Leaked text messages reveal horror ordeal

An Aussie has been left ashamed and embarrassed after he was caught out by a devastating incident twice, which has turned his life upside down.

A Perth man who was left feeling “foolish and humiliated” when he lost $45,000 to a scammer was further devastated when he was tricked out of the rest of his life savings trying to recover the stolen funds.

All up he was fleeced out of $115,000 and was forced to return to work just weeks after retiring – with his life turned upside down.

Often when scam victims have their savings stolen there is a focus on the financial fallout – but it goes well beyond that, creating a crisis in all aspects of their life, as they fall for tricks used in the likes of politics and gambling.

Victims feel shock, shame and stigma and experience isolation as they fear telling anyone what’s happened. In many cases there are relationship and family breakdowns, friendship breakups, mental health impacts and ongoing trust issues.

News.com.au has launched People Before Profit, calling on the federal government to make it mandatory for banks to compensate scam victims – just like in the UK.

In October last year, the UK introduced world leading legislation making compensation mandatory for scam victims within five business days unless in cases of gross negligence.

IT’S TIME BANKS PUT PEOPLE BEFORE PROFIT. SIGN THE PETITION

Clinical psychologist Dr Rob Battisti said he thinks anyone can be scammed no matter their circumstances.

He has seen the devastation that hits scam victims as he has helped a number of clients in his Sydney-based clinic.

Often it starts with shock and disbelief at being scammed but he warned this can be further used against a scam victim.

