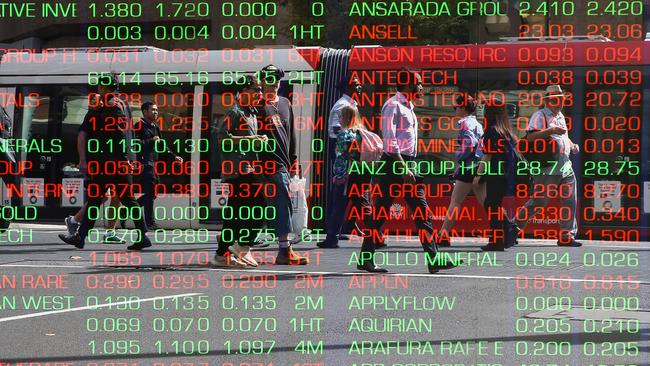

ASX edges higher on tech, property rally

A rally in interest rate sensitive stocks on Wednesday pushed the sharemarket into the green for a fifth consecutive session.

A rally in interest rate sensitive stocks on Wednesday pushed the sharemarket into the green for a fifth consecutive session.

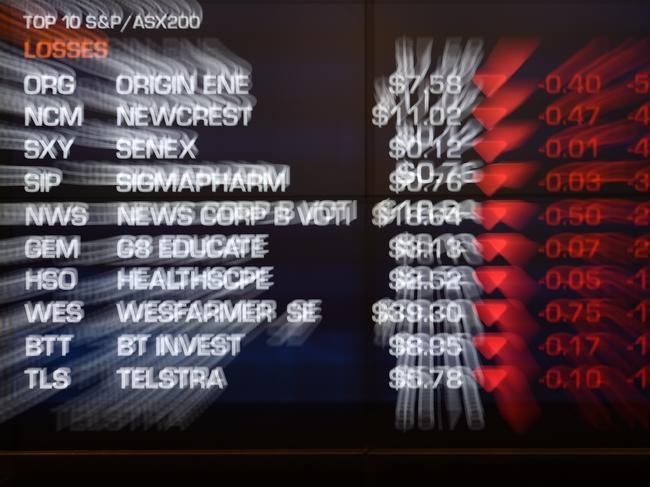

The market closed broadly flat, with seven of the 11 sectors in the black. Perpetual’s forgettable day after KKR deal triggers calls for chair to exit with outgoing CEO. Analyst downgrades hit Imdex. IPH bids for Adamantem-target Qantm.

RBA board considered a rate hike, ‘not ruling anything in or out’. Inquiry wants steps to combat supermarket giants’ power. Earnings upgrade lifts AGL. ANZ profit down, $2bn buyback ahead. Sims tanks.

Australia’s sharemarket rose for a third day running, tracking the US market to its highest daily close in almost two weeks, after cooling non-farm payrolls data gave hope of a soft economic landing with interest rate cuts.

Vladimir Putin’s brutal war on Ukraine is chaotically reshaping the global economy, and investors should be prepared to make changes. Here are the potential winners and losers on the ASX.

ASX 200 extends gains for a fifth day in a row, led by mining and energy companies. Santos CEO reverses MinRes board move and CommSec to pay $20m fine for overcharging.

Further gains for oil and iron ore on the ASX 200 and near-record coal prices fuelled a rollicking run for Australia’s resources sector.

ASX 200 extends gains for fourth day, closing up 0.3 per cent after GDP jumps in fourth quarter as US futures turn up, damping negative offshore leads. Oil prices spike.

Investors remain uncertain in the face of the Russia and Ukraine conflict but an associated spike in commodity prices helped Australia’s mining and energy sectors bounce on Wednesday.

A surge in household spending helped Australia’s economy rebound in the December quarter, prompting this claim.

ASX closes up 0.7 per cent, led by energy, tech and banking stocks. RBA flags inflation ‘spike’ amid Ukraine crisis. Crown faces $1bn fine and Virtus ignores BGH on revised CapVest bid.

Bitcoin has seemingly risen from the dead in a move that has experts scratching their heads as the Russian invasion of Ukraine rages on.

Stockmarkets saw the Ukraine war coming, and after an initial plunge they bounced back. Things may get worse, but there are lessons investors should remember.

ASX finishes up 0.7 per cent as resource stocks rally, amid harsher sanctions on Russia. Zip and Sezzle to merge, Suncorp hit with $75m flood cost and BGH ups its Virtus bid.

Original URL: https://www.themercury.com.au/business/markets/page/189