Daughter’s despair as elderly mum falls for every scam in the book and she can do nothing but watch on

The $200,000 was from a life insurance policy but ended up in the pockets of scammers – and that was only the “tip of the iceberg”.

Andrea Smith was sifting through her mother’s belongings when she came across a letter that would turn both their lives upside down.

Ms Smith’s 80-year-old mother had detailed how she had lost $200,000 – a life insurance payout bequeathed to her by her late son – to a fake cryptocurrency trading platform.

Ms Smith’s brother had died of brain cancer and he had laid out “very strict conditions” in his will that his money should go towards renovating the family home, where Ms Smith and her mother both reside.

Instead it all went straight to scammers.

“I’m devastated,” Ms Smith told news.com.au. She then got permission from her mum to look through her bank accounts to investigate further and realised that was “just the tip of the iceberg”.

“My mum hasn’t fallen for just one scam, she’s fallen for every possible scam.”

Ms Smith is lending her support to news.com.au’s campaign People Before Profit, calling on the federal government to make it mandatory for banks to compensate scam victims – just like in the UK. In October last year, the UK introduced world leading legislation making compensation mandatory for scam victims within five business days unless in cases of gross negligence.

IT’S TIME BANKS PUT PEOPLE BEFORE PROFIT. SIGN THE PETITION HERE.

“The amount of nights I kept myself awake, wishing I had the money to renovate our house, feeling so guilty,” Ms Smith said. “She had that money and she lost it.”

Ms Smith’s mother lost at least $200,000 to Coinbit, a well-documented fake crypto website that defrauded people all over the world.

“I could not stop crying. It’s blood money. It’s literally blood money in this case,” Ms Smith said. “It is not a victimless crime.

“They have taken it from my brother who died, and it just makes me absolutely sick. And I really hope karma exists and they get exactly what’s coming to them.”

Do you have a similar story? Get in touch | alex.turner-cohen@news.com.au

Ms Smith’s mum has been incredibly tight-lipped about everything when pressed.

Ms Smith suspects it’s because the older woman has either forgotten about all the scams, as she has been diagnosed with dementia, or is too “mortified” to tell her.

Using various bank records, Ms Smith has tracked huge swathes of her mother’s money lost to scammers – but those are only the ones she knows about.

She estimates at least $300,000 has been pillaged by online criminals.

“I don’t know what I will find next,” she said.

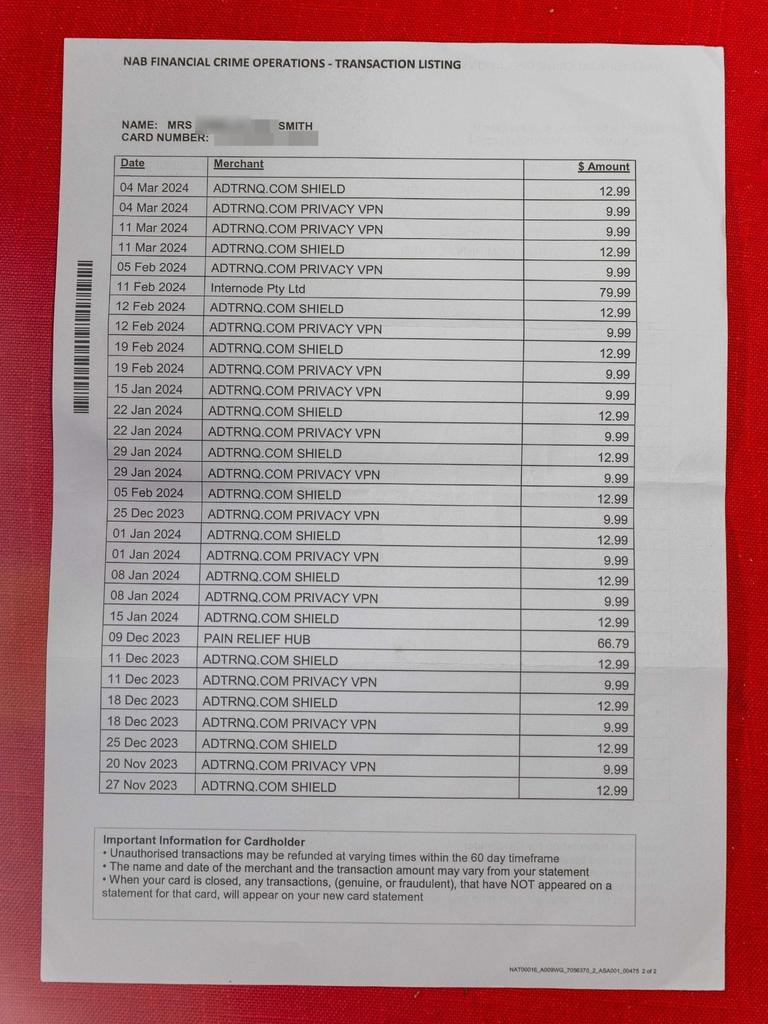

Ms Smith’s mum also somehow must have got her debit card skimmed, with scammers using it to buy things online for at least two years – “possibly longer”, she said.

