Weak CPI will push RBA to $150bn new bond splash in August

Lower-than-expected inflation has given the RBA room to add another $150bn to its bond-buying program this year, say some of the nation’s best kown economists.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Lower-than-expected inflation has given the Reserve Bank room to add another $150bn to its bond-buying program in August to help to keep interest rates low and push more cash into the economy.

But economists say the central bank is likely to start “tapering” the controversial quantitative easing program next March as it looks for an exit to for the massive stimulus program designed to steer the nation through the COVID shock.

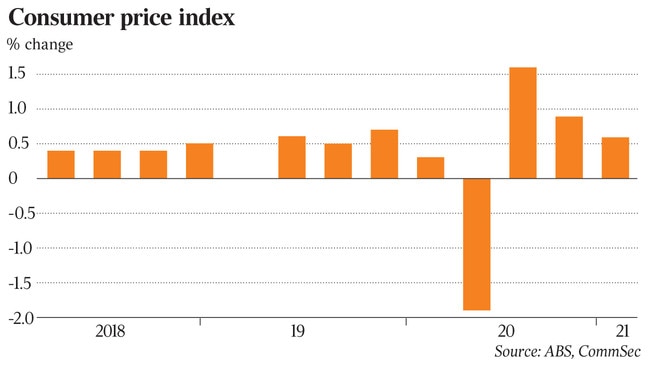

It came as CPI data for the March quarter left underlying inflation measures well below the central bank’s 2 to 3 per cent target band.

Headline inflation rose 0.6 per cent on a quarterly basis versus 0.9 per cent expected by economists, and the year-on-year CPI measure rose 1.1 versus 1.4 per cent, as temporary government policies to support housing and education had a bigger-than-expected impact.

The trimmed mean CPI preferred by the central bank also missed estimates.

The RBA will start a third $100bn QE program in September and a fourth QE program of $50bn in March, and will also extend its yield curve control policy by committing to buying the November 2024 bond at the 0.1 per cent cash rate, according to Westpac chief economist Bill Evans.

“The RBA is committed to the orderly functioning of the Australian bond market,” Mr Evans said.

“We expect it will assess that it has reached a comfortable limit of Australian government securities holdings after two more stages of QE.”

The move comes in the face of an economy growing at a rapid clip with the housing market surging and unemployment recovering from the hit from the COVID pandemic.

At the same time Australia is set to get a further financial windfall with analysts tipping iron ore — the nation’s biggest export — could soon cross the threshold of $US200 per tonne.

Iron ore hit an all-time high of $US193.85 per tonne on Tuesday according to a daily price published by S&P Global Platts, as demand in China rose in the lead up to a Labour Day holiday period from May 1 to May 5.

That surpassed a record of $US193 a tonne reached in 2011 and represents an 18 per cent price increase in April alone.

The commodity could climb further amid a stimulus-led global construction boom and China expands production, according to analysts at Macquarie.

Despite the export boom Mr Evans saw the RBA adopting a “clear policy approach of not tightening (monetary) policy in 2021 with a view to reviewing the policy stance in 2022”.

Its QE and yield curve control policies were “aimed at boosting demand and employment” through containing upward pressure on the exchange rate and supporting confidence that the RBA still expects that it will not be raising the cash rate before 2024 “at the earliest”.

At the RBA’s February board meeting in 2022, Westpac expects the bank to outline plans to taper its QE program to $50bn from early March.

The RBA’s observation that by the end of the QE program it will hold around 30 per cent of Australian government securities on issue and 15 per cent of semi-government securities, “indicates that the bank is very mindful of its potential to restrain liquidity in the bond market.”

Mr Evans said that by the end of QE the RBA will own around 40 per cent of the Australian government securities, putting it well ahead of the Federal Reserve in the US.

About 52 per cent of sovereign bonds are owned by non-residents including central banks and pension funds, and of the remaining 48 per cent owned by residents about half is held by banks, which are required to hold sovereign bonds to meet regulatory requirements.

An extended QE program from the RBA could “crowd out the bond market, risking disruption to its functioning” and “constraining liquidity which could “perversely precipitate a widening of bond spreads as investors claim a liquidity premium to hold Australian bonds.”

Mr Evans said while the government was likely to delay budget repair for a number of years, annual deficits will still be falling because of booming iron ore prices and a strong jobs market.

Similarly, Capital Economics senior economist Marcel Thieliant predicted that while the RBA would probably revise down its near-term forecasts for the unemployment rate at its meeting on May 4, it would project inflation falling short of its 2-3 per cent target.

“As such, we still expect the bank to announce a third round of asset purchases by mid-year and reiterate our view that markets have gone too far in pricing in rate hikes,” he said.

The strong jobs rebound has “diminished the urgency” of additional stimulus as both employment and hours worked rose above pre-virus levels in March and at 5.6 per cent the unemployment rate is almost one percentage point lower than the Reserve Bank had expected it to be by June.

RBC Australia chief economist Su-Lin Ong said the Reserve Bank could still raise its inflation forecasts next month despite the low CPI and weekly payrolls data numbers, but the policy outlook depended on how the labour market fared.

Ms Ong said the RBA needed to see more data on the jobs market and did not expect any changes to its yield curve control or QE until August.

“Key will be whether the RBA lifts its inflation forecasts slightly, especially at the back end of the horizon, to 2 per cent from 1.75 per cent, despite the slightly weaker starting point,” she said.

More Coverage

Originally published as Weak CPI will push RBA to $150bn new bond splash in August