Internal pick stabilises Westpac but tough task ahead for new CEO

Analysts say Westpac’s new CEO Anthony Miller faces challenges but is likely to deliver stability for the lender.

Westpac’s newly-announced chief executive Anthony Miller has challenges, but analysts say he is likely to deliver stability for the lender, which has underperformed rivals over the past year.

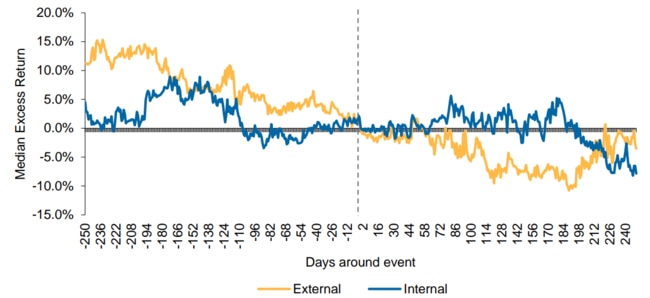

In a note to investors, Macquarie equity analyst Jason Shao said internal picks for CEO often attracted a muted market response, in contrast to external hires, where shares often slumped in response.

Mr Shao said this was often due to a view in the market that internal hires were “likely to completely redefine the strategy, reducing risks around execution and costs”.

But he said subsequent share price outperformance after external hires was driven by CEOs who “implement changes after a period of settling in”.

Mr Miller, who recently ran Westpac’s business and wealth unit after a stint steering the institutional division, will take on the running of the bank on December 16.

He joined Westpac after leading Deutsche Bank Australia and New Zealand.

Morgan Stanley analyst Richard Wiles said Westpac’s new CEO faced five key issues, including finalising the management team and executing on the first year of the mammoth ‘‘Unite’’ technology program.

Westpac plans to spend $1.8bn-$2bn stripping out almost 100 systems from its tech stack and moving sub-brands onto the bank’s core platforms.

Mr Wiles said Mr Miller had to control investment spending and operating cost growth, while building on the recent improvement in retail banking and restoring growth to the business lending division.

Barrenjoey bank analyst Jon Mott said there were many issues facing Westpac, but the bank was “taking steps in the right direction”.

“(Westpac’s) focus over the next two years is execution of the Unite technology simplification program. This is effectively the full systems integration of St George Bank, 16 years after acquisition,” he said.

“We are not expecting a material change from this strategy with Anthony Miller taking over as CEO.”

CLSA analyst Ed Henning said Westpac was “starting to do a lot right”, noting “strong momentum in the business”.

“There is also potential for further capital management and it remains under-owned by domestic institutions, although we see these largely factored into expectations, and there remains some execution risk around the technology program Unite and competition seems to be increasing,” he said.

Shares in Westpac have lifted more than 40 per cent over the year, closing at $32.31 on Tuesday.

The rally came despite many market watchers warning bank valuations are stretched.

But UBS strategist Richard Schellbach noted the sector may be a better alternative to listed miners. He said banks had outperformed and were up almost 30 per cent for the year, while mining companies had seen share price slides about 20 per cent.

Mr Schellbach said banks, while seeming expensive, were competing in a crowded market of high valuations.

“Aussie banks have never been as expensive as they are now, this we agree with,” he said. “But at the same time we must remember that stretched valuations are not unique to Australian banks, but are in fact a story through stockmarkets globally.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout