Australia’s latest warning on China

A spillover from China’s weak economy and surging petrol prices pose significant challenge to taming inflation, the RBA has cautioned.

A spillover from China’s weak economy and surging petrol prices pose significant challenge to taming inflation, the RBA has cautioned.

All 11 sectors finished in the red on Monday, with the local benchmark dragged down by a sell off in tech stocks.

The share market soared on Friday as strong leads from Wall St and Europe and better-than-expected data from China lifted traders’ confidence about the global economic outlook.

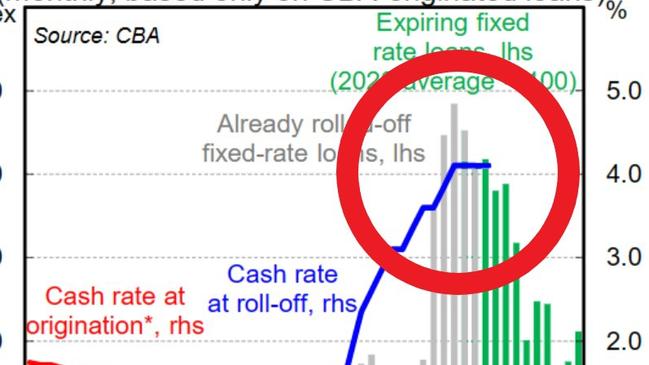

The cash rate seems to have stopped rising – for now – but there’s a worrying sign that things could be about to get a lot worse.

Mortgage rates have hit new lows with one player offering a lucrative fixed rate that Australians have never seen before.

Two of Australia’s major banks have dealt a blow to savers by further slashing rates on deposit accounts.

It’s a great time to buy property with record-low interest rates, but homebuyers are cautioned to avoid these mistakes when shopping for loans.

Aussies are feeling the financial pinch of 2020, with some “extremely” nervous about being able to keep a roof over their head.

Most Aussies haven’t left the country this year – barely even the house – but “average” Australians could have made thousands of dollars by doing nothing.

First homebuyers have incentives left, right and centre to buy a home, but even though prices are affordable it may not last for long.

Cash-strapped Australians could end up in dire straits if laws are changed to make it easier to get credit, financial experts warn.

New data from one of Australia’s major banks reveals buying has reached record levels and is fuelling a mass migration.

Original URL: https://www.couriermail.com.au/business/economy/interest-rates/page/200