What cost Philip Lowe his job

Philip Lowe will depart the Reserve Bank this week after a controversial tenure. But what does he plan to do next?

Philip Lowe will depart the Reserve Bank this week after a controversial tenure. But what does he plan to do next?

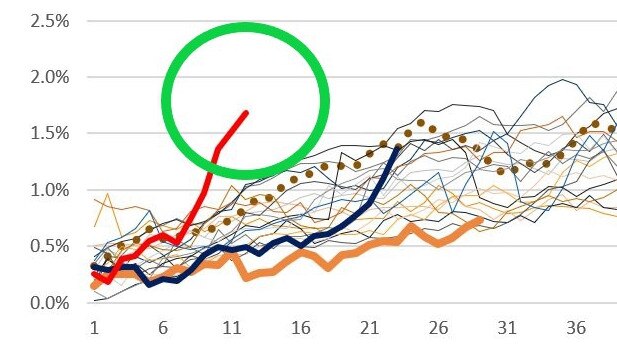

An “alarming trend” in Australian mortgages could signal a new era of difficulty for a certain section of Aussie mortgage holders.

Reflecting on his seven-year term leading the nation’s top bank, outgoing RBA boss Phil Lowe has defended his legacy and issued a new warning.

Fresh data shows the Australian economy is slowing under the weight of high interest rates, with population growth staving off a recession.

A promise was made to keep interest rates low until at least 2024 but new circumstances could see a world of pain for Aussie homeowners.

Excessive mortgages have been handed out to people who may not be able to pay them back. This is why that’s bad news for Australia.

APRA took an important first step to head off a risk from a red-hot property market that may help keep interest rates low.

Australian property prices have had their fastest annual growth rate in 32 years, and while the monthly pace has slowed, a new peak could be coming.

A major crackdown for home loans is on the cards to stop a growing problem caused by historically low interest rates and surging property prices.

The head of a major bank says steps need to be taken to cool Australia’s red-hot property market so we don’t have to follow in New Zealand’s footsteps.

An expert has revealed when they believe property prices in Australia will ease so people looking to buy are in with a shot.

Australia’s historic low official cash rate has been kept on hold, with the RBA saying the Delta outbreak has caused the economic recovery to lose momentum.

Original URL: https://www.couriermail.com.au/business/economy/interest-rates/page/183