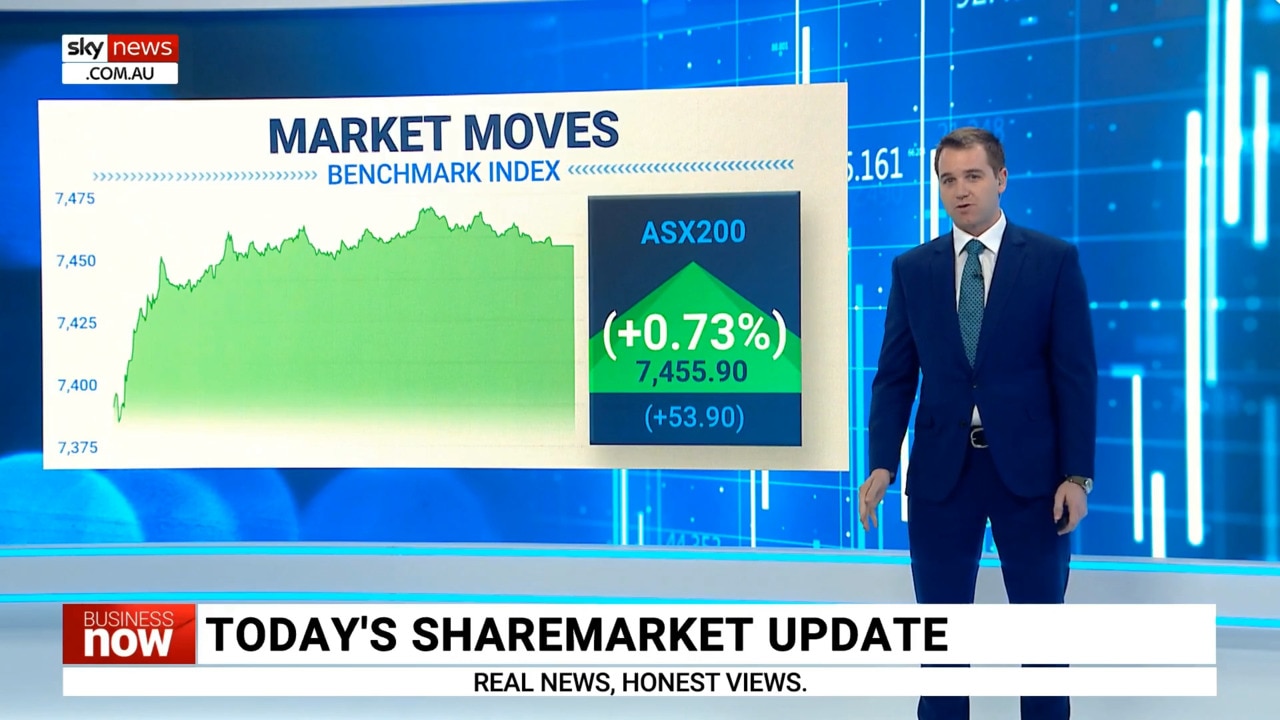

ASX200 closes on second consecutive 100-day high, up 0.7 per cent

It’s been a ripper day on the Australian share market with the majority of stocks increasing, but there’s two outliers.

Breaking News

Don't miss out on the headlines from Breaking News. Followed categories will be added to My News.

The Australian share market has continued its winning streak, topping its 100-day high only set one day ago.

The S&P/ASX200 closed up Thursday, gaining 53.90 points or 0.73 per cent to 7,455.90, beating Wednesday’s already impressive figures.

The market galloped out of the gate after opening, retaining its momentum for the rest of the day to finish at 1.48 per cent off its 52-week high.

The majority of the sectors received sizeable boosts led by real estate with a 3.35 per cent jump, information technology up 2.19 per cent and consumer discretionary up 2.08 per cent.

“Falling inflation and the prospect of central banks on hold had consumer-facing stocks dancing for joy,” he said.

“Kogan gained 3.91 per cent to $6.65, Adair’s gained 10.68 per cent to $1.71, Nick Scali gained 5.80 per cent to $10.39, and Harvey Norman gained 3.02 per cent to $3.75.”

Mr Sycamore said it was a “similar story” for most of the banks, with only Macquarie seeing its price dive by 4.37 per cent to $175.03 as lower volatility in markets weighed on earnings.

Macquarie Group reported weaker-than-expected profits in the first-quarter of the financial year, blaming it on poor trading conditions.

The big four were led by Westpac which had its price lifted 1.78 per cent to $22.35 followed by NAB which increased 1.53 per cent to $28.47, CBA up 1.48 per cent to $106.53 and ANZ up 1.26 per cent to $25.78.

Two companies had their stock growth reach the double digits, with Megaport Limited winning the day after growing 14.44 per cent to end at $10.62 followed by Imugene which rose 12.36 per cent to $0.10 a share.

The materials and energy sectors were the only ones not joining in on the fun, down 1.04 per cent and 0.53 per cent respectively.

“After disappointing production guidance, gold miner Regis Resources dived 10.77 per cent to $1.87,” Mr Sycamore said about the lowest performing stock of the day.

Miners and energy providers made up four of the bottom five shares today, with Regis Resources followed by Whitehaven Coal which fell 5.85 per cent to $7.08, New Hope which fell 5.65 per cent to $5.34 and Iluka Resources which dropped 4.37 to $10.51.

The big miners were also in trouble, Fortescue Metals dropped 3.40 per cent despite announcing it had delivered on its targets for the year to June 30.

Meanwhile BHP slipped by 1.50 per cent as iron ore futures fell 1.20 per cent and Rio Tinto slipped 2.50 per cent after announcing a small interim dividend.

Volatility in the lithium space are also to blame for faltering prices in the mining sector according to Mr Sycamore.

Originally published as ASX200 closes on second consecutive 100-day high, up 0.7 per cent