Inflation and supply chain issues will impact the economy in 2022

Two very different issues are due to clash and combine – and the impact on the Australian economy could be disastrous.

Have you seen the movie ‘Godzilla vs Kong’? It’s a terrible movie, but a good metaphor for what the Australian economy is likely to experience in 2022. Two enormous, powerful forces are going to clash. In the movie there is a lot of collateral damage. In the Australian economy in 2022, that damage is likely to take the form of inflation.

You can expect inflation to sweep through the supermarkets, the aisles of Bunnings, and anywhere imported goods are found, raising prices.

The Godzilla in our story is Australian spending power and the King Kong is the supply chain.

Let’s look at Godzilla first.

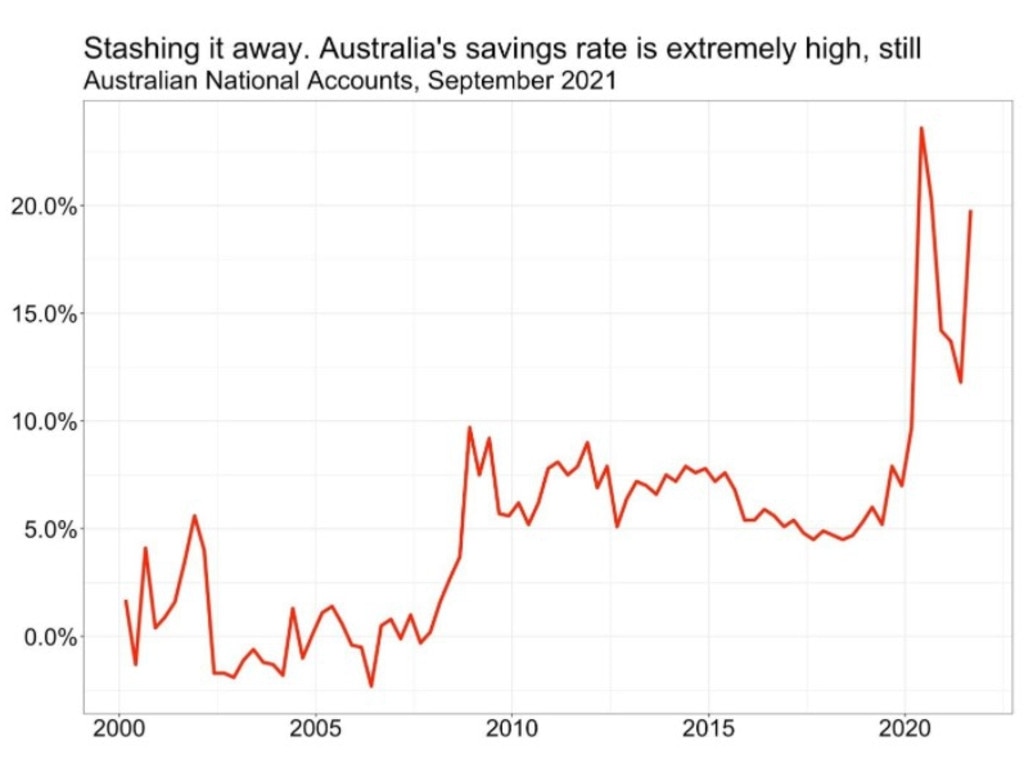

Throughout the pandemic, the Government has been pumping money into the economy, through JobKeeper and JobSeeker and other payments. Those fiscal injections made sure that out economy never crashed too badly. As a result, the unemployment rate is now actually lower than it was pre-pandemic. Aussies are in good financial shape.

The savings data shows how financially fit we are now. People are stashing money away, and paying down their mortgages at rapid rates. You can see it in this next chart: The savings ratio is crazy high. Aussies have all this money just sitting there, trembling in anticipation, waiting to be unleashed.

Stream more finance news live & on demand with Flash. Australia’s biggest news streaming service. New to Flash? Try 14 days free now >

Another way we can see the Godzilla of Australian buying power is in the retail sales data. There was a brief moment where we were able to draw breath between Delta and Omicron. And in that brief moment we went on a spending spree. The next graph shows that the amount we spent in November 2021 was a huge record. We are just dying to get out there and blow some money, as soon as this virus lets us.

On the other side of the Battle Royale of 2022 is the supply chain. That’s King Kong. Omicron is wiping out whole factories of workers, taking out ports, leaving ships bobbing around uselessly at sea. The supply chain problems of 2021 didn’t have a chance to be repaired, and then Omicron came along and made them worse. Much worse.