They appear to be using her mother’s card to regularly pay for a subscription to a VPN, likely allowing them to continue to conduct their criminal activity on other people.

And every time they make a transaction, her mother is also hit with an international transaction fee from her bank, in this case NAB.

“Weekly overseas transactions, sometimes occurring twice a day, went undetected by NAB’s security team,” she said. News.com.au understands some transactions were flagged, while others weren’t because they were for legitimate goods and services, and for small amounts of money, and not the type of behaviour that would trigger anti-fraud flags.

The overseas VPN subscription does appear to be coming from a legitimate business – just one incredibly difficult to unsubscribe from.

The fraud team assured the concerned daughter that the VPN transactions had only occurred on one card. But when her mother was issued with a new credit card, the transactions persisted.

When she rang NAB again, they claimed they had no record of the issue.

Ms Smith went through her mum’s email to check and it was here she came across a message from NAB in 2020, where they referenced the fact her mother had believed scammers who were impersonating the bank.

Ms Smith believes that the bank should have flagged more transactions, given that her mother had already fallen for an obvious scam.

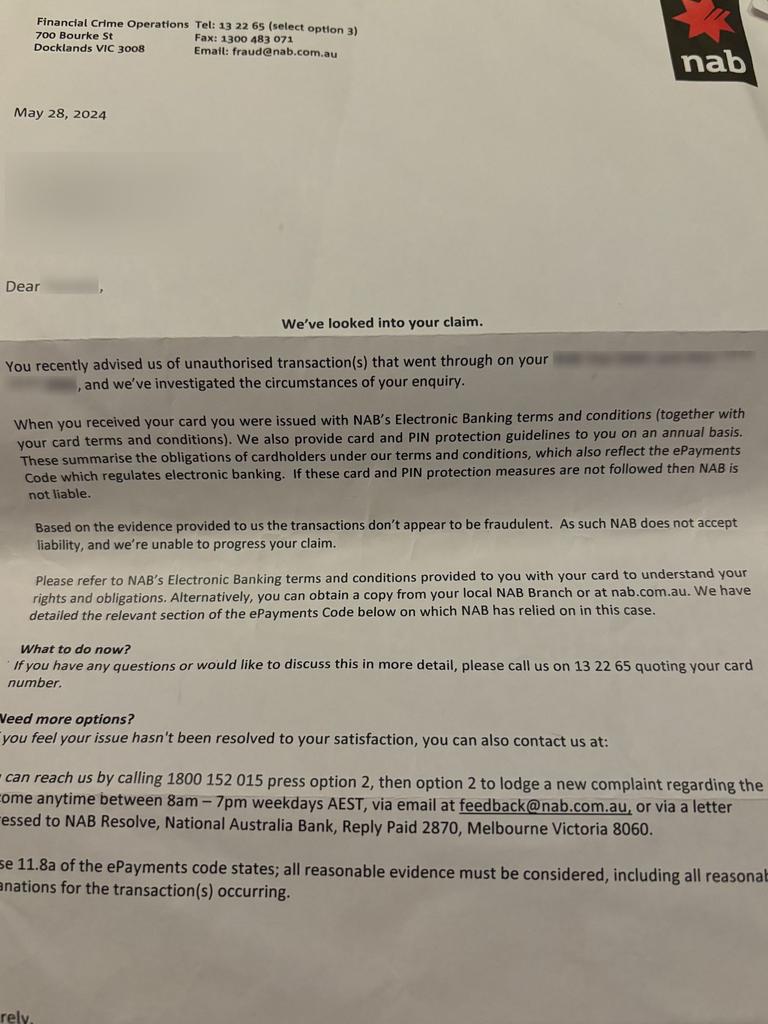

After six months of Ms Smith chasing answers and refunds from the bank, NAB concluded that the VPN purchases were not unauthorised transactions and the bank was not at fault as her mother had given away details like her PIN number.

“This response is both unsatisfactory and distressing,” Ms Smith said.

She has lodged a case against the bank with the Australian Financial Complaints Authority.

A NAB spokesperson said: “NAB takes its responsibility to scam prevention seriously. We have a bank-wide scam strategy in place to tackle this global epidemic. While we cannot comment on specific cases, we urge all customers who believe they have been scammed to assist, so the matter can be fully investigated.”

Ms Smith has been left bracing herself for the next time her mother will fall for a scam, which she believes is inevitable.

Recently, she discovered her mother has been writing letters to people she believes is Mick Jagger and Hugh Jackman and coaxed to giver away her card details.

More Coverage

“I don’t know how to stop this,” Ms Smith said. “She doesn’t believe me when I say something is a scam and she won’t listen to advice about the internet or answering the phone.”

She has made an application to the Victorian Civil and Administrative Tribunal (VCAT) to be given financial control of her mum’s accounts.

“She isn’t okay. Even years ago we thought she wasn’t okay,” Ms Smith said.

alex.turner-cohen@news.com.au