Interest rate rises could cause property prices to fall in 2022

There are two widely conflicting opinions on what will happen to house prices in 2022 but this chart doesn’t bode well for anyone paying a mortgage.

The huge showdown for 2022 will be on interest rates. The market is pricing in three rate hikes, the RBA says there will be none. Who is right?

The tension here is very important, because if interest rates rise this year, the expected fall in house prices could be upon us sooner than expected.

If you own a house or would like to, the future of interest rates is very important to you. Rising interest rates will make it more expensive to have a mortgage. Plus higher rates will reduce the amount people can borrow to buy a home, which will mean house prices could fall.

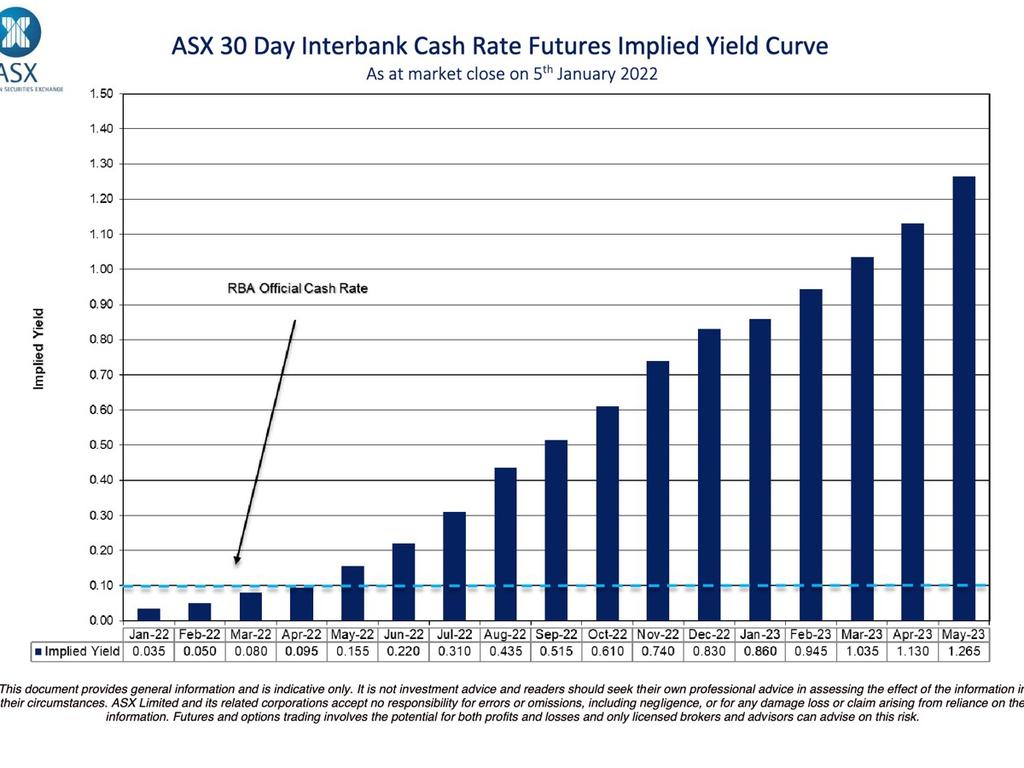

If you believe the market, interest rates are set to rise at least three times in 2022. Check out this next chart.

Each blue bar represents a month, from January 2022 to May 2023. The height of the blue bar is what the market “expects” the official interest rate to be at that time. In June 2022, the market expects official interest rates at 0.22 per cent. In December, it expects 0.83 per cent. That’s a big increase in just 11 months’ time.

When the financial news talks about the market “pricing in” rate hikes by some time, this chart is what they are referring to.

Now, you might be looking at this chart and thinking the expectations look weird. The RBA usually lifts interest rates by chunks of 0.25 per cent. Why does the chart show numbers like 0.22 per cent instead of more plausible numbers like 0.25 per cent?

The reason is it’s not a true “forecast” made by one person. It’s just the outcome of different people buying and selling financial assets called “futures”.

At the top it says “implied yield curve”. That is important to remember. This chart is made by looking at the price of certain financial assets, and calculating from those prices what the market is implying about the future of the official interest rate. It changes all the time as the price of those assets changes.

The story we get from looking at market pricing is especially interesting at the moment because it is so very different from the official story. Where the market expects at least three rate hikes in 2022, the people in charge of interest rates expect none.

