Australia’s mortgage cliff disaster peaks as homeowners buckle after brutal RBA rate rises

A financial nightmare is now unfolding – and money expert Mark Bouris says it will be “disastrous for hundreds of thousands of families”.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

It’s been almost two weeks since Treasurer Jim Chalmers announced that Michele Bullock will take over from Philip Lowe as Reserve Bank Governor – and it’s clear she has her work cut out for her.

First, Bullock will be tasked with overseeing the Albanese government’s new reforms to the Reserve Bank, which includes the abolition of the board and the establishment of two separate bodies – one that sets interest rates and another that oversees the bank’s governance and day-to-day operations.

Second, she will have to reflect on why the RBA was unable to see high inflation coming during the days of the Covid pandemic when interest rates were kept artificially low by aggressive quantitative easing policies.

Remember that last year, Bullock told the Economics Legislation Committee she was “caught by surprise” that inflation had started to rise, even though Australia’s money supply – a key measure of inflation – almost doubled over the last decade.

Third, there’s very little chance inflation is coming back to the RBA’s two-to-three per cent target any time soon given power prices, rents, food prices, insurance and health costs continue to rise.

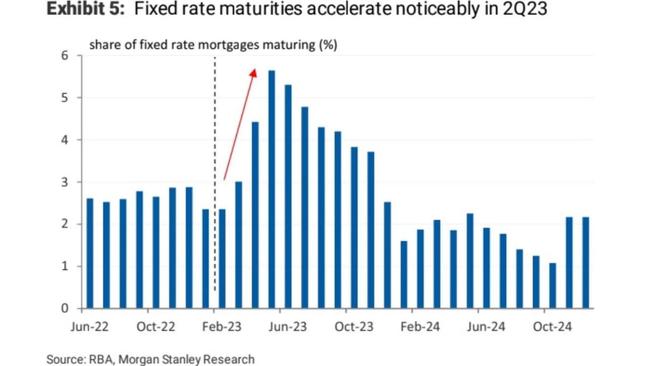

But perhaps most concerning is the fixed-rate mortgage cliff that Bullock now stands atop of.

This year, approximately 800,000 home loans – totalling $350 billion – are expected to transition from a fixed interest rate to a higher variable rate.

In other words?

Those who took on cheap fixed-rate mortgages in the years leading up to or during the pandemic will see the rate on their mortgage go from around 1.9 to 2.5 per cent to between 6 and 7 per cent.

This will be disastrous for hundreds of thousands of families.

For instance, if you took on a $500,000 loan in say, late 2020, your average monthly repayment would be about $1850.

Fast-forward two years later, when your rate goes from 2 per cent to 6.5 per cent, your monthly repayment would rise to more than $3000. That’s a 50 to 70 per cent increase in monthly repayments, depending on the exact nature of their loans.

And Australia’s fixed-rate mortgage cliff is peaking right now – meaning people are only just having their repayments double, which will progressively strain their household budgets over the rest of the year.

The short point?

First, even if Bullock decides to stop hiking rates, homeowners will continue to suffer over the next 12 months as many haven’t switched from low fixed rates to high variable rates.

Second, as more and more mortgages move from low fixed rates to high variable rates, consumers will cut their spending, which will impact businesses and by extension, the wider economy.

And finally, it’s unclear whether all this will bring down inflation, which is, by the way, the whole point of hiking interest rates.

Think about it.

This year, the federal government alone has added an extra $185 billion in spending. Government spending is, of course, inflationary as any fair-minded economist would tell you.

There are also issues on the supply side too.

For instance, how will higher interest rates lower the price of energy? Lowering the cost of energy requires new power infrastructure. That isn’t cheap and it takes a while.

How will higher interest rates reduce food prices? Many farmers have loans, which will get more expensive as rates rise. Many are also struggling to keep up with higher fertiliser prices and critical labour shortages.

How will higher interest rates bring down rents, especially when vacancy rates are at near-record lows and more than 700,000 migrants are set to arrive on our shores over the next two years?

How will higher interest rates bring down the cost of housing, given hundreds of construction companies are collapsing because they took on fixed-price contracts before Covid-induced supply chain issues led to the price of steel, cement, cladding, glass and other building materials going through the roof?

These are questions that need to be answered, and they need to be answered by the government, because the only weapon the RBA has in its arsenal to kill inflation is interest rate hikes.

My conclusion to all of this?

One can only feel for Michele Bullock.

Inflation isn’t going away, and interest rate hikes are only going to make the next few years more painful.

Perhaps the government’s reforms to the Reserve Bank will help.

One can only hope …

Mark Bouris is the executive chairman of Yellow Brick Home Loans. For more information on getting the best home loan, refinancing and some of the industry’s leading experts tips, visit the Y Home Loans website.

Originally published as Australia’s mortgage cliff disaster peaks as homeowners buckle after brutal RBA rate rises