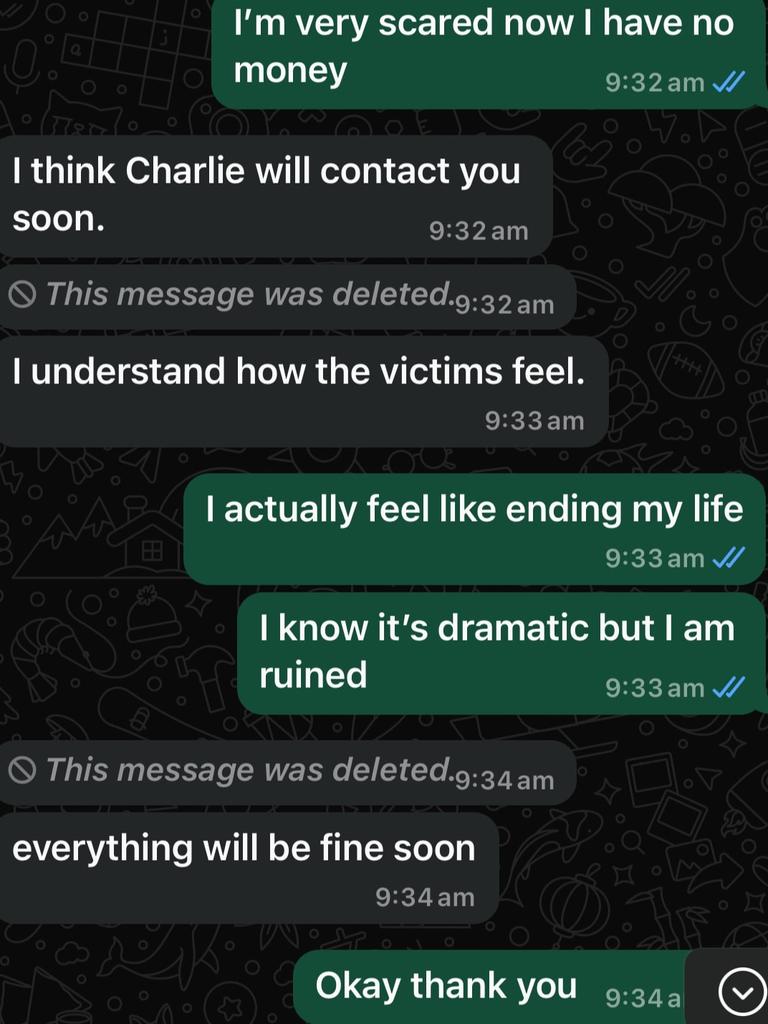

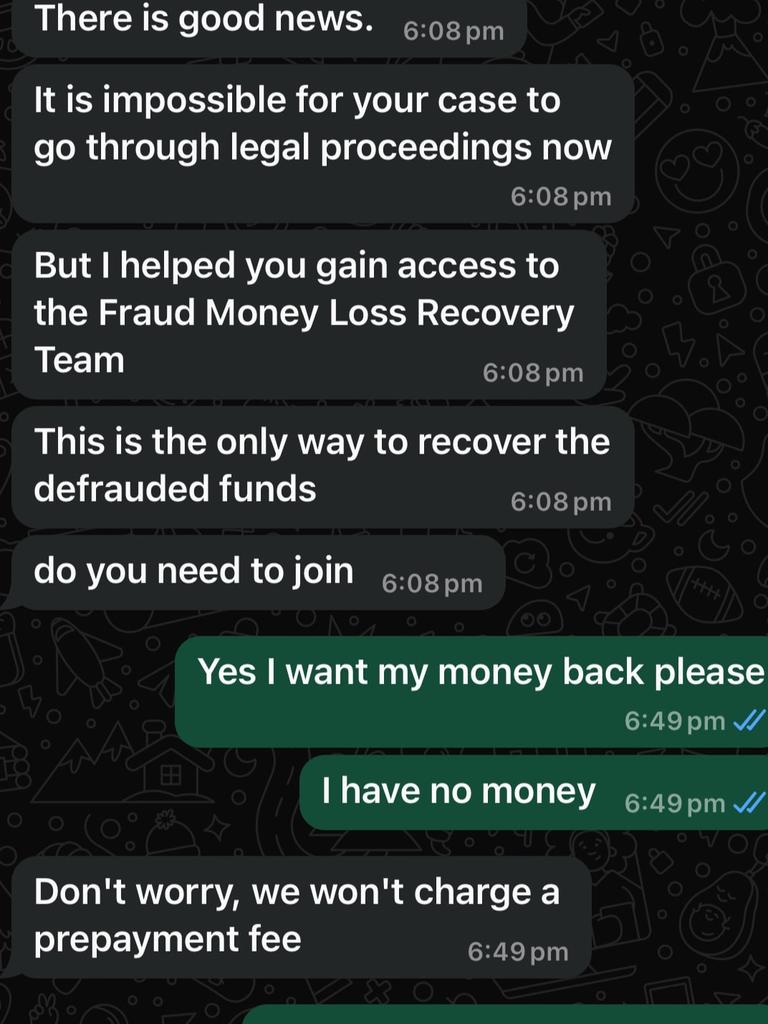

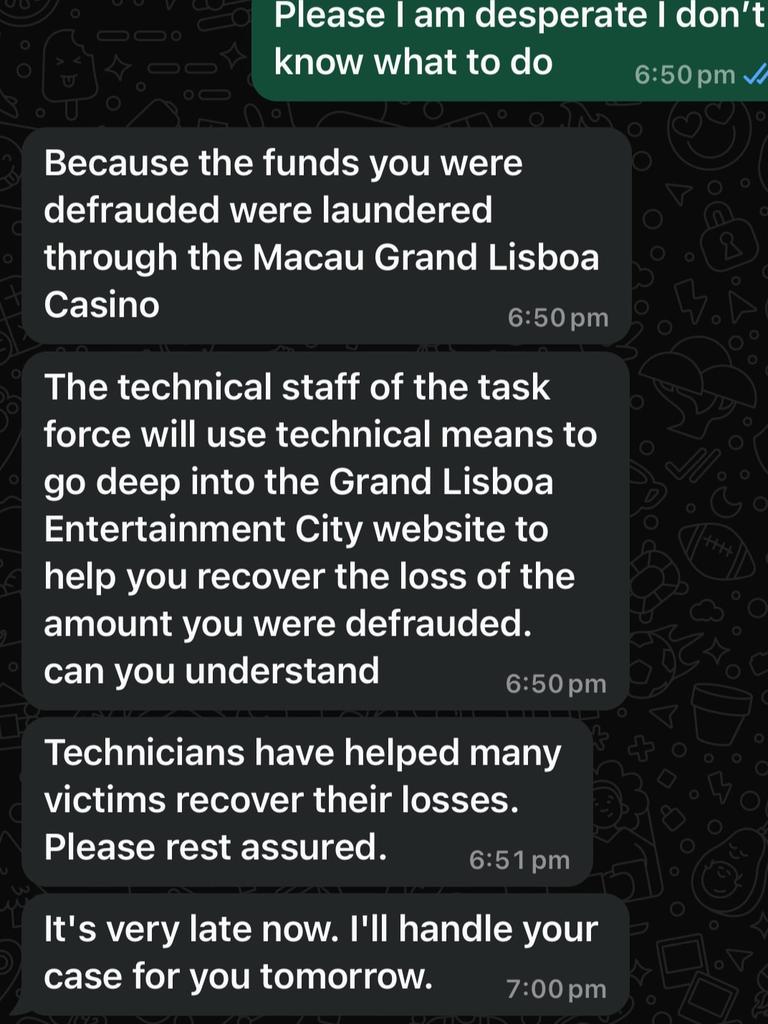

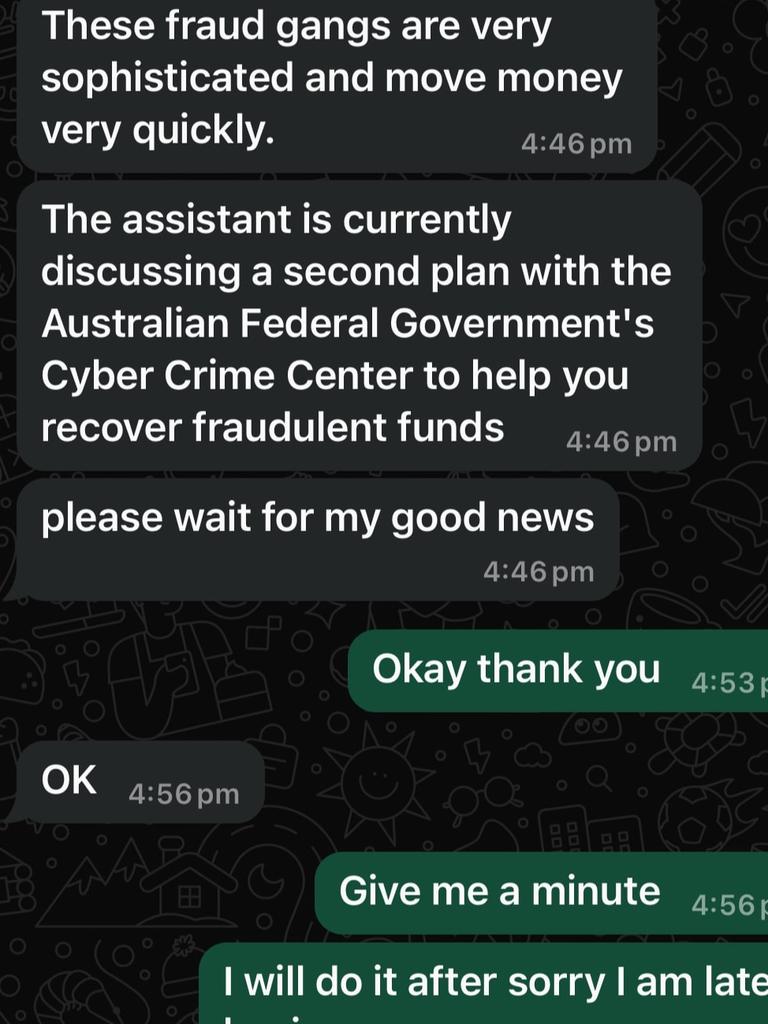

“Tied to disbelief is almost wishful thinking – wishing or hoping there is some terrible mistake and that’s how we get scenarios where someone has been scammed and they get caught up in a secondary scam,” Dr Battisti told news.com.au.

“It’s just where they need to pay a bit more money in order to fix this problematic process or whatever so people can be more deeply caught up and it compounds the feelings of shame and embarrassment.

“They don’t want to share with anyone as they think others wouldn’t be caught up and it’s just themselves. But the individuals who do this use extremely sophisticated techniques that are informed by human behaviour theory and are similarly used in marketing, politics and gambling – they know what they are doing.”

This is what happened to Mr Croft. In September last year he left his job, cashed in his superannuation and spent $45,000 investing in an online gift selling platform.

