Westpac sees better economic times ahead

Westpac believes Australia’s economy will soon turn the corner on its gloomy conditions, as the big four bank unveiled a $7bn full-year profit.

Westpac believes Australia’s economy will soon turn the corner on its gloomy conditions, as the big four bank unveiled a $7bn full-year profit.

MinRes takeover/break-up not ruled out as billionaire boss Chris Ellison’s exit plan takes shape. AFP enter PwC Australia offices as part of confidential breach probe. Westpac down on dividend miss, high costs.

Aussies have pocketed $6.4bn in extra income since July’s Stage 3 tax cuts, but what we’re doing with it might come as a surprise.

Peter Herbert will be appointed interim head of Westpac’s business lending arm.

CBA and Westpac say current settings are appropriate as NAB and the ABA call for changes to the serviceability buffer.

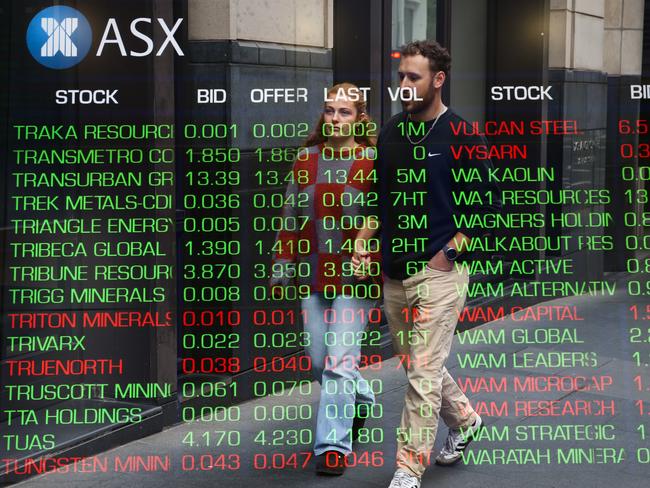

ASX 200 slips in cautious trading. WiseTech CEO resigns. CBA, Westpac rebuff flexible serviceability buffer call for home loans. Weak quarter weighs on Reece, Fortescue and Brambles. Super Retail tried to settle claims ahead of court fight. HMC lines up data play with $2bn Global Switch deal.

There’s a long list of items for the incoming Westpac CEO to address such as locking down an executive team and ensuring the bank’s risky technology overhaul is well executed.

Westpac, St George and two regional banks have been hit by an outage affecting app access and online banking, with Aussies left unable to access their money.

A court has found four key figures linked to a former Sydney equipment financing business engaged in Australia’s largest ever bank fraud, writing more than $500m in fake leases.

The $3.4bn financial firm AMP Capital announced on Thursday it had finalised its promised plan to return $1.1bn worth of capital to its shareholders, so what does it do next?

One of Australia’s major banks has cut against the grain in the age of digital wallets and will no longer offer a key service, claiming declining interest.

Consumer sentiment has lifted to the highest level since 2022 showing Australians no longer fear the prospect of the RBA delivering an unwanted interest rate increase.

Now the debate turns to BT Panorama and if Westpac puts that on the market next.

Property giants lift on ‘cheaper debt outlook’. Santos down despite oil price spike. Origin loses ground after abandoning hydrogen plans. Sell rating weighs on ‘overly ambitious’ Guzman y Gomez. IMF backs RBA’s tight stance.

Australia’s top bankers are in the limelight after the anointing of Westpac’s new boss, leaving just ANZ and Commonwealth Bank to announce their future leadership line-up.

Bonus savings accounts have long caused consumer confusion, and are stingy for many savers. Now they’re changing again.

There is talk in the market that Westpac’s auto loan back book sale may have stumbled.

Analysts say Westpac’s new CEO Anthony Miller faces challenges but is likely to deliver stability for the lender.

Peter King has played a key role in restoring confidence in Westpac after it was hit by the Austrac scandal and then Covid.

A former Goldman Sachs banker wants to pull Westpac out of its self-imposed wilderness. Is the banking major ready for change?

The banking major’s incoming boss Anthony Miller is prone to telling colleagues he is the underachiever of his family, given two of his siblings represented Australia at the Olympics. He’ll certainly have to revise his talking points.

Wealth and business banking boss Anthony Miller will continue Westpac’s technology and risk transition plans when he takes over the top job from Peter King in December.

Westpac has announced its new chief executive, who has a vision to return the big-four bank to a “position of leadership”.

Premier Investments flags lower earnings, sacked Smiggle boss Cheston denies ‘serious misconduct’. Hotel Property Investments rejects $718m bid by Charter Hall Retail, Hostplus. Westpac CEO successor named. Steadfast in a trading halt. Star results awaited.

This international banking executive is certain to feature on the target list of Westpac’s board and the headhunting firm spearheading a search for its next CEO.

Warning lights are flashing on consumer spending, with Westpac chief executive Peter King cautioning things are unlikely to get any better until a rate cut.

Westpac is facing court action from its head of audit and risk, who has alleged she was bullied for blowing the whistle on possible financial crime.

Two out of the four chief executives of Australia’s major banks have tipped an early-2025 cash rate cut.

The Westpac Group boss believes the Reserve Bank will begin cutting rates from early next year, forecasting the figures rates will settle at.

The cost of living and higher interest rates are hurting younger Australians more than most, the chief executives of Commonwealth Bank and Westpac have warned.

Original URL: https://www.theaustralian.com.au/topics/westpac/page/3