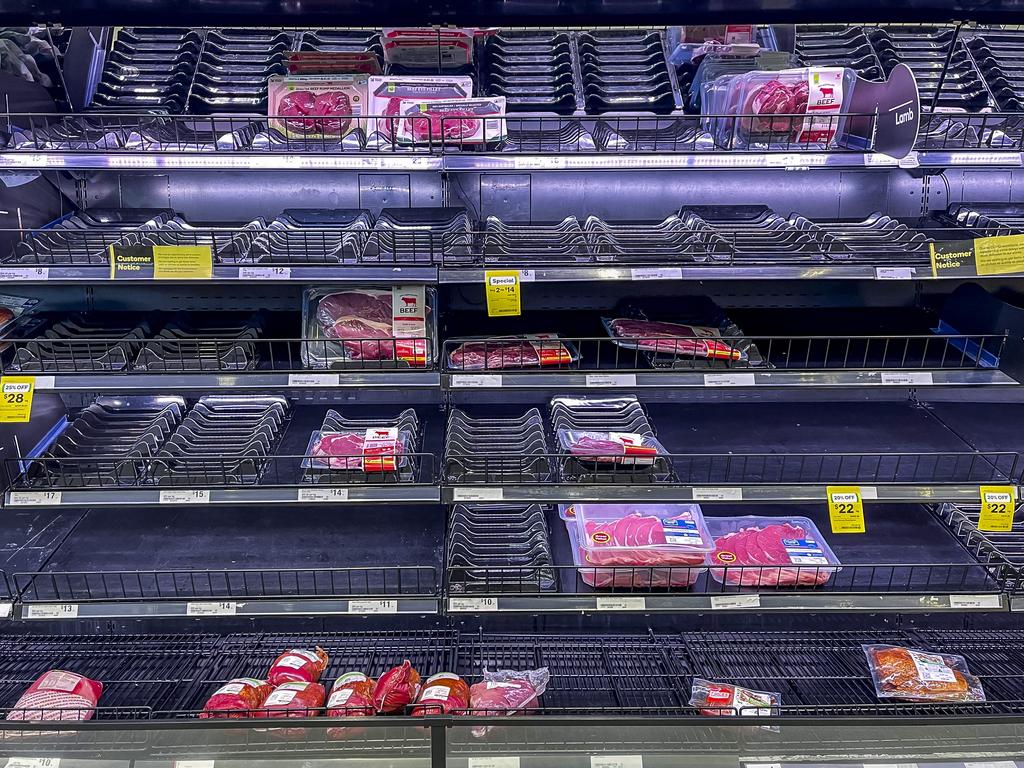

Empty shelves are going to be the new normal. Who knows what product will be next to run out? It could be a food stuff or it could be a much more expensive item: Toyota Landcruisers are a good example. The number of them sold in Australia in December was only half of what was sold in the same month the year prior, and that’s not because we stopped wanting them. The point is that supply chain problems are everywhere.

The shipping company Maersk put out its usual report on shipping recently, warning of yet more delays in 2022.

“Long waiting times at origin and destination ports continue to put pressure on the network to maintain weekly sailings,” the report said. “The upcoming Chinese New Year between February 1-7 is likely to create a pre-holiday cargo spike especially as some South China barge services will be suspended … The capacity lost due to delays means space will become even tighter in [Chinese New Year].”

So what happens when the Godzilla of spending power runs into the King Kong of supply chain screw-ups? The combo of hot demand and ice cold supply means there’s only one way for prices to go. Up.

• If supply falls and demand stays the same, prices go up.

• If demand rises and supply stays the same, price go up.

• If demand rises and when supply falls, oh boy. That’s the double whammy. Prices go up hard and fast.

This is why predictions of inflation in 2022 are getting more widespread.

In fact, we have a good example of what happens to prices when elevated demand meets depressed supply. We can see it in rapid antigen tests. They only cost a few dollars to make but they are selling for as much as $60 right now. (Australian housing is actually another good example of this phenomenon, but that’s a topic for another story.)

This all sounds very frightening, are there any upsides?

The upsides of all this are if you would like interest rates to rise, or you are hoping for a pay rise.

Two things are likely to happen if inflation starts grinding upwards. One is that companies need to pay workers more to afford the same things. Real wages will fall if wage rises don’t keep up with inflation, so it is likely wages will rise. This works better if people are changing jobs – it’s much easier to get a wage hike by changing job than by staying still.

The second thing that can happen is that the RBA raises interest rates. That is designed to shoot a tranquilliser dart into Godzilla. If people have higher mortgage payments, they have a bit less left over to spend online and at the pub, so the pressure on companies to raise prices is a bit less.

King Kong, however, we can’t do much about. The supply chain issues are global, and if they are the main reason for rising prices, then we are stuck. We just have to hope that big ape will stop running amok.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.