Bullock’s RBA set to leave rates steady

Millions of homeowners are expected to be spared another punishing rate hike, but the RBA is set to issue a warning that further increases are yet to come.

Millions of homeowners are expected to be spared another punishing rate hike, but the RBA is set to issue a warning that further increases are yet to come.

There’s been a dire prediction about interest rates that no Aussie wants to hear, ahead of the RBA’s monthly rate decision today.

Amid warnings from economists, the Reserve Bank will weigh up whether a further rate hike is needed to tame inflationary pressures when it meets on Tuesday.

It’s the last thing Aussie mortgage payers need as another interest rate rise looms amid a volatile global economy.

The first Reserve Bank of Australia meeting of the year was a big one. Here’s what it means for your mortgage, house prices and your shares.

The Reserve Bank of Australia has unveiled massive changes to monetary policy as well as signalling its intent on interest rates.

The Australian economy is at a crossroads with experts in “uproar” over what to do. One move in particular would “reek of panic”.

It’s been an uncertain two years for all Aussie states but one major city has defied some odds while falling foul to others.

Aussie drivers have been slugged by record high petrol prices but one city is copping it harder than others from all directions.

The Australian sharemarket continued its dire start to the year with mining and technology firms among the hardest hit on Monday.

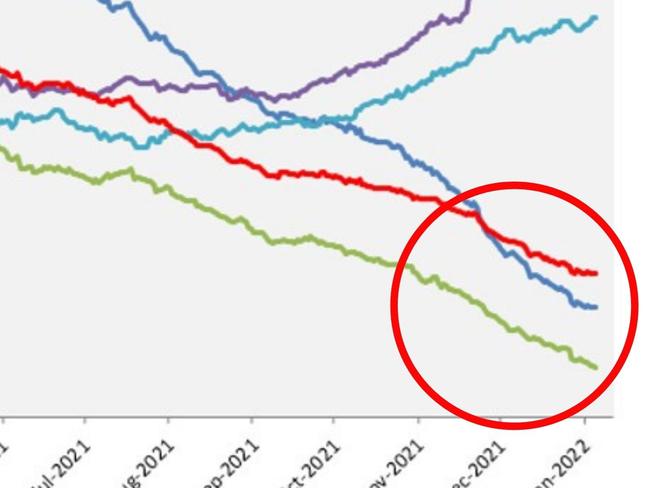

Australian borrowers could see their monthly repayments rise by about $500 over the next two years with the RBA tipped to begin jacking up interest rates.

The boss of financial regulator ASIC says he is worried about the number of Australians exposed to the fluctuations of the crypto market.

Original URL: https://www.couriermail.com.au/business/economy/interest-rates/page/179