‘Disgusting’: Aussie’s horror mortgage reality

A NSW man has been left in tears after facing a cruel reality when it comes to paying off his mortgage.

An Aussie farmer spent “days crying” after uncovering the sophisticated way he had been deceived, losing $48,000 and leaving him with massive debts.

Adding to the devastation is the fact that Peter Hastie now has to pay interest on the stolen money for years to come.

Chillingly, the bank account the scammer used to steal Mr Hastie’s money was opened just six days before the fraud.

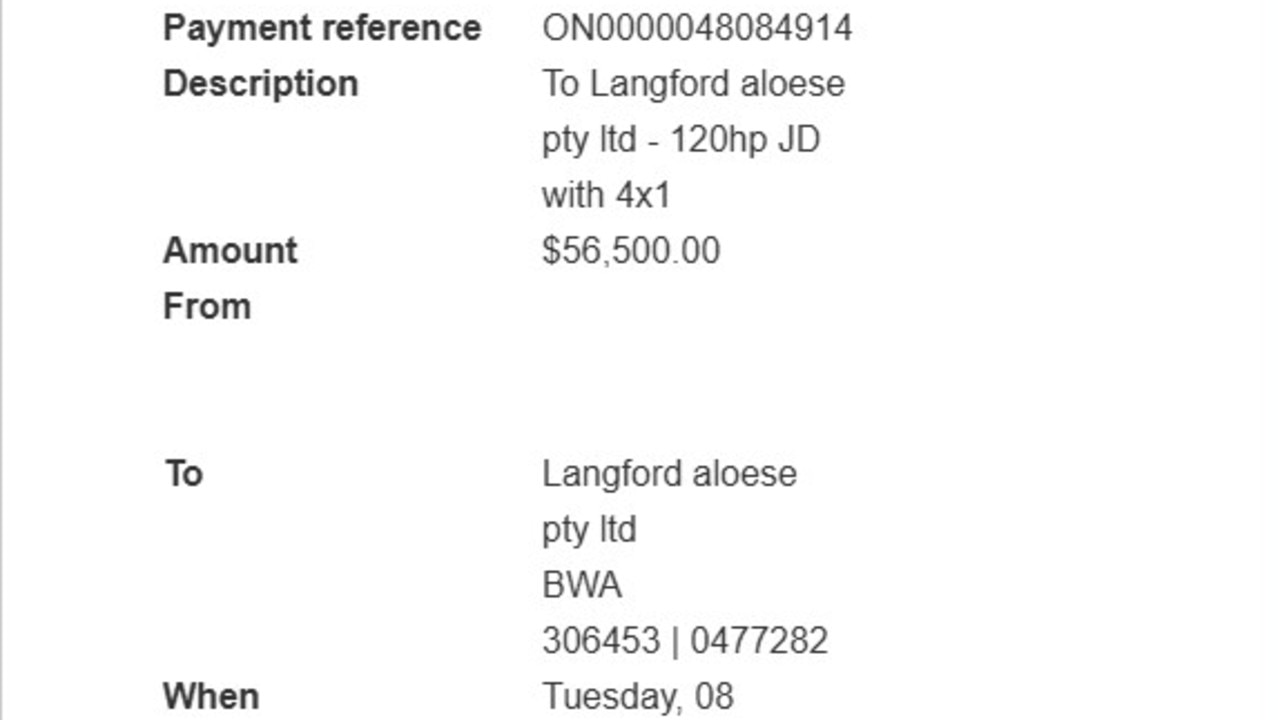

The 44-year-old, who has a farm north of Coffs Harbour, used $56,500 from his Macquarie Bank offset account to purchase a much-needed tractor in 2022.

He transferred the money into a Bankwest account and expected delivery of the tractor within two weeks.

“The night before it was meant to be delivered I had this gut feeling that something wasn’t right,” he told news.com.au.

MORE:Call your bank: Rate cut trap revealed

Do you have a story? Contact sarah.sharples@news.com.au

Frantic attempts to contact the dealership, which he had found online, went unanswered. His previous interactions with the firm had not raised red flags as the scammer knew information about tractors “intimately”, Mr Hastie said.

Mr Hastie said he also did his due diligence by checking the company’s ABN online, which was legitimate, as well as other details.

When he alerted Macquarie Bank to the scam, he claimed the response was “too bad, too sad” and he was told he had authorised the transaction.

“I didn’t approve the transaction to a scammer,” he said.

“When Macquarie said that’s it too bad, too sad I went into shock. I was obviously really embarrassed. I couldn’t tell my family I had lost $56,000. It spun me out mentally, it really spun me out. I was like sh*t how do I explain this?”

While $8700 was recovered from the scammer’s account, Mr Hastie had to fork out another $68,000 to buy another tractor.

This saw the payments on his mortgage climb skyrocket.

Meanwhile, he claims Macquarie Bank initially offered him no support to ease the burden of his now $1 million loan.

“There was no empathy or sympathy. It’sjust terrible,” he noted.

“No one proactively came to me and said we see there’s been a mistake and we will drop the interest off what you have to pay back … They still want to make money, which is to someone’s detriment.

“I was just really surprised and disappointed that a banking institution in Australia, despite evidence to the contrary, couldn’t even offer some sort of recompense for the fact we have gone through a sh*t time and still make money off $56,000. You are just dealing with a machine.”

Mr Hastie has slammed Australian banks’ attitudes to scam victims.

“We have reached a point in our society where we will no longer have the confidence in the Australian banking institution to put our money in, if banks can’t protect or at least care if something goes wrong to us,” he said.

“If banks aren’t able to take some responsibility or due diligence or support to give to customers, they won’t use you. Scamming is just rife.”

The only way Mr Hastie could protest his treatment was by moving banks, he added, although he was still heavily in debt.

“I’m in the hole again for another $68,000, paying off primary and interest for a tractor I didn’t get, and another tractor, plus a mortgage for the house and farm,” he said.

Mr Hastie is also scathing that scammers can seemingly open an Australian bank account with ease and yet victims are unable to find out any information from the receiving bank.

He said the receiving bank in this case, Bankwest, told him he had to go through Macquarie Bank to find out any information.

News.com.au understands that the Bankwest bank account was created on 2 February, 2022, six days before Mr Hastie deposited the money on 8 February.

A Bankwest spokesperson said it has strict customer identification procedures, which require customers to provide multiple forms of identification when opening a new account.

Mr Hastie revealed he was “embarrassed” to admit the situation to his family.

“I am mortified, I am depressed, I am embarrassed,” he told his wife at the time.

Mr Hastie added he was lucky to have other businesses that the family can earn money from, otherwise the scam would have resulted in them losing their home and the farm.

He wants to see the UK system introduced in Australia where banks are mandatorily required to pay back scam victims within five days, unless in cases of gross negligence.

“Through services agreements banks wipe themselves of any responsibility. So where does it end when people use a platform where banks can’t guarantee its effective protection from scammers and turn around and say it’s your fault?” he added.

Mr Hastie said he spent months feeling emotional about the scam with a “welling up in his throat” whenever he talked about it, but that had turned to being “pissed”.

“I just want my money back,” he noted.

A Macquarie Bank spokesperson said their client was the victim of a third-party scam.

Scammers deploy very effective techniques to trick people into thinking they are dealing with a legitimate person and can have a devastating impact on their victims. We were able to recover some of his money and provided a range of support options, including reducing the interest on his home loan,” they said.

“We welcome the passing of the government’s Scams Prevention Framework to ensure social media companies, telecommunications providers, government agencies and banks all play their part in protecting Australians from scams.”

sarah.sharples@news.com.au