Warning for Aussies ahead of tax time

Two major groups of Aussies are being warned to be vigilant with their tax returns as the Australian Tax Office is set to crack down on common errors.

Two major groups of Aussies are being warned to be vigilant with their tax returns as the Australian Tax Office is set to crack down on common errors.

Upstart airliner Bonza launched in Australia with budgie-smugglers and purple cocktails, but 18 months later the low-cost carrier collapsed. Here’s why.

All 11 sectors fared well on the last day of the ASX trading week, with several companies reaching record highs across the day.

Bourse has best weekly gain in five weeks, up 0.7 per cent. McDonald’s Australia annual sales up 7 per cent. Wesfarmers hits record high. Path to low inflation ‘not yet’ secure: ex-RBA boss. Macquarie falls. Block jumps.

The Australian mining giant has lined the pockets of its investors, but pickings may be slimmer in the year ahead.

ASX rose 0.6 per cent by the finish, led by BHP, CBA and Telstra. Deloitte may take on the Probuild voluntary administration. Rio Tinto books $US21.09bn annual net profit.

Australia’s major supermarkets have revealed the reasons grocery bills will become more expensive over the next few months.

The price of oil has surged as tensions boil over between Russia and Ukraine, with the United States announcing sanctions.

There has been another huge development in the “meth pipe” video drug saga engulfing Grill’d co-founder Geoff Bainbridge.

ASX led lower by tech and discretionary stocks. Nanosonics falls on profit slump, Cochlear and Costa leap of earnings, Coles profit dips and Tyro sell off continues.

ASX led higher by utilities. A2 Milk leaps on profit beat, AGL rises on rejected bid, Tyro shares collapse on results, Bluescope posts record half and insurers win landmark case.

Cryptocurrency prices have plunged in the last 24 hours as investors panic – and some believe hackers are to blame.

ASX posts biggest fall in a week as investors sell utilities and health stocks. Magellan surges on profit beat, QBE dives on poor result, Origin slides on downgrade and Latitude buys Humm’s BNPL.

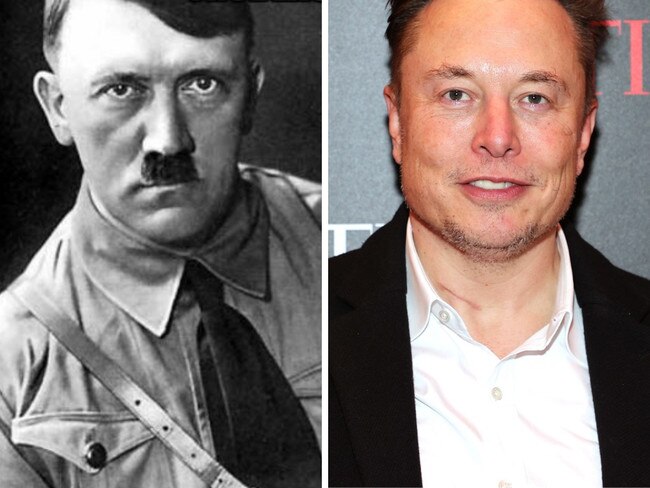

Tesla boss Elon Musk has been slammed for posting a meme that compared Canadian Prime Minister Justin Trudeau to Adolf Hitler.

Original URL: https://www.themercury.com.au/business/markets/page/191