‘Big risk’ facing Australian economy

The spillover effects of one ‘big risk’ has Treasurer Jim Chalmers issuing a warning on the Australian economy.

The spillover effects of one ‘big risk’ has Treasurer Jim Chalmers issuing a warning on the Australian economy.

There’s bad news ahead for Australians trying to buy a new home, with a construction downturn set to hit and further amplify price pressures.

The peak construction union has been slammed over its push to ensure union representatives are appointed to Australia’s most powerful economic institution.

With the Aussie dollar skidding to a nine-month low, economists are warning that Australia’s slowing economy and a deteriorating outlook in China mean further falls are likely.

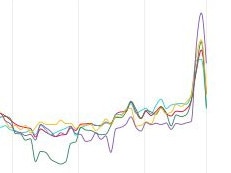

The Reserve Bank has kept interest rates at the historically low level of 0.1 per cent, despite the boom in property prices nationwide.

While jobs and growth is good for some, the swift recovery of the Aussie jobs market could be a catastrophe for anyone with a mortgage.

Lower-than-expected inflation has given the RBA room to add another $150bn to its bond-buying program this year, say some of the nation’s best kown economists.

As property prices soar, Westpac has likely signalled the end of ultra-low rate short-term financing.

The nation’s second largest lender has bumped up home loan rates, signalling an end to bargain-basement mortgages.

Home loan lenders are hiking mortgage rates despite no immediate changes enforced by the Reserve Bank.

The boss of one of Australia’s major banks says low interest rates have created an unusual situation for people facing an age-old property conundrum.

Australian housing prices are surging thanks to buyer demand and dirt cheap home loan rates. But will the boom continue?

Original URL: https://www.couriermail.com.au/business/economy/interest-rates/page/187