NAB hikes interest on fixed rate home loan products

For the second week in a row, one major bank has announced it will hike interest rates for some unlucky customers.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

NAB has raised the interest customers will pay for its fixed rate loans for the second week in a row.

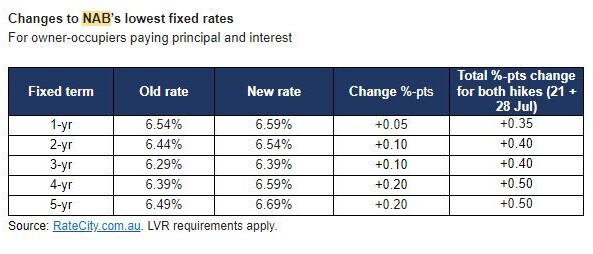

The major bank increased the fixed rate for owner-occupiers and investors by up to 0.20 percentage points after an increase to the same rates last Friday.

The increases, combined with the hikes from Friday, July 21, means some rates have climbed by up to 0.50 percentage points in the space of eight days.

Borrowers who are thinking about locking in their rates will be “rattled” by the second round of hikes from NAB, according to RateCity research director Sally Tindall.

“When push comes to shove, borrowers are overwhelmingly opting to go variable, giving banks the runway to hike fixed rates with little consequence,” she said.

“If borrowers are looking to fix anytime soon they’d do well to keep an eye on what the big banks are doing or, better yet, look beyond them.”

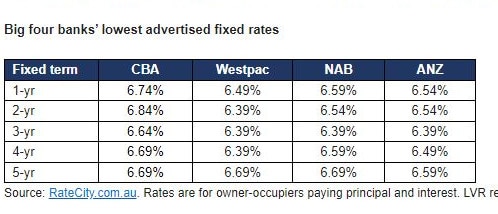

NAB is beaten out by the other big banks for all fixed rate loans except for its three-year option, where it ties with Westpac and ANZ at 6.39 per cent.

Westpac offers the lowest rates for those who want to fix for one or two years at 6.49 per cent and 6.39 per cent respectively.

Meanwhile, those who want to fix their rate for five years could turn to ANZ, which has the lowest rate of the big banks at 6.59 per cent, or opt for smaller bank RACQ, which has a rate of 5.34 per cent.

None of the big banks have the lowest fixed rates in any category, according to RateCity, with Australian Mutual Bank leading the two and three-year fixed loans with a 5.23 per cent and 5.33 per cent rate respectively.

The majority of lenders are opting to increase their fixed rates, with 66 lenders hiking the rate on a two-year fixed loan compared with just three who have cut.

Originally published as NAB hikes interest on fixed rate home loan products