But four days later he realised it was a scam.

Tragically, he fell for a second scam when he came across a lawyer who said she could help him recover the stolen money.

“It was $70,000 I lost through them. I lost all my superannuation, I sold my car, all up I am out of pocket by $115,000,” he told news.com.au.

The 65-year-old said he was crippled by anxiety and depression as a result of the ordeal and didn’t contact his bank Westpac straight away.

But he said he was shocked when his bank tried to recover the funds from the receiving bank, NAB.

“NAB turned around and said as I had taken $560 out of the platform that I was part of the scam and they deemed the money in the account as part of the fraudulent scam,” Mr Croft said.

“It was $560, it was not like I am living in a mansion and drinking champagne. They declined to pay the money back or try to look into it any further.”

He said NAB’s response to the scam was unfair.

“I can’t understand how these people are allowed to operate a bank account in Australia and to label me as part of the scam without talking to me or finding out more information. It blows my mind this can happen,” he said.

“I can understand if it was a crypto transaction, but it was legitimately paid into their bank account. I can’t understand how they can have a bank account in Australia. Meanwhile, I had to block my licence number and a get a new passport. I was also told if (the scammers) have that information they could try and take out loans in my name.”

A NAB spokesperson said as soon as the bank receives reports of potential scam activity, it acts immediately by blocking suspicious accounts where necessary and co-operating with other banks’ investigations.

“As soon as we become aware of a mule account, we investigate and take appropriate action to stop the muling activity. We report these accounts in line with our financial crime obligations,” the spokesperson said.

“While we make every effort to recover lost funds, unfortunately it’s not always possible because of the speed and sophistication of these organised criminals.”

Mr Croft said being scammed twice had devastated his family. They had to go to Anglicare for assistance as they couldn’t pay their rent or pay bills and needed food vouchers.

He also had to return to work as a butcher after retiring and has lost 7kgs from the stress.

“All our lifesavings are gone. We have got no future, we can’t retire, we have got nothing to look forward to,” he added.

The scammers also rang him to taunt him that they had stolen his money.

“I sat on it for two weeks before I told my wife as I tried to get the money back,” he said.

“I just couldn’t do it on my own anymore and I had to tell her and it’s been downhill since that.

“You shouldn’t blame yourself and beat yourself up but I’m the sort of person who does. I take it personally if I make a mistake. It hurts.”

A Westpac spokesperson said they could not comment on individual cases but stopping scams is one of its highest priorities and the bank is continuing to invest significantly in scam prevention and detection measures.

The impact of a scam can depend on the amount of money stolen, Dr Battisti noted, but said losing lifesavings can “fundamentally change the trajectory of someone’s life and there is enormous grief around they life they could have that have had”.

Given only four per cent of scam victims receive any sort of reimbursement in Australia, Dr Battisti noted that being consumed by getting those lifesavings back can also be damaging for Australians.

“In most cases, it’s impossible or near impossible to get that money back and so when you have been a scam victim the big challenge is how long it takes you to essentially accept that it happened?,” Dr Battisti said.

“So you can somehow keep moving in your life even when there’s been an awful outcome – it doesn’t matter how upset you are it won’t change the outcome. But it is important to grieve and work out how to accept the situation.”

Dr Battisti said society is set up to blame victims so people can “psychologically protect themselves” from thinking it could happen to them.

“We don’t like to think of awful things happening to us, so when people end up in situations where we can potentially blame them then we don’t have to do anything,” he noted.

“If it an happen to us, it creates an internal distress where we feel we have to do something to deal with a threat and we don’t like experiencing a threat.”

This leads to alienation and intense loneliness for scam victims often from the people close to them who question why they didn’t call a bank directly, why they chose to clink on a link or why they blindly believed a scammer, Dr Battisti added.

“Having compassion for the simple fact that anyone can be manipulated with the right tools is something we have to be mindful of,” he noted.

More Coverage

“Preventive education is important but is not going to guarantee anything as scams become more sophisticated. This can happen to anyone. It’s not just about people who are lower socio economic status, old or there mental health is impacted.

“Anyone can be impacted as people care. So if you happen to be captured in a group of people that are targeted and it’s thing you care about, you can be potentially manipulated.”

sarah.sharples@news.com.au