RBA’s big clue on interest rates

‘Do what is necessary’: Aussies may not be in the clear when it comes to interest rate increases as a key expense threatens to derail inflation.

‘Do what is necessary’: Aussies may not be in the clear when it comes to interest rate increases as a key expense threatens to derail inflation.

A spillover from China’s weak economy and surging petrol prices pose significant challenge to taming inflation, the RBA has cautioned.

All 11 sectors finished in the red on Monday, with the local benchmark dragged down by a sell off in tech stocks.

The share market soared on Friday as strong leads from Wall St and Europe and better-than-expected data from China lifted traders’ confidence about the global economic outlook.

Homeowners will have their eyes peeled on today’s RBA cash rate decision but there’s another figure that could seriously impact the viability of your home loan.

Of all the major cities, this one didn’t see property prices surge in 2021 – but that looks like it could be about to change.

Deep down we knew it couldn’t last and now predictions are showing it probably won’t – but the impact it will have is still unknown.

When this decision was made, Australia was on the brink of disaster – but 18 months on, it could be the thing that sends our economy spiralling.

Three paramount factors which buoy the Australian economy are combining to create a financially uncertain 2022.

It is ‘still plausible’ official interest rates will stay on hold until 2024, but there’s some way to go until important targets are met.

Rising fuel prices could see families spend less in local businesses over the summer, experts warn.

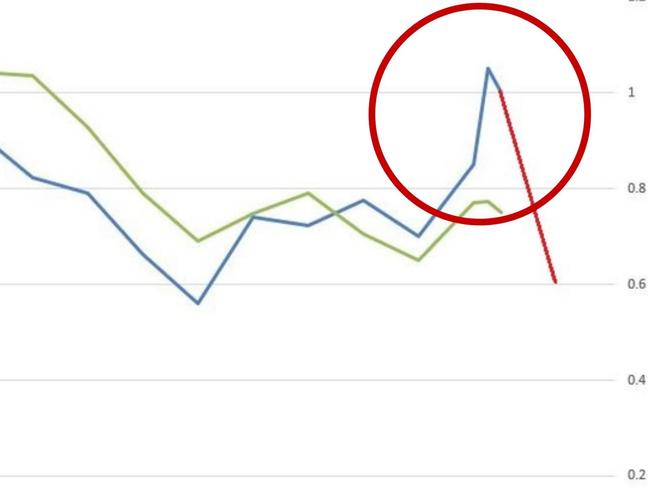

A Reserve Bank discussion paper has found that a rise in household liquidity has bolstered financial resilience even as debt to income surged.

Original URL: https://www.couriermail.com.au/business/economy/interest-rates/page/181