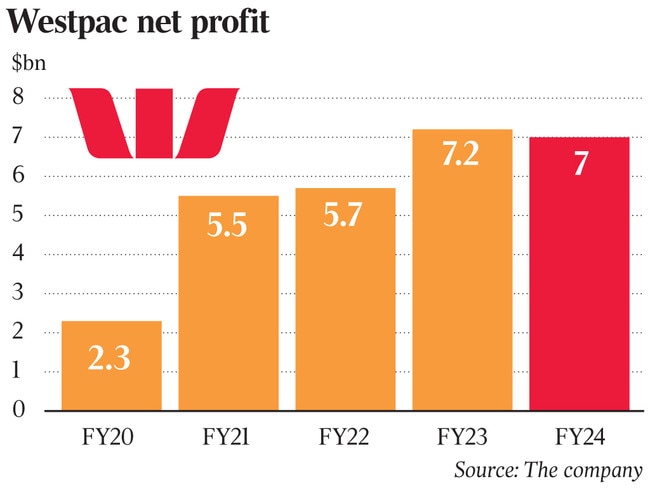

Westpac sees better economic times ahead as bank posts $7bn profit, announces $1bn share buyback

Westpac believes Australia’s economy will soon turn the corner on its gloomy conditions, as the big four bank unveiled a $7bn full-year profit.

Banking major Westpac is seeing signs Australia’s economy has turned a corner after a gloomy year, announcing plans to plough a further $1bn into a share buyback after posting a $7bn full year profit.

Ruling off its financial results on Monday, Westpac revealed a 3 per cent slide in earnings, in line with analyst expectations for the banking major amid breakneck new lending across business and home loans.

Chief executive boss Peter King warned the lender was seeing considerable stress in parts of the economy, with more than 19,000 customers now on the bank’s hardship program amid a rise in delinquencies.

But Mr King said many of those who had taken on the bank’s offer of a repayment pauses had resumed paying their mortgages amid strong jobs growth.

“You do have a few people that decide to sell their house,” he said.

But Mr King said there were bright spots ahead for Australian borrowers, noting unemployment remained low and bank data showed a recovery in consumer spending.

Westpac’s $3.34bn second-half profit comes after the bank delivered $3.64bn in earnings in the first half, announcing plans in May to buy back $2.5bn in bank shares.

This comes as Westpac is also preparing to spend more than $3bn on its technology transformation program labelled ‘Unite’, aimed at tying together the bank’s disparate internal systems and finally integrating lender St George with the incumbent core banking platform.

Already the bank has spent $114m on the project, with the tech transformation set to command 40 per cent of Westpac’s expenses in the coming three years.

Mr King, who marked his final set of Westpac results as CEO ahead of the ascension of Anthony Miller in the top job, said he had removed much of the complexity from the bank over the last four years.

“We’ve exited 10 businesses, and this sees Westpac is now a simpler and stronger bank,” he said.

Mr King, who joined Westpac in 1994, took on the CEO role in 2020 in the wake of a damaging Austrac money laundering scandal that cost the bank $1.3bn and led to the departure of CEO Brian Hartzer.

Mr Miller will start on December 16. Mr King will be paid $7.9m in his final year.

Westpac’s results showed the uneven impact of the forces buffeting the bank, with its consumer lending arm squeezed amid the mortgage war with rival lenders for Australia’s home loan customers.

The consumer lending division saw its profits slashed by 17 per cent to $2.84bn.

Loans lifted 4 per cent over the year, hitting $807bn, with Westpac’s home lending up 1.2 times overall system growth.

Mr King said Westpac was now past peak-refinancing, as the mortgage cliff of pandemic borrowers moved from fixed rate loans to floating variable rates.

He said Westpac may even look to sit out a future mortgage war, noting: “I wouldn’t be slavish to system (growth) in mortgages.”

Instead, Mr King said Westpac could look to make money from different segments of the mortgage market.

“We do want to grow in all our markets, but mortgages is the one where being below system, I wouldn’t be upset,” he said.

The business banking arm saw profits lift 13 per cent to $2.35bn, amid a 7 per cent jump in new lending.

Westpac told investors its net interest margin on lending had been squeezed over the year, down 1 basis point to 1.95 per cent.

That was ahead of analyst estimates for 1.92 per cent.

But Westpac noted its NIM improved for the second half, on the back of more profitable lending, hitting 1.97.

Impairments across Westpac’s loan book were low, with Mr King noting this reflected “a combination of prudent lending practices and resilience across household and business customers”.

Mr King said the bank’s data was showing card spending was beginning to recover, but noted much of recent tax cuts had been banked instead of spent by consumers.

The Westpac boss said many of the bank’s customers were now “used to these higher levels of interest rates” but noted he was hopeful the Reserve Bank of Australia would cut the cash rate early next year.

“If we don’t then I think we’ll actually see slower growth in the economy, it’s probably more that the growth will be slower than issues in the mortgage book,” he said.

“There’s certainly more positive signs as we look into 2025, but we’re very conscious of the global outlook at the moment.”

Westpac declared a 76c final dividend, taking total returns for the 2024 financial year to $1.51.

UBS banks analyst John Storey said Westpac had delivered an “in-line result” noting the bank’s underlying lending margins “look encouraging”.

“We continue to think the path to a sustainably higher (return on earnings) … is centred on cost out and simplification initiatives,” he said.

Jarden banks analyst Jeff Cai said Westpac’s result “supports the theme that bank earnings are resilient”.

Atlas Funds Management chief investment officer Hugh Dive said Mr King had delivered a “pretty good” set of results, warning Westpac had “no room for error” given its current elevated share price.

Westpac shares have climbed 47.81 per cent in the last 12 months.

“It is better to see some acceleration and improvements in the second half,” Mr Dive said.

Westpac shares slipped on early trade, but recovered to close up 0.93 per cent to $32.40.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout