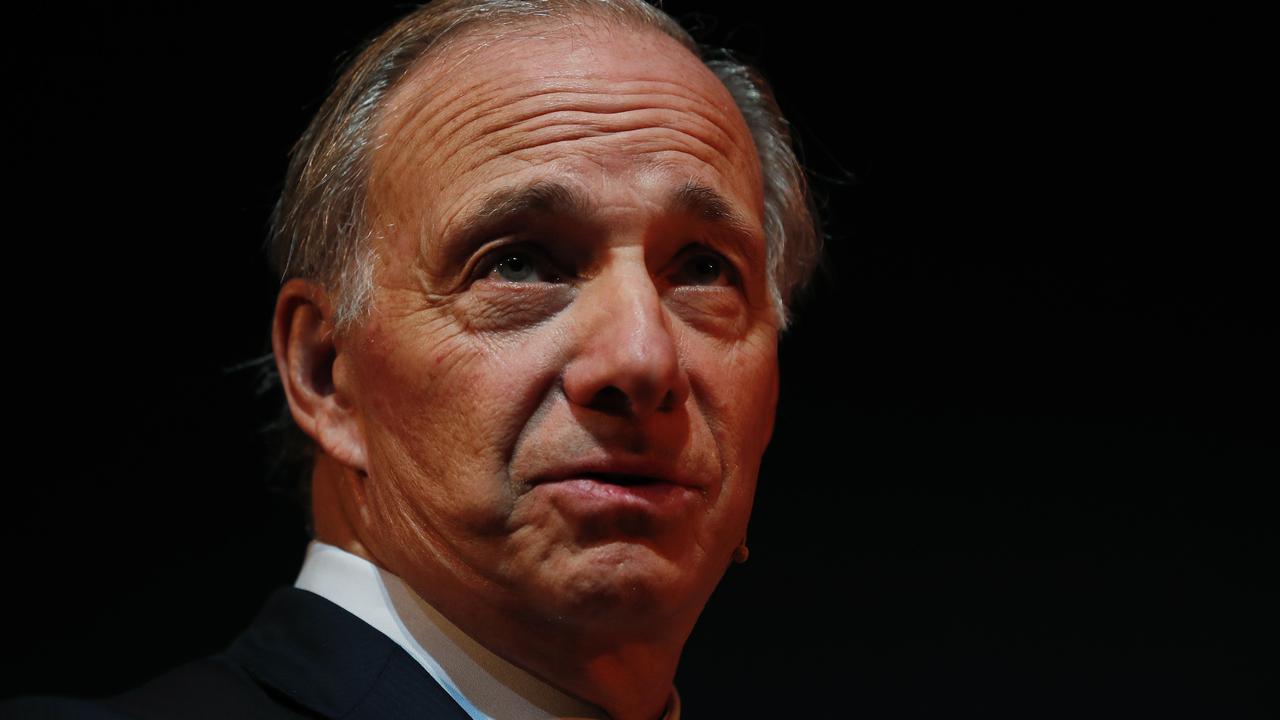

Billionaire investor Ray Dalio’s warning as inflation skyrockets

A billionaire investor is warning that “raging inflation” is eroding people’s wealth as prices start to rise sharply in major economies.

Billionaire investor Ray Dalio is warning that skyrocketing inflation is driving down real wealth.

The hedge fund manager said “raging inflation” was eroding people’s wealth – particularly those who have their money in cash.

On Thursday the US Labor Department reported a 6.2 per cent increase in the cost of living in the world’s biggest economy over the past year.

That’s the highest jump in inflation since December 1990 and more than economists were expecting.

Much of the surge was in energy prices, with petrol spiking 6.1 per cent last month, and fuel oil jumping 12.3 per cent. The price of food and cars also increased markedly.

There are fears inflation could also be rising in Australia.

Yesterday’s inflation report showed inflation raging so you are now seeing inflation erode your wealth. That is no surprise. (1/4)

— Ray Dalio (@RayDalio) November 11, 2021

In a LinkedIn post, Mr Dalio said the government was printing more money, people were getting more money and that in turn was leading to more buying. He said that was to blame for much of the inflation.

He also warned some people were making the mistake of thinking that they were getting richer because their assets were increasing in price. But he said many didn’t realise their buying power was being eroded.

Inflation running rampant

“Inflation is running super-hot,” Neil Wilson, chief markets analyst at Markets.com said, pointing to multi-decade highs of key gauges in the US, Japan and China.

Friday saw yet more evidence with German wholesale prices jumping 15.2 per cent year-on-year in October, the fastest clip since March 1974 and an acceleration from the previous two months, he said.

“Yet investors don’t seem that bothered,” Mr Wilson said.

“Ultimately, the market remains fairly comfortable with fundamentals” and with central banks keeping rates -- and with them, bond yields — artificially low, “equities remain the only game in town”.

While inflation headwinds are clearly spooking some, persistently low interest rates are leaving yield-hungry investors with few options other than to keep their faith in stocks — a scenario analysts dub TINA — there is no alternative.

“Equities can’t continue to hold firm against this backdrop but in a TINA (there is no alternative) world, stranger things have happened,” said Oanda analyst Craig Erlam, pointing to surging gold prices and the strengthening dollar.

Gold futures in New York were little changed at a five-month high of US$1,864.3 per ounce as the precious metal’s traditional value as protection against inflation meant “investors turned to an old friend in time of need”, Mr Erlam said.

Markets are looking to see if the global inflation spurt will ease as supply chain disruptions and wage hikes normalise and businesses recover from their pandemic hit.

Toyota Motor is making up for lost production from supply shortages as Japanese factories return to full capacity for the first time in seven months, according to media reports, while Lufthansa announced an early payback of its bailout from the German government as demand rebounds.

A better-than-expected earnings season as companies passed on their rising costs to customers has given confidence that the economic recovery remains on track.

“What we have seen this week is only profit taking, the recent retracement could be the opportunity to bag some bargains,” AvaTrade analyst Naeem Aslam said.

– with AFP