ASX flat as investors eye inflation data

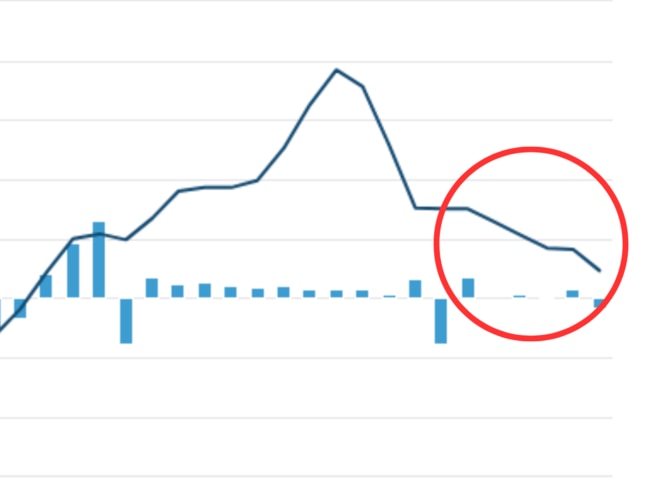

Australian shares were flat on Monday before important inflation data is released midweek.

Australian shares were flat on Monday before important inflation data is released midweek.

Aussies are being urged to dramatically alter their spending habits as new research indicates physical cash is an endangered species.

With family budgets coming under further strain, consumers heavily wound back on spending on non-essential items in April.

With family budgets coming under further strain, consumers heavily wound back on spending on non-essential items in April.

Economists predict Australians will cop it in the coming months whether the RBA increases rates or not on Tuesday.

The Australian share market has had its two-day boost come to an end with Friday finishing off the week on a low note.

For the second week in a row, one major bank has announced it will hike interest rates for some unlucky customers.

Mid-year sales have failed to get Australians spending as the cost-of-living crisis continues and people are cautious with their money.

It’s been a ripper day on the Australian share market with the majority of stocks increasing, but there’s two outliers.

A financial nightmare is now unfolding – and money expert Mark Bouris says it will be “disastrous for hundreds of thousands of families”.

It’s obvious that the Chinese economy is now seriously struggling – and it’s bad news for Australia too for one major reason.

A major Australian bank has forecasted rates to rise once more next week, despite positive inflation news.

Another major Australian construction company has been placed into administration, with workers stood down and construction halted on hundreds of units.

Australians wanting to break free from streaming services will be given even greater freedom with a new banking feature,

Original URL: https://www.themercury.com.au/business/economy/page/199