Treasury Wine Estates will divest its commercial wine portfolio

In a bid to focus on luxury labels and stem a $354m hit to its 2024 results, Treasury Wine Estates will divest struggling commercial wines like Lindeman’s, Yellowglen and Wolf Blass.

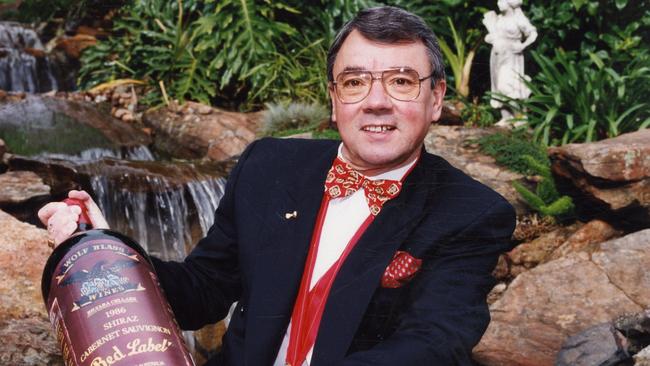

Treasury Wine Estates will sell former powerhouse brands such as Lindeman’s, Wolf Blass and Yellowglen as it shifts attention and resources to its luxury portfolio led by Penfolds and upmarket Napa Valley labels.

For some of the brands – such as Wolf Blass with its famous eagle imagery – it will be the end of decades of ownership by Treasury Wine.

Treasury was once part of beer and wine giant Foster’s.

In the late 1990s and early 2000s it went on a spending spree to buy popular wine brands.

Wolf Blass and sparkling wine Yellowglen were acquired by Foster’s in 1996 as it aggressively pushed into the wine sector.

Once very popular, the labels now contribute less than 5 per cent to Treasury Wine’s annual gross profit.

They have been displaced by Penfolds and more recently Treasury Wine’s portfolio of Californian wines.

The divestments could mean that by next year more than 90 per cent of Treasury Wine’s sales come from luxury and premium wine brands.

The commercial wines put up for sale are part of the company’s Treasury Premium Brands division, which takes in other labels such as 19 Crimes, Pepperjack, Seppelt and Squealing Pig. These wines, which have been performing better, will be kept for now.

However, the entire division is suffering from a fall in demand for cheaper wine as well as a downturn in overall wine consumption, triggering an impairment of $354m ($290m post-tax) in its fiscal 2024 results.

This impairment will be treated as a material item. It relates primarily to the writedown of goodwill ($115m) and brands ($229m), predominantly commercial brands, including Wolf Blass (acquired in 1996), Yellowglen (also 1996), Lindeman’s (acquired 2005), and Blossom Hill (acquired 2015).

“The changes to the carrying value assessment reflect moderated top-line expectations as a result of challenging market conditions for commercial wine, across all markets, and the underperformance of Treasury Premium Brands relative to the category at these commercial price points,” the company said on Tuesday.

Treasury said these adverse trends had offset the benefits from that division’s strategic focus to “premiumise” its portfolio, where it has delivered a three-year net sales revenue compounded annual growth rate of 10 per cent for its priority divisional brands, which include Wynn’s, Pepperjack, Squealing Pig and 19 Crimes.

It had been thought for some time that Treasury Wine would divest its underperforming commercial wines.

Speculation mounted as the winemaker kicked off a review of the division earlier this year, ramped up its investment in the Napa Valley and extended the reach of its iconic luxury brand Penfolds, including growing grapes and making Penfolds wines in the US, France and China.

Treasury Wine’s push into California’s famed Napa Valley is tied to the acquisition of luxury chardonnay maker Frank Family Vineyards for $435m in 2021, and has cemented its position in premium and luxury wine.

In 2023, Treasury acquired California’s DAOU Vineyards for as much as $US1bn.

“We continue to see strong long-term growth trends for luxury wine in Treasury Wine’s key global markets, with a significant value-creation opportunity,” said Treasury Wine chief executive Tim Ford at the time of the DAOU purchase. He also outlined plans to pivot Treasury Wine away from commercial wines to focus on premium and luxury labels.

On Tuesday, Treasury Wine said it had been assessing the future operating model for its Premium Brands division.

E&P Capital retail analyst Phillip Kimber said the revenue breakdown for the Treasury Premium Brands division was about 65 per cent luxury and premium wine ($650m) and about 35 per cent commercial wine ($350m), but the profit was relatively low.

“The gross profit margin on these brands is very low at around $60m,” he said.

“It is only the commercial brands being impaired and that Treasury Wine are looking to divest. We note that the impairment is non-cash and investors did not ascribe much value to the commercial brands.”

He said the market would likely welcome the divestment, given limited demand.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout