Treasury Wine Estates Ltd higher Thursday, outperforms the Consumer Staples sector

Here is the latest company close update for Treasury Wine Estates Ltd, TWE.

Here is the latest company close update for Treasury Wine Estates Ltd, TWE.

Treasury Wine Estates is facing a series of challenges in the US and around the world as wine consumption slows and its rock star Penfolds label expects an earnings decline, analysts warn.

Treasury Wine says its rock star wine label Penfolds will have a marked slowdown in earnings. But don’t expect to see the iconic red caps in the bargain bin.

Strong IPO debuts build on ASX optimism over possible de-escalation of Middle East tensions. Whyalla Steelworks’ sale process begins. CBA hits record. Rio Tinto and Gina Rinehart plan a new iron ore mine.

Anyone for a mid-strength Shiraz, mango Rosé or passionfruit prosecco? The owner of wine icon Penfolds has launched a new range of no and low-alcohol wine made out of the Barossa.

The shock decision by a top US wine distributor to exit the Californian wine market completely has left Treasury Wine Estates scrambling for a new partner, with the Penfolds maker also warning on earnings due to the rocky economy.

RBA well placed to ‘respond decisively’ to international developments. Fair Work Commission grants above-inflation 3.5pc wage rise. NAB cuts economic forecasts. IDP Education dives 46 per cent.

After a soaring five-decade career, much of it spent as chief winemaker at Treasury Wine Estates, the artful Chris Hatcher finally puts his name on the label. The results are superb.

Sam Fischer, who has more than 30 years experience in beer and spirits, plus fashion through his directorship of British fashion icon Burberry, has been tasked to lead Treasury Wine into its ‘next era of growth’.

The sharemarket has closed higher for a seventh day in a row following April’s 89,000 jobs bounce and expectations the Reserve Bank will cut interest rates on Tuesday. CBA continues to power ahead, hitting a record of $169.74. GrainCorp soars on profit upgrade.

Treasury Wine Estates boss Tim Ford believes the winemaker must wean itself off cheap wines and focus on luxury brands such as Penfolds.

Sigma gains as $300m worth of shares change hands. Alliance Aviation’s labour costs growing after first industrial action in two decades. IAG top loser as investors miss buyback. Temple & Webster top gainer. ‘Cleaner result’ sees ASX Ltd soar.

Tim Ford doesn’t just want to pack product off to China never to be seen again; he believes his Treasury Wine Estates and Penfolds brand can be a driving force in that country’s wine community.

Taylors Wines has pulled out of talks to acquire labels from Treasury Wine Estates but is still in the hunt for acquisitions.

It is family-owned operators, rather than big corporate names, which are keen on scooping up Treasury Wine Estates’ non-core brands that the wine major is looking to offload.

Australia’s iconic Penfolds wine will have a new Chinese home after Treasury Wine bought a controlling stake in a 43-hectare luxury winemaker in China.

Australia’s luxury wine brand Penfolds has ‘real energy’ after re-entering the Chinese market following the end of crippling tariffs, Treasury Wine Estates boss Tim Ford says.

He’s the new Qantas chairman and some shareholder groups fear John Mullen has too much on his plate to be a Treasury Wine Estates director.

Maurice Blackburn Lawyers and Slater and Gordon have reached an in-principle agreement on behalf of the winemaker’s shareholders.

John Mullen has too many board seats to continue as Treasury Wine Estates’ chair, according to the ASA. But other influential proxy advisers are more relaxed ahead of this week’s AGM.

Sigma rockets on ACCC compromise to get $8.8bn merger with Chemist Warehouse across the line. Treasury Wine caves in to proxy demand on CEO bonus. Warmest August since 1910 sees retail sales lift 0.7 per cent.

Deal-makers are unsure who will acquire the commercial wine brands of Treasury Wine Estates after Pernod Ricard sold its Australian business to Bain Capital.

The Penfolds producer has long been confident about the potential of the Chinese market, but faces a very different China from the one that closed its doors to Australia four years ago.

Treasury Wine Estates boss Tim Ford says the company is in the ‘best position it has ever been’ as it sheds its low margin commercial wines to focus on the needs of luxury wine drinkers.

AUD rises on ‘quite tight’ jobs market. Cochlear, Origin sink on profit miss . Telstra rises despite profit fall. Treasury Wine lifts on China boost. Goodman dips on mixed results. Nufarm tumbles on earnings downgrade.

As Australia-China relations improve, companies from Treasury Wine to Goodman Group will give insight into the new settings for business.

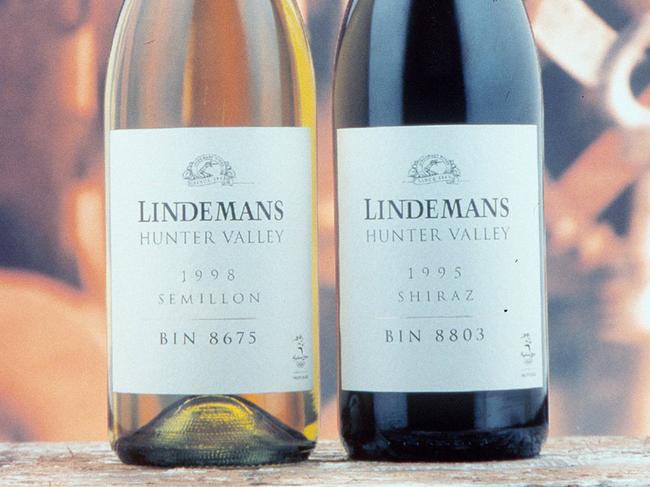

In a bid to focus on luxury labels and stem a $354m hit to its 2024 results, Treasury Wine Estates will divest struggling commercial wines like Lindeman’s, Yellowglen and Wolf Blass.

Driverless forklifts, and robots which collect data and move barrels around – take a look at Treasury Wine Estates’ Barossa Valley facility following a $10m revamp.

Penfolds will soon have 200 staff on the ground in China as it aims to aggressively grow the recently reopened market, on the back of a record Australian vintage.

Fast food chain Guzman y Gomez hits high of $30.60 on listing. City Chic flags loss as sales dive. VanEck Bitcoin ETF debuts. Treasury Wine down on guidance miss. Cyan lifts MMA Offshore bid.

Original URL: https://www.theaustralian.com.au/topics/treasury-wine