Australian economy is riding on $507 billion government stimulus package

The future of our economy is riding on an expensive strategy that’s wiped out the annual budget – but there’s no way of knowing if it will actually work.

On the wall in the office of fictional FBI agent Fox Mulder, the protagonist of the X-Files TV and movie series, there is a poster with a UFO on it, with the caption ‘I Want To Believe’.

As Australia heads into 2021 the mood surrounding the Aussie economy is quite similar, a whole lot of hope and belief, amid a great deal of uncertainties, in a world of unknowns.

While the narrative coming from much of the financial media and the Morrison government is one of optimism, attempting to accurately determine what condition the economy will be in when the various government support programs end is challenging to say the least.

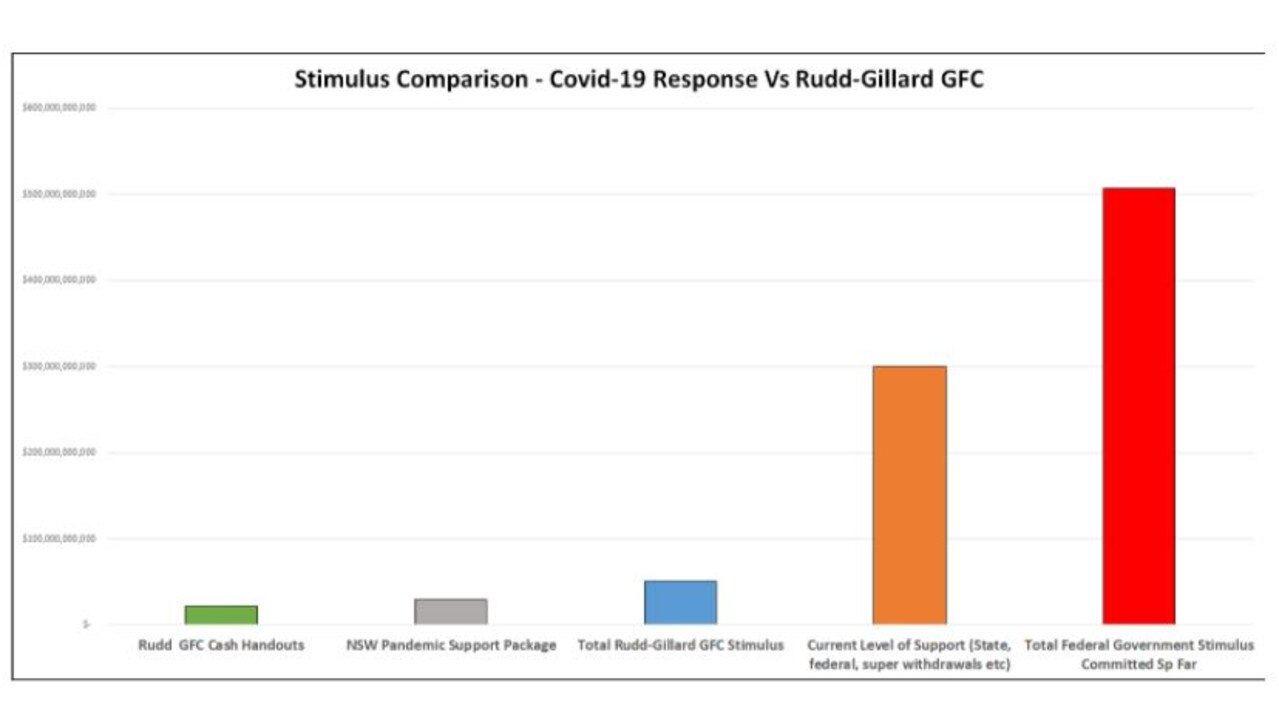

As it stands, between the various government stimulus programs at a federal and state level, and the tens of billions of dollars in superannuation withdrawals, approximately $300 billion in support is currently flowing through the economy.

The 2020-21 Budget commits further response and recovery support, bringing the overall support to $507 billion, including $257 billion in direct economic support.

When spending reaches such dizzying heights, it’s at times hard to find a meaningful yardstick to measure such an enormous level of expenditure.

To put the current level of government support into perspective, it’s around 61 per cent of the entire federal budget for the 2018-19 financial year (which happens to be the last financial year not impacted by the coronavirus pandemic).

RELATED: Word that could screw Australia’s recovery

But how does the current stimulus stack up against past crisis response packages in recent Australian history?

During the height of the global financial crisis the then Rudd government deployed a series of cash handouts to tax payers and welfare recipients in order to kick start the economy. Over the course of that policy $21.4 billion was injected into the economy.

Over the entire Rudd-Gillard government global financial crisis response package, a total of $51 billion was spent. This included policies such as infrastructure construction, the school halls construction program and the controversial “pink batts” installation scheme.

Except unlike the current stimulus programs that are expected to inject around $300 billion over the 12 months to the end of March, the Rudd-Gillard government’s spend was spread over four years.

RELATED: One place house prices will get smashed

To put the current level of government support for the economy into perspective, it’s more than 14 times larger than the Rudd government’s cash handout scheme. And almost six times larger than the entire four-year stimulus package from the Rudd and Gillard governments.

But despite the unprecedented scale of the Morrison government’s stimulus and the other various support programs, there is still around $250 billion still to come from the federal government alone.

Even the New South Wales state government’s commitment of a total of $29 billion in pandemic support packages, makes the Rudd government’s GFC era cash handouts seem somewhat thrifty.

As it stands, with total government support sitting around $300 billion or approximately 15 per cent of GDP.

RELATED: Three states winning at house prices

In fact, the current level of government support is so great, that it’s larger than the budget deficit of 1941 during the darkest hours of World War Two.

But is the largest peacetime cash splash in the history of Australia actually mending the economy or merely providing a temporary sugar hit?

The answer to this question is a matter of hotly contested debate around the globe. With most nations currently engaging in similar policies of using unprecedented levels of stimulus to support their economies, the answer will be key to the world’s economic fortunes going forward.

Generally the downside argument can be summed up as: the cash injected into the economy will temporarily boost spending and provide some short term support for headline GDP growth. But ultimately not result in the kind of economic activity that will drive long term prosperity and stable economic growth.

This potential downside is exacerbated by concerns that financial markets are arguably highly overvalued, due to central bank digital money printing and risks are not being properly priced.

In the words of legendary investor and billionaire Jeremy Grantham:

“This bubble will burst in due time, no matter how hard the Fed (US Federal Reserve) tries to support it, with consequent damaging effects on the economy and on portfolios. Make no mistake – for the majority of investors today, this could very well be the most important event of your investing lives.”

As many found out around the world the hard way during the global financial crisis, issues in financial markets, particularly ones of a large magnitude, have a way of causing equal or even greater damage in the real economy and the labour market.

Despite the positive narratives and even outright hype surrounding the future of the Aussie economy, risks continue to build globally both within financial markets and the real economy, as the pandemic continues to ravage nations across the world.

What condition we will find the Aussie economy in, once the curtain of $507 billion in total federal government stimulus is lifted is a mystery and may remain so for quite some time.

Going forward, the only certainty is uncertainty. Experts are divided on whether we face a long but relatively smooth road to recovery or whether our path may be quite a bit more bumpy.

Ultimately like FBI agent Fox Mulder, we may want to believe in the Aussie economy, but the reality in the coming years may be quite different.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator