‘A storm’: Middle-class Australia in crisis

The “perfect storm” has hit previously comfortable middle-class families who are beating down the doors of charities desperate for help.

The “perfect storm” has hit previously comfortable middle-class families who are beating down the doors of charities desperate for help.

The fate of embattled RBA governor Philip Lowe will be decided within weeks, but one Liberal says the ‘poor old’ guy should be given another go.

Australians struggling with the cost of living have been offered a glimmer of hope from the Prime Minister.

As the PM backs in ‘two outstanding public servants’ tipped to replace RBA chief Philip Lowe, the opposition has slammed the government for ‘demonising’ the governor.

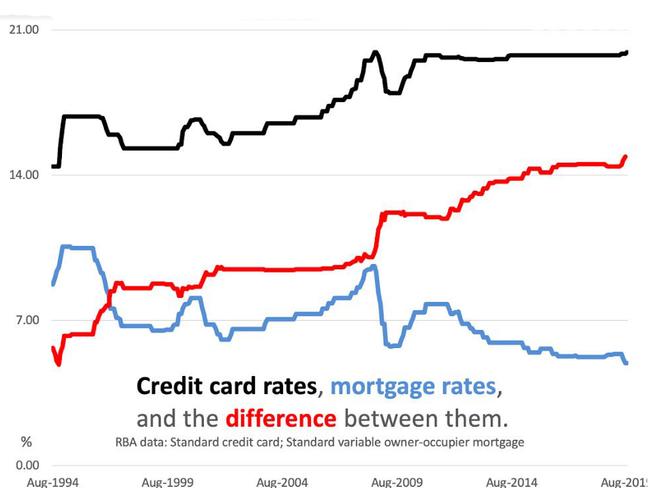

It’s the great mystery of the Australian financial system — and this “dangerous burden” on consumers is about to get much, much worse.

An expected rate cut tomorrow will briefly unite the two parties against the big banks, but it’s not expected to last.

Home loan customers can be left paying exorbitant interest rates that cost them tens of thousands of dollars more on their mortgage.

Experts say the wisest path to financial security is to pay down your home loan faster. Here’s a guideline on the best way to do that.

A former treasurer says Australia is living in “abnormal times”, with worrying economic factors that have never existed before.

For five years, the Reserve Bank has been worried about one thing. Now it has flip-flopped and it means more cash to splash for all of us.

Get excited — you’re about to have more money in your pocket, but the extra cash comes with a catch, and the health of our economy is on the line.

The Australian share market has opened sharply higher as investors deal with the implications of the US central bank’s rate cut and jobs figures reveal the state of the nation’s unemplyment.

Original URL: https://www.couriermail.com.au/business/economy/interest-rates/page/199