Aussie cities and CBDs could become ghost towns as people move to the country

There’s one place that people are leaving in droves and the ripple effect could see a huge change in how Aussies invest in and buy property.

Considering buying a house in the city? Read this first. Country property could be the big pivot of 2021. Do you want an apartment? In a year’s time, you might regret not buying an acreage.

The signs are already there. City house prices are up just 2 per cent in the last year, while regional prices are rising an impressive 6.9 per cent, according to property CoreLogic. That’s three times faster.

I was in regional Australia recently and there was a crowd outside the real estate agent looking at the ads in the window. Meanwhile, the closer you get to the inner city, the more you can smell the economic desperation.

City authorities are desperate to get people back into the city centres. Office workers who’ve spent the year at home need to come back, they moan. Shoppers must return!

Apartment developers are bemoaning the elevated vacancy rates in their towers. (Vacancy rates are over 9 per cent in both Melbourne and Sydney, according to SQM property research.)

But the wishes of people with skin in the game are just feathers in a hurricane of human behaviour change. The way we live is not the same anymore. The forces that glued us closer to the city centre are coming apart.

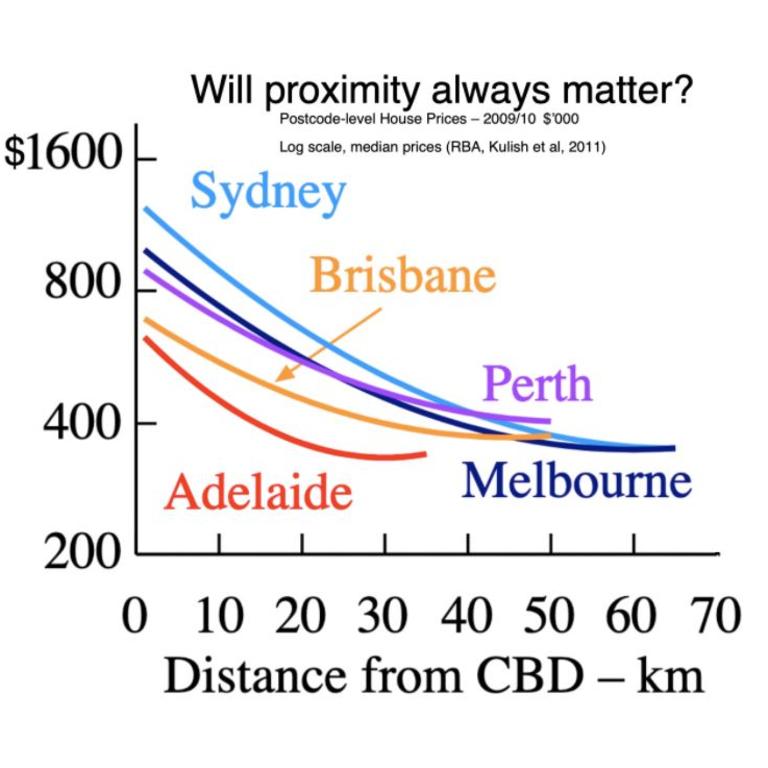

As a general rule, houses closer to the city centre have been more expensive, as the next chart shows. And the effect has been stronger in the bigger cities, especially Sydney.

RELATED: Three states winning at house prices

The invention of the car changed the shape of the world. Cities got a lot bigger.

Zoom is not as good as the car. But it could still have an effect.

“As remote working opportunities became more prevalent and demand for lifestyle properties and lower-density housing options became more popular, regional areas of Australia saw housing market conditions surge,” said property company CoreLogic in a recent blog post.

“Regional housing markets had generally underperformed relative to the capital city regions over the past decade, but 2020 saw regional housing values surge as demand outweighed supply,” added CoreLogic’s research director Tim Lawless.

Ghost towns are a thing. The economy changes and everyone moves out.

A great example is central Detroit. Once a vibrant inner urban area, it’s now full of burned out, abandoned buildings. They finally knocked most of it down and now large parts of it have been taken over by nature.

The following picture is taken from Google Streetview in central Detroit. It is right near the General Motors factory that actually still operates but it uses fewer staff and because other car factories have closed, the inner city is obliterated.

RELATED: Reason average Aussies are suddenly rich

Greater Detroit, including the surrounding suburbs, is still in good economic health. There’s lots of those wealthy American suburbs with winding streets, enormous homes, lawn, and country clubs. Anyone who works in the automotive industry can live in the suburbs and commute to the factory by car.

I’m not suggesting this will happen to the same extent in any Australian city. But looking at the extremes of how economic change affects cities can help us understand it. There are two effects, really. One is about the decline of certain industries. The other is about the rise of transport technology changing where it is practical to live.

Western Australia knows plenty about how the decline of certain industries affects property markets. All Australia’s worst-performing property markets over the last decade are in regional WA as the mining industry shed jobs.

Melbourne’s enormous education industry depends heavily on China and it remains to be seen if students will come flooding back when the pandemic is finally dealt with. It could well be the case that relations with China are strained and they cut off our exports of education. In that case a large number of city apartments will be looking for tenants.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.