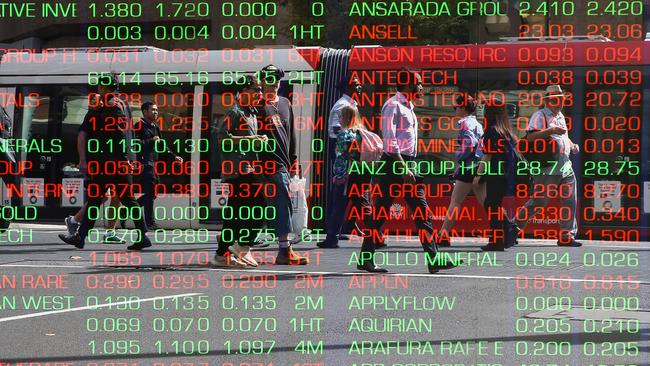

ASX snaps five-day winning streak

Consumer and financials were crunched on Thursday as investors grew increasingly concerned with the impact of elevated inflation on households.

Consumer and financials were crunched on Thursday as investors grew increasingly concerned with the impact of elevated inflation on households.

Aussies are about to get a tax cut cash boost and most will ‘spend’ it in a surprising way.

The sharemarket has closed 1.1 per cent lower, with banking and retail stocks leading the losses. CBA records biggest fall in three weeks. Super Retail, JB Hi-Fi sales disappoint. Baby Bunting tanks.

A rally in interest rate sensitive stocks on Wednesday pushed the sharemarket into the green for a fifth consecutive session.

Global markets are soaring on new hopes a diplomatic solution can be found to end the bitter conflict between Russia and Ukraine.

Cryptocurrency is finally on the up after weeks of being stuck in a rut. And there’s one reason why.

The local sharemarket rallies with all sectors gaining. Tsingshan backs Nickel Mines, Mesoblast and tech firms climb, Aristocrat quits Russia and NAB flags higher inflation.

Banking and tech shares shone on Wednesday during an unexpected relief rally that helped the Australian sharemarket halt a three-session slide.

ASX slumps below 7000 as investors sell energy and mining stocks. St Barbara surges while Nickel Mines dives. Fortescue teams up with Airbus and Ampol quits Russian oil.

The war in Ukraine continues to push energy prices higher, but instead of benefiting local miners, attention has now turned to the possibility of stalled economic growth.

Hopes for a quick resolution to the conflict in Ukraine have been lost — and its resulted in the worst decline in US shares in 16 months.

ASX lower as investors sell tech and health stocks. Qantas dives on oil surge as Woodside hits two-year high, AGL slips on rejected bid and Rio Tinto fined.

All sectors were down bar the defensive staples but it has been a week of resilience thanks to resources-sector gains on commodity-price strength.

Vladimir Putin’s brutal war on Ukraine is chaotically reshaping the global economy, and investors should be prepared to make changes. Here are the potential winners and losers on the ASX.

Original URL: https://www.themercury.com.au/business/markets/page/188