The RBA Governor Philip Lowe has repeatedly said he doesn’t expect to raise interest rates in 2022, because he doesn’t expect inflation to rise. He made a major speech in December where he once again emphasised this point.

“The Reserve Bank Board will not increase the cash rate until actual inflation is sustainably in the 2–3 per cent target range,” he said.

“We are still a fair way from that point. In our central scenario, the condition for an increase in the cash rate will not be met next year. It is likely to take time for that condition to be met and the Board is prepared to be patient.”

The market clearly doesn’t believe he will be patient, or doesn’t believe that inflation will stay low.

At the moment, house prices are forecast to fall in 2023, which is when the RBA has hinted official interest rates could finally rise. But if the interest rate rises come sooner, then the house price falls could come sooner too.

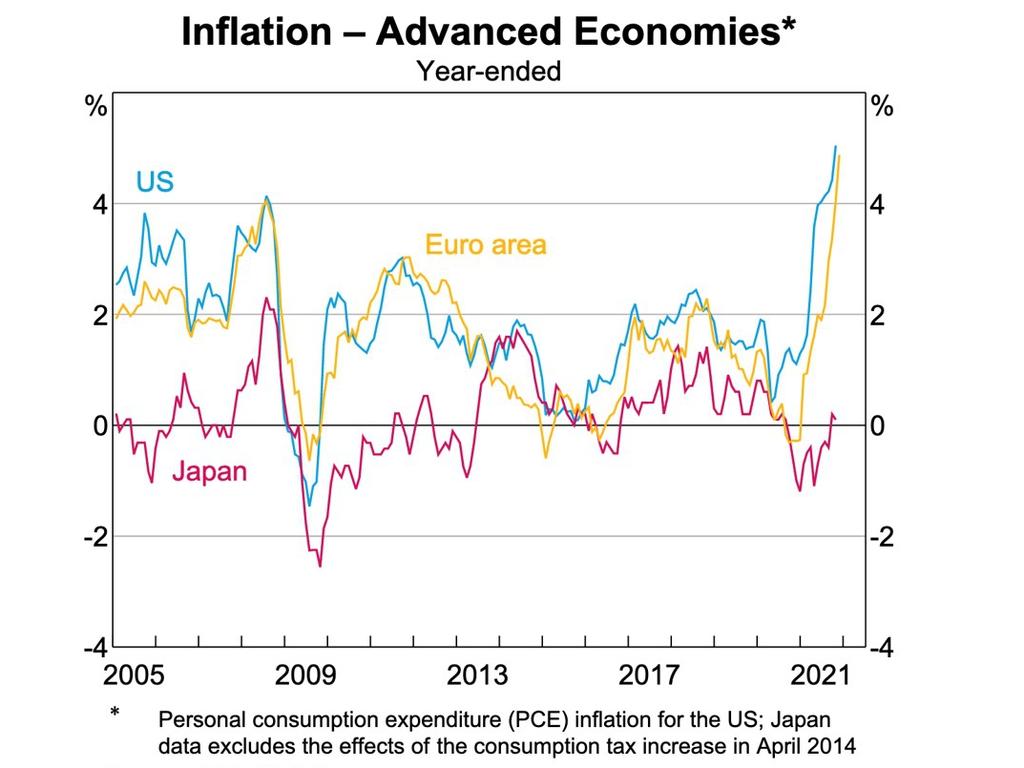

What would make the RBA do what the market expects, and raise rates in 2022? The answer is high inflation. As the next chart shows, inflation is soaring in the US and Europe. Is Australia on the same track?

The most recent data for Australia showed inflation rising by 3 per cent over the past 12 months. Some things got a lot more expensive, like petrol, while other things like clothing, footwear and phone bills got cheaper.

Three per cent inflation is higher than we are used to, but certainly not as high as America or the USA, and probably not high enough to make the RBA freak out and raise interest rates.

But the supply chain issues that have caused price rises are continuing, and it is possible inflation will spread to other categories.

More Coverage

Inflation data comes out only four times a year, and the next release will be on January 25, covering the period October to December 2021. If that shows continued price rises, then you can bet the market will start pricing in even more inflation hikes in 2022, and there will be even more disbelief of the RBA’s official line on not hiking interest rates this year.

So was inflation high in October, November and December last year? If the answer is yes, then the chance of rate hikes in 2022 goes up, and the future of house prices gets much more wobbly.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.