Plunge in Tech shares drags ASX down

All 11 sectors finished in the red on Monday, with the local benchmark dragged down by a sell off in tech stocks.

All 11 sectors finished in the red on Monday, with the local benchmark dragged down by a sell off in tech stocks.

The share market soared on Friday as strong leads from Wall St and Europe and better-than-expected data from China lifted traders’ confidence about the global economic outlook.

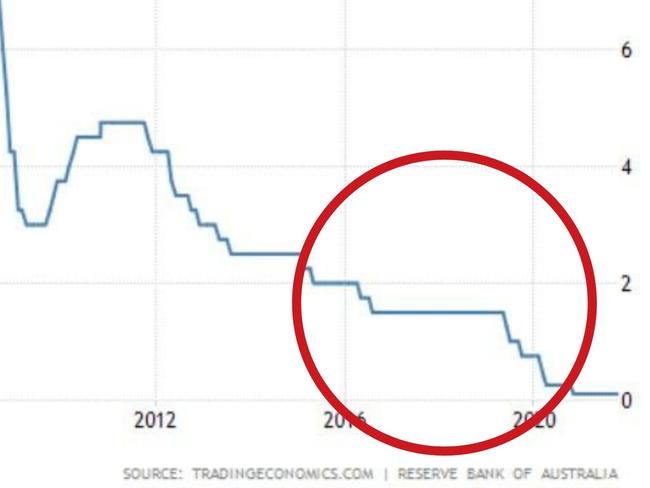

The cash rate seems to have stopped rising – for now – but there’s a worrying sign that things could be about to get a lot worse.

The number of Aussies in work has hit a new high as fresh figures show more people are picking up part-time jobs.

Rising fuel prices could see families spend less in local businesses over the summer, experts warn.

A Reserve Bank discussion paper has found that a rise in household liquidity has bolstered financial resilience even as debt to income surged.

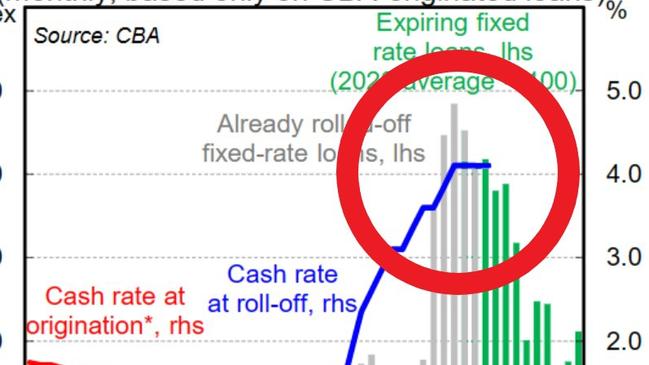

The RBA still hasn’t raised interest rates but that won’t stop the banks doing something that will cause a world of pain for Aussie home buyers.

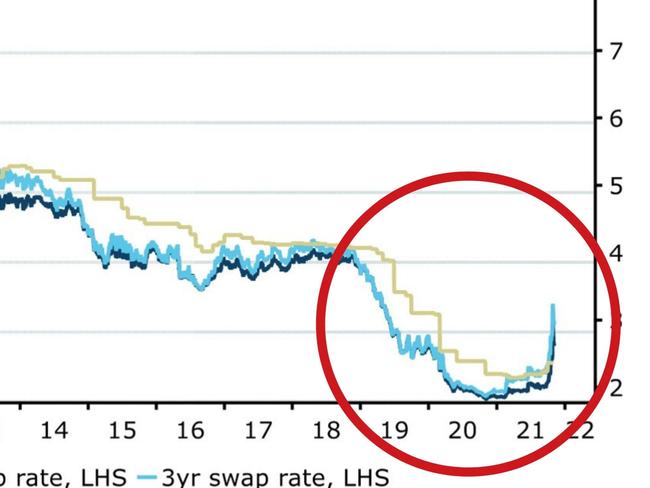

A decision that was made to ensure Australia stayed afloat during the pandemic is now wreaking havoc in the economy.

Rising interest rates, commodity crashes and fear of inflation could spell a disaster for the Aussie economy but everything might not be quite as it seems.

The central bank now seems open to the possibility of lifting the all-important cash rate before 2024 – but expect your own bank to move beforehand.

A key decision in Australia on Tuesday could be a “potentially market-moving one” for the globe, as a new financial threat takes hold.

After almost two years of economic instability and a pandemic, the next fear is that hyperinflation could be coming for us.

Original URL: https://www.couriermail.com.au/business/economy/interest-rates/page/182