating financial abuse.”

She wants to see the disclosure of this information scrapped for women like her who have experienced economic abuse.

“It doesn’t matter how much money I make, I will always make more than him, but it’s fodder and material to keep the abuse going as he knows how much I make,” she said.

Both women claim to have also experienced shocking responses from their banks in regards to the mortgage too.

For Amanda, she reached out to Commonwealth Bank (CBA) about her financial difficulties paying the mortgage.

The Queensland woman said while she entered into a hardship arrangement, but CBA continued to send text messages about overdue debts and letters about the arrears.

“Each time I would be on the phone for 40 minutes and have to relive the situation,” she said.

Then her ex-husband was also receiving text messages from the bank which further inflamed the situation resulting in abusive text messages, she said.

“Each time the info got back to him it undid the negotiations around custody and financial separation,” she added.

“By not fighting I was going to lose absolutely everything. I could have just not paid but then the bank would have foreclosed and I would have lost every cent to my name.”

Jade also had a bad experience with ANZ. In financial distress, she visited a branch to request the loan repayments switch to interest only.

The mum-of-two was floored by the response. The Branch manager suggested she “go home and talk very nicely to her husband about the mortgage”.

“I left in a bit of state of shock. I called the bank later on, they were apologetic, but I declined to make a formal complaint as I had so much going on,” she said.

“The bank let me switch to interest only to minimise the payments for a while. But there was just the lack of understanding. I wasn’t looking for sympathy. I was looking for a practical understanding of what was happening and this was six years ago. It wasn’t 30 years ago.

“My faith in the system is pretty shaken for me. I’m a professional person, a relatively intelligent person who can navigate systems … but women need to look out for ourselves. I don’t think we can rely on the systems.”

An ANZ spokesperson said the bank does not tolerate the use of banking channels for financial abuse.

“Our frontline bankers are trained to identity customers who may be experiencing family violence and financial abuse and we have a range of support measures in place,” they said.

“We always strive to provide our customers with appropriate support and we regret the customer’s initial experience in the branch was upsetting in this case.”

For Amanda, the financial hardship arrangements have had a devastating effect as she claims it was never disclosed it would impact her credit rating.

“I paid off the arrangements and I paid them off early, every single one,” she said.

“I finally got out. But I can’t buy a house for me and my child as my credit rating is screwed, because financial hardship is a negative event and is reportable.”

Jade has also found herself in a situation where she is doomed to rent for the rest of her life.

“I don’t think I’ll ever be able to afford to buy again even with a relatively good job and income,” she said.

Amanda is also still working to get her credit rating cleared.

“It’s a complete mess,” she noted.

But emerging from a domestic violence relationship left her in a “deep hole” despite earning $170,000 a year, Amanda added.

“I had really bad mental health for a long period of time because he didn’t go bankrupt, he lost all of our money and I was living in flight or fight forever,” he said.

“You are so embarrassed about the situation you have gotten yourself into. I’m a smart woman. I advise clients on $100 million deals and I got myself into this situation and I couldn’t get out.”

A Commonwealth Bank spokesperson said the organisation offers trauma-informed support.

Amanda was assisted across a range of areas including a specialist support from the CommBank Next Chapter team and separately was offered hardship support, including payment plans and repayment deferrals over a 10 month period.

“We acknowledge our engagement with (Amanda) in this instance could have been simpler and her experience does not reflect the expertise or sensitivity we strive to provide our customers, especially those experiencing domestic and family violence,” the spokesperson added.

“We will take on board (Amanda’s) feedback about what has happened to her as we appreciate there are always opportunities for us to do better.”

Founder and chief executive of the Centre for Women’s Economic Safety (CWES) Rebecca Glenn said one in six women have experienced some form of economic abuse from a current or former partner, although this was a conservative estimate.

She said economic abuse generally presents in three forms – restriction, exploitation and sabotage.

Both Amanda and Jade experienced sabotage. Ms Glenn said it involves an intimate partner potentially destroying property to create costs, interfering with employment or stopping paying the mortgage and bills to create devastating costs.

She said they have supported women who were the main breadwinners but faced “dire” circumstances.

“It’s a misunderstood issue,” she said. “There has been a sense that if have women have the economic means, they have the freedom to walk away from an abusive partner and it’s not as simple as that.

“Where there’s economic abuse there are almost always forms of other abuse going on so it’s very dangerous to contemplate removing the economic resources that the abusive partner is relying on.”

Banks had come a long way in recognising economic abuse but that training and education had to be ongoing with staff, she said.

But the system also needs to rethink joint bank products so that it is easier to disentangle after a separation, rather than “trying to clean up after there has been financial devastation because of way the perpetrator misused one of the products”, she noted.

Economic abuse can touch on women from all walks of life, she added.

“There is not one set of circumstances of women impacted by economic abuse. There are those who have been stay at home mothers through to very senior executives with a lot of money and controlling a lot of money at work.

“Yet they are still unsure if they can buy a cup of coffee as they don’t know what the ramifications might be when they get home,” she explained.

The CWES runs money clinics, providing one-to-one confidential financial counselling to support women at any stage of their domestic and family violence experience.

It recently released a film examining the “silent violence” being impacted on women when it comes to economic abuse.

*Names have been changed

sarah.sharples@news.com.au