Major warning in new rates decision

The RBA has kept interest rates on hold at 4.1% today but a major bank is forecasting more pain to come.

The RBA has kept interest rates on hold at 4.1% today but a major bank is forecasting more pain to come.

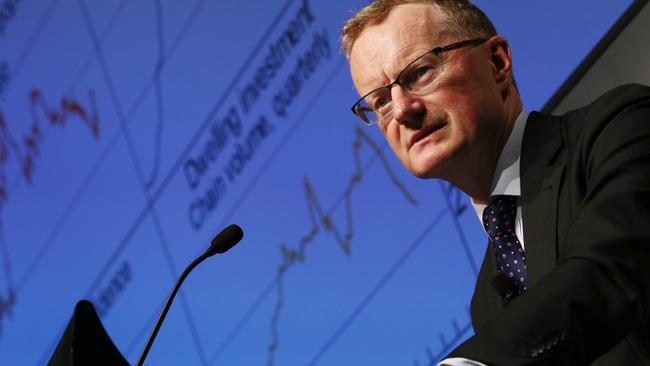

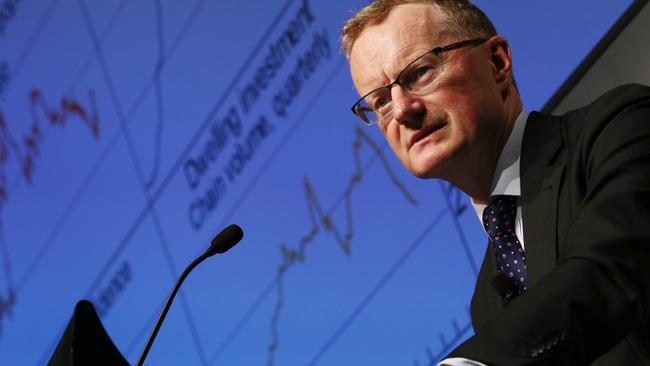

Outgoing RBA boss Philip Lowe has spared Aussies further financial pain as he heads for the door in less than a fortnight.

Fresh data on household spending and anaemic household spending all but confirm rates reprieve when the Reserve Bank meets on Tuesday.

As the Euro-summer holiday season is drawing to a close, new data reveals the truth behind some of the luxurious getaways.

There are more than 3400 suburbs across Australia where you fork out more for rent than a mortgage, with a difference of up to $158 a week.

Our economy hinges on interest rates not rising for 18 months but there’s increasing worry no one has a clue what will actually happen.

Australia’s official interest rates have been kept at a historic low after the Reserve Bank’s monthly meeting.

The nation’s urge to buy a home has continued, with new lending data showing a surge in new mortgages.

Interest rates should rise much quicker than the Reserve Bank forecasts, two major banks have predicted.

The signs are already there that higher interest rates are going to come sooner than expected.

Australia’s sharemarket ended the week at record high, despite a hit to commodities caused by a rising US dollar.

One of Australia’s big banks has dealt a blow to its customers, cutting rates on its savings products for the second time this year.

Original URL: https://www.couriermail.com.au/business/economy/interest-rates/page/185