Rising fertiliser prices and inflation will impact living expenses

It’s a product we take for granted but the global rising cost of one thing could leave Aussie with a lot less money to play with.

As inflation continues to make headlines and act as a political minefield around the world, in recent weeks the issue has swiftly risen to prominence here in Australia, as concerns build over the rising cost of living.

Prime Minister Scott Morrison wasted no time in reaffirming the decade’s old political narrative that the Coalition is the best party to minimise inflation and keep interest rates low.

Leaving aside for a moment the still roaring debate over how much the government can actually control either of those things, there is one form of inflation that is perhaps the most concerning, which the government holds little to no control over: rising food prices.

According to the United Nations FAO global food price index, we are currently seeing some of the highest food prices in history.

But there are rising concerns this could only be the beginning of the challenge of rising food prices faced by households around the world.

As the global supply chain crisis continues, there are products that many of us take for granted that have risen to a new level of prominence in the minds of the public.

Fertiliser – the under appreciated vital link

Recently it was a lack of computer chips slamming the brakes on the global economic recovery, but there is another even more concerning situation brewing, the skyrocketing cost of fertiliser.

According to the Green Markets North American Fertiliser Price Index, fertiliser prices are currently at record highs and appear set to head even higher.

I don’t think central banks, economists, financial markets, and politicians are paying enough attention to this chart! #foodpricespic.twitter.com/ujzdpVnC4l

— jeroen blokland (@jsblokland) November 14, 2021

In the second half of 2020 demand for fertiliser surged as postponed crop plantings were finally completed and the economy reopened.

After enduring an extremely challenging period during the initial lockdowns which saw crops left to rot and milk poured down the drain, rising food prices gave farmers a major incentive to ramp up production and make up for lost time.

This strong demand was already underpinning a meteoric rise in fertiliser prices from their mid-2020 lows, but there was to be other factors which would put a rocket under prices.

Energy crisis and fertiliser prices

In recent months a perfect storm of conditions has descended on Europe, Asia and North America, leading to much greater demand for natural gas and coal.

From insufficient rainfall to power hydro-electric dams in Scandinavia to an unseasonable lack of wind in Western Europe, there has been an unexpectedly heavy reliance on fossil fuels for gas and heating.

The resulting run up in European natural gas prices has been relentless, with prices rising by as much as 800 per cent when compared with their 2020 averages according to some indices.

With natural gas a key ingredient in many modern fertilisers, rocketing prices saw some fertiliser manufacturers suspend production because it simply wasn’t viable to continue with such high input costs.

As fertiliser costs continue to rise globally, governments are increasingly concerned about potential shortages and also the impact of rising costs on domestic food production.

Two largest fertiliser exporters kerb exports

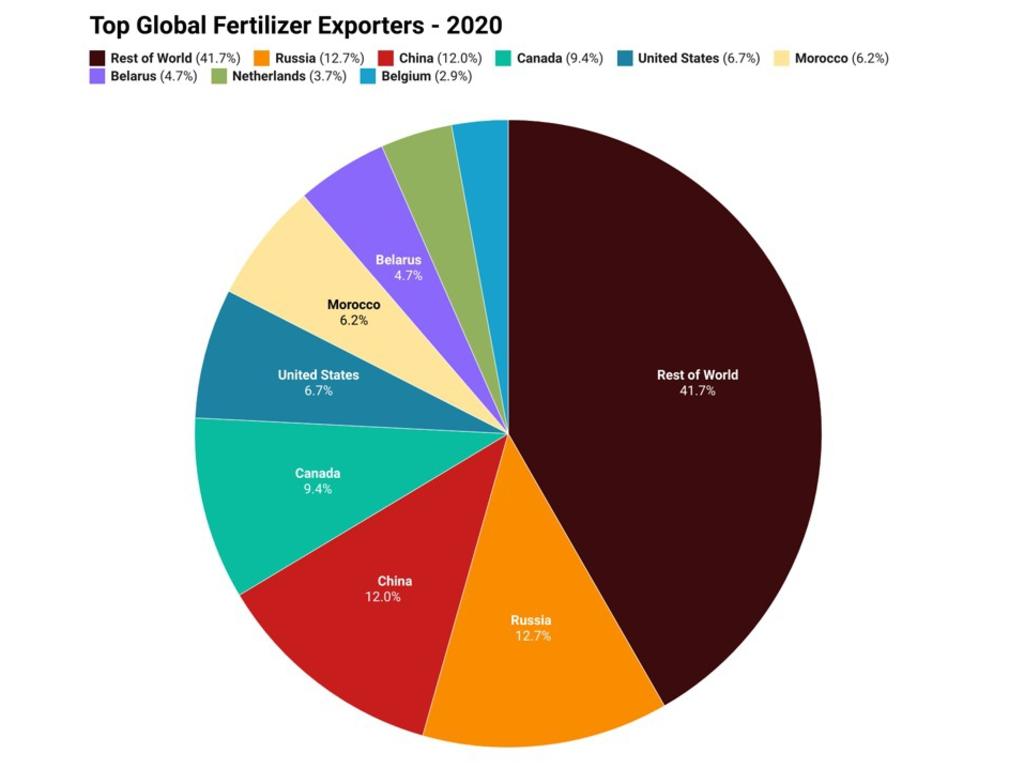

The world’s two largest exporters of fertiliser are China and Russia, together accounting for almost a quarter of all global exports.

In the past few months, both Moscow and Beijing has imposed limits on the level of fertiliser exports in order to ensure supplies for local farmers.

Recently Russian President Vladimir Putin instructed government officials to develop a series of backup measures to neutralise the potential destabilisation of fertiliser markets, as the European energy crisis continues to impact production.

A global problem with a global impact

From the wheat fields of Northern Canada to the coffee farms in the mountains of Latin America, the rising cost of fertiliser is being felt by farmers and food producers.

In Brazil, roughly 30 per cent of coffee farmers haven’t received the fertilisers they’ve ordered or cannot find any to buy at a reasonable cost according to Regis Ricco, a director at agricultural consulting firm RR Consultoria Rural.

In Saskatchewan province in Northern Canada, the impact of rising fertiliser prices could scarcely come at a worst time. After a growing season defined by one of the worst droughts in Canadian history and poor crop yields, some farmers are wondering if they could get by using less fertiliser on this harvest in order to save money.

While some may have a degree of success with that strategy depending on the condition of their farm’s soil, it’s likely that it could lead to significantly worse crop yields and less store ready crops produced.

Aussie factor and a global outlook

Earlier this month Australian manufacturer, Incitec Pivot announced that it would be shutting its Gibson Island fertiliser plant in South East Queensland by December 2022.

While the plant’s potential closure has been on the table for at least five years, its closure could come at a challenging time for Aussie farmers if fertiliser prices remain at or near record highs.

With fertiliser prices set to continue to rise and food prices expected by many analysts to follow, the world may be in for a challenging time.

In 2011 record high global food prices played a significant role in the genesis of the Arab Spring and contributed to social unrest throughout the world.

Closer to home, the impact on Aussie farmers is likely unavoidable as global forces raise the price of local fertiliser stocks.

Australians are also likely to feel the impact of rising global food prices at the supermarket, although not as keenly as households in the developing world.

Ultimately, higher fertiliser and global food prices are another brick in an increasingly large inflationary wall, that the Aussie economy and the general public may need to scale in the coming months and